- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

Can Recent Satellite Launches Change the Investment Case for Iridium Communications in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Iridium Communications is a hidden bargain or a value trap? You are not alone, especially as more investors are re-examining the stock this year.

- The share price has swung noticeably, up 1.5% this week but still down over 44% year-to-date and more than 43% in the past year, shaping new perceptions around risk and potential growth.

- Recently, headlines about satellite launches and new partnerships for global connectivity have provided a fresh context to Iridium's price shifts. These developments highlight both opportunity and uncertainty, and are shifting how investors think about the company’s future market position and the stability of its revenue streams.

- On the valuation front, Iridium scores a 4 out of 6 on our valuation checks, suggesting undervaluation in several key areas. Next, we will break down the usual valuation methods. In addition, there is a smarter, holistic way to assess value that could change how you view this stock.

Find out why Iridium Communications's -43.2% return over the last year is lagging behind its peers.

Approach 1: Iridium Communications Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future free cash flows and then discounting those amounts back to their present value. This method helps investors understand what the company is really worth today, based on its ability to generate cash in the future.

For Iridium Communications, the most recent free cash flow sits at $312.87 million. Analyst forecasts suggest modest annual growth in free cash flow over the next several years, culminating in an expected free cash flow of $377.15 million by 2029. Projections beyond that rely on Simply Wall St's estimates, continuing the trend of incremental growth.

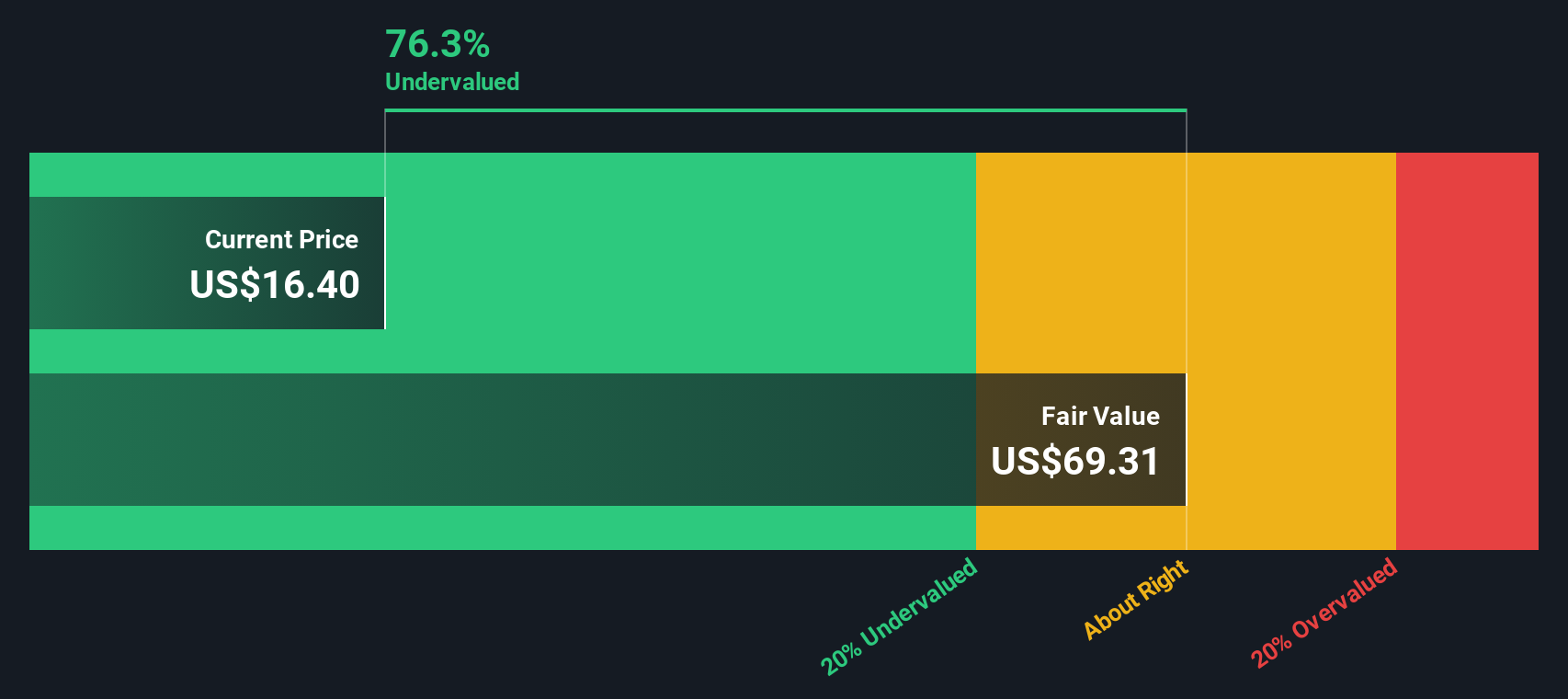

Based on these cash flow projections and using the 2 Stage Free Cash Flow to Equity DCF model, Iridium's intrinsic value is calculated at $69.49 per share. With the current share price trading at a significant discount, this implies the stock is considered 76.3% undervalued according to the DCF valuation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Iridium Communications is undervalued by 76.3%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Iridium Communications Price vs Earnings

Price-to-Earnings (PE) is a widely used valuation metric for profitable companies because it directly relates a company’s share price to its per-share earnings. This helps investors quickly gauge how much they are paying for each dollar of profit. As a result, it is a practical choice when a company, like Iridium Communications, is consistently generating positive earnings.

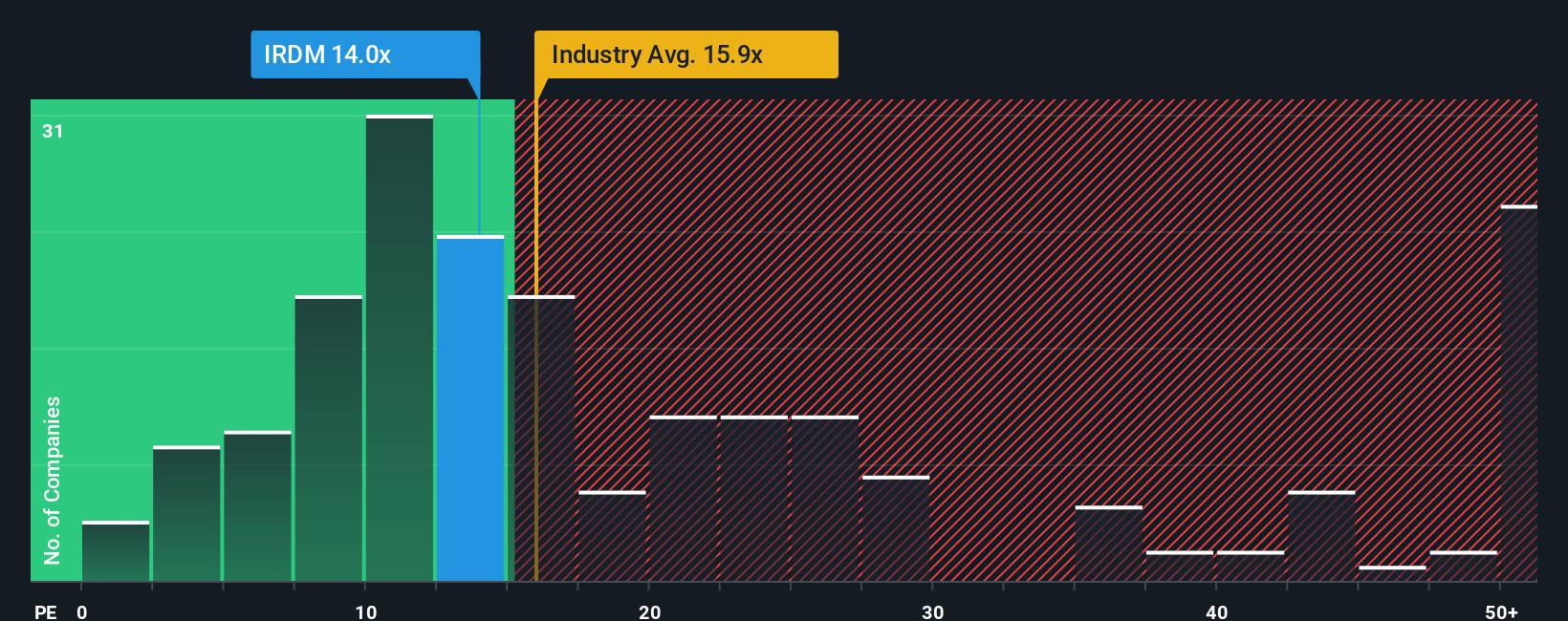

The “right” PE ratio varies according to factors such as future growth expectations and the perceived riskiness of a business. Higher growth prospects often justify higher PE multiples, while increased risks or lower expected growth can decrease the multiple. For context, Iridium's current PE is 13.68x. This is above its peer average of 6.61x, but below the telecom industry average of 16.31x.

Simply Wall St’s proprietary “Fair Ratio” offers a more tailored benchmark. Unlike generic industry or peer averages, the Fair Ratio (16.71x for Iridium) factors in not just sector trends but also company-specific data such as profit margins, expected earnings growth, risk profile, and the company’s market cap. This approach gives investors a clearer sense of whether the current multiple aligns with Iridium's particular strengths and weaknesses, regardless of what other telecom stocks are trading at.

With Iridium trading at a PE of 13.68x and its Fair Ratio at 16.71x, the stock is meaningfully below its fair relative value. This suggests that the market may be underestimating Iridium's growth or risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Iridium Communications Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple yet powerful tool that blends your unique perspective or "story" about a company, such as your assumptions for Iridium’s future growth, margins, or strategic direction, with a financial forecast and a resulting fair value. Instead of seeing investing decisions as just a set of numbers, Narratives make it easy to connect your insights about a company’s business, leadership, and industry shifts directly to what you think shares are worth and when to act.

Narratives are available directly on Simply Wall St’s Community page, used by millions of investors as an accessible way to show, test, and update their investment thesis. With Narratives, you can instantly compare your estimated Fair Value against the current share price, helping guide more informed buy or sell decisions. In addition, as major news or earnings updates emerge, Narratives are dynamically refreshed so your view stays up-to-date.

For example, on Iridium Communications, one investor’s narrative might forecast a fair value of $38.60 based on belief in high PNTS adoption and buybacks lifting earnings, while another pegs fair value at just $29.75 due to concerns about competition and slowing service revenue growth.

Do you think there's more to the story for Iridium Communications? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success