- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

Iridium Communications (IRDM) Margin Improvement Challenges Bullish Narratives as Growth Slows

Reviewed by Simply Wall St

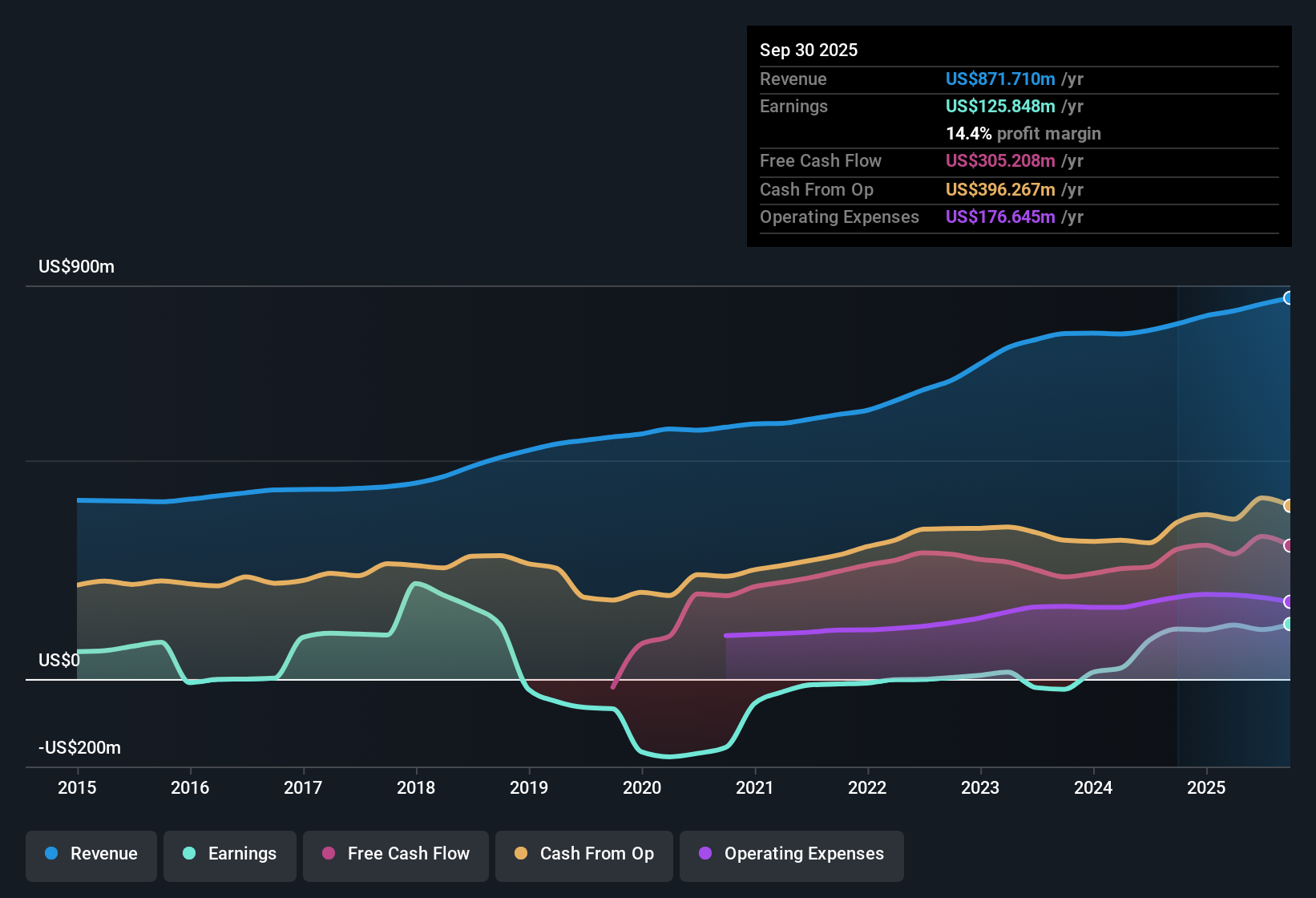

Iridium Communications (IRDM) reported net profit margins of 14.4%, a slight uptick from the prior period’s 14.1%, with EPS up 10% in the past year. However, earnings growth has cooled dramatically from a five-year average of 79.4% per year, highlighting a step down from the company’s previous pace. Investors are left weighing improved margins and a discounted share price against much slower growth forecasts in the years ahead.

See our full analysis for Iridium Communications.Up next, we’ll see how these headline figures compare with the main narratives investors follow on Simply Wall St, and whether the latest results support or disrupt the story so far.

See what the community is saying about Iridium Communications

Cash Flow Opens Up as Capex Declines

- Iridium’s fully deployed next-generation satellite constellation means capital expenditures have started falling, which is freeing up more cash flow to return to shareholders through buybacks and potential dividend increases.

- Analysts' consensus view highlights how reduced capex and improved cash generation support high-margin service expansion and future returns:

- With a structurally attractive free cash flow yield and a declining capex profile, Iridium is positioned to boost per-share earnings potential through share repurchases.

- According to consensus, this dynamic serves as a key differentiator versus satellite peers because Iridium can focus on building shareholder value while competitors continue to invest heavily in upgrades.

- To see how the analyst narrative frames Iridium’s capital allocation and profit outlook, check the full consensus case. 📊 Read the full Iridium Communications Consensus Narrative.

Valuation Gap Remains at Discount

- Iridium’s current share price of $18.14 is more than 70% below the DCF fair value estimate of $69.56, with analysts’ consensus price target at $32.63. This reinforces its position as one of the more attractively priced names among US telecom peers.

- Analysts' consensus view notes this deep valuation discount as a double-edged sword:

- Some view the low price-to-earnings ratio and wide gap to intrinsic value as an opportunity, given persistent profit and revenue growth.

- Others caution that the discounted valuation reflects justified caution about Iridium’s slowing top-line momentum and flagged financial position, suggesting patience may be warranted until forecast growth re-accelerates.

Subscription Shifts Pressure Recurring Revenue

- A trend of maritime customers moving from higher-ARPU primary services to more affordable backup plans is resulting in average revenue per user (ARPU) pressure and segment headwinds that have yet to stabilize.

- Analysts' consensus view flags this as a core bearish theme:

- They caution that continued shifts to lower-value plans and slower IoT service growth could threaten longer-term service revenue and margin gains.

- Delayed adoption of high-value Position, Navigation and Timing (PNT) services is seen as a risk to achieving Iridium’s longer-term revenue targets, especially if key government and commercial customers take time to ramp up.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Iridium Communications on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these numbers from a different angle? Share your perspective and build your own take on Iridium in just a few minutes. Do it your way.

A great starting point for your Iridium Communications research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Iridium faces headwinds from slowing growth, pressure on recurring revenue, and questions about its ability to sustain top-line expansion going forward.

If you want more consistent performance, check out stable growth stocks screener (2099 results) for companies with a proven record of steady earnings and revenue growth through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion