- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:GSAT

Is Globalstar’s Rally Sustainable After Satellite Partnership Drives 144% Gain in 2025?

Reviewed by Bailey Pemberton

If you’re trying to decide what to do with Globalstar stock right now, you’re not alone. After all, this is a company that’s delivered an incredible 867.9% gain over the past five years. Even in the past year alone, Globalstar shares have soared 144.0%. Those numbers are hard to ignore, and they’re making plenty of investors and would-be investors take a closer look.

Of course, not every stretch has been straight up. In the past month, Globalstar is up 38.0%, but zoom in on just the last week and you’ll see the stock pulled back by 5.9%. That kind of volatility is part of the story, especially for a company operating in a sector that’s been attracting attention as new technology opens fresh doors. Market sentiment can shift quickly as investors debate Globalstar’s role in the growing satellite and IoT ecosystem. Sometimes, optimism over future deals or technical advances adds a buzz, while other times, risks and uncertainty cool enthusiasm just as quickly.

So how should you think about Globalstar’s true value? According to our valuation analysis, Globalstar is currently undervalued in 0 out of 6 standard checks, resulting in a value score of 0. On the surface, this might leave questions about whether shares are still a bargain at these levels. Don’t worry, we’re about to break down the key valuation methods one by one, giving you a clearer framework for your decisions. And stick around to the end for an even more insightful way to think about valuation that goes beyond the basics.

Globalstar scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Globalstar Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used approach that estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to their present value. This method aims to capture the value of money generated by the business, adjusted for the time value of money.

For Globalstar, current free cash flow stands at $304.44 million. According to analyst estimates and subsequent forecasts, the company's FCF is projected to fluctuate over the next decade, reaching about $203.79 million in 2035. Notably, analyst projections extend out to five years, with further estimates extrapolated beyond that period. This forward-looking model incorporates both the uncertainty and opportunity inherent in long-term forecasting for a technology-focused business.

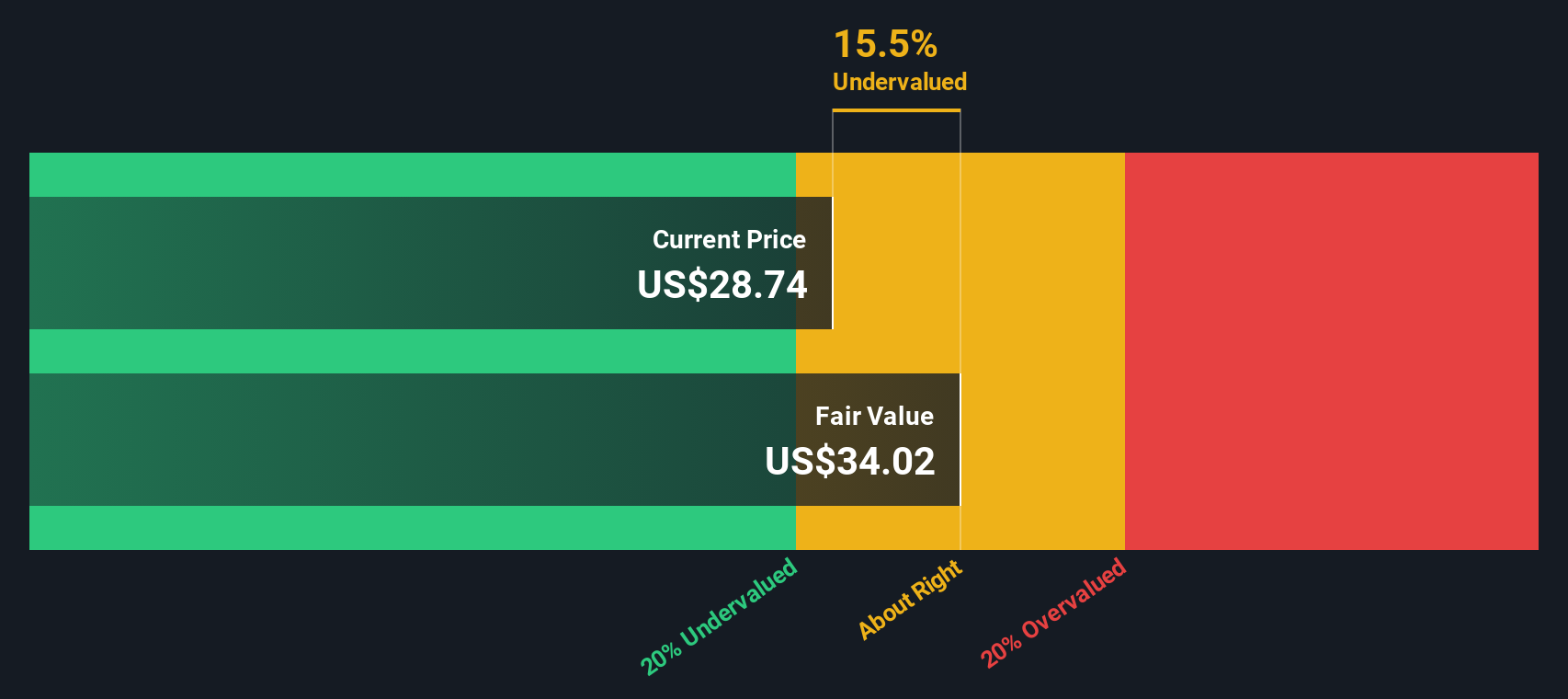

Based on these cash flow projections, the estimated intrinsic value per share for Globalstar comes out to $34.02. However, when compared to the company’s current share price, the DCF calculation suggests the stock is trading at a 30.2% premium to its intrinsic value. In other words, the market price currently exceeds what the underlying cash flows would imply as fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Globalstar may be overvalued by 30.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Globalstar Price vs Sales

The price-to-sales (P/S) ratio is a favored valuation metric when analyzing companies like Globalstar that are not currently profitable. For businesses still in high-growth mode or investing heavily in future opportunities, the P/S can give investors a sense of how much they are paying for each dollar of revenue, regardless of near-term profitability.

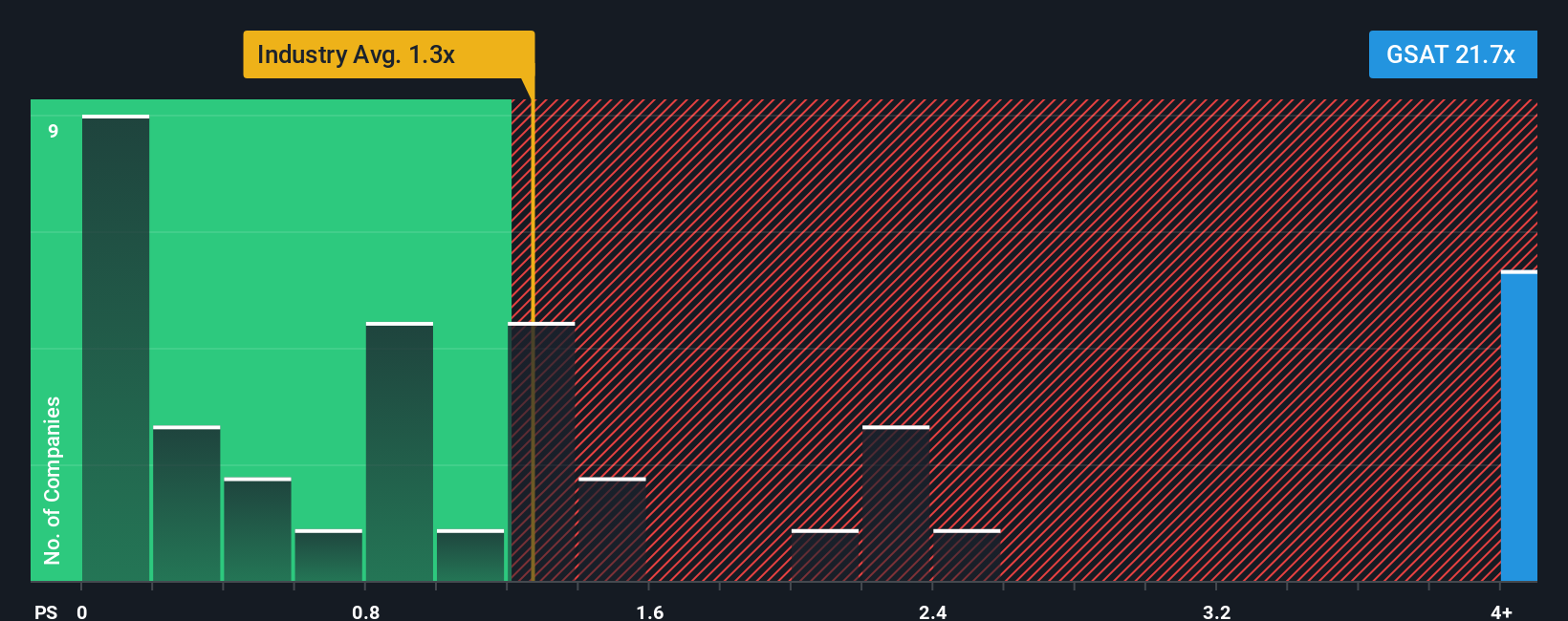

A company’s P/S ratio reflects how investors weigh future growth potential against current risks. If a firm is expected to grow rapidly, it may command a higher P/S multiple. Conversely, higher risks or subdued sales growth could justify a lower ratio. For context, Globalstar currently trades at a P/S ratio of 21.5x. This is well above both the telecom industry average of 1.3x and the average among its peers, which stands at 1.5x.

Simply Wall St uses a proprietary Fair Ratio that adjusts for a company’s specific growth outlook, risk profile, profit margins, and its size within the industry. This Fair Ratio is designed to offer a more nuanced perspective than a simple industry or peer average, as it accounts for factors unique to Globalstar. For Globalstar, the Fair Ratio is calculated as 1.9x. Since this is significantly lower than the current P/S multiple of 21.5x, the analysis points to the stock being priced well above what underlying fundamentals and expected growth would justify.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Globalstar Narrative

Earlier, we mentioned there is an even better way to think about valuation, so let’s introduce you to Narratives. A Narrative is your story for a company, combining your personal perspective on what drives its future with measurable financial forecasts, such as your own fair value, revenue, earnings, and margin estimates. By linking a company’s story, like Globalstar’s evolving role in satellite connectivity, to the numbers, Narratives let you see how your assumptions play out in a real valuation and help you judge whether the share price represents an opportunity or a risk.

Narratives are designed to be easy and dynamic. Used by millions of investors on Simply Wall St’s Community page, they allow you to compare your fair value with the latest market price and see instantly if you believe it is time to buy or sell. Narratives automatically update as new news or company results emerge, so your view is always based on the latest information and assumptions.

For example, one investor might build a bullish Globalstar Narrative, expecting government and defense partnerships to accelerate network growth and project a fair value of $60 per share. Another investor might take a more conservative view, focusing on competition and capital needs to arrive at a fair value of $45 per share.

Do you think there's more to the story for Globalstar? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSAT

Globalstar

Provides mobile satellite services in the United States, Canada, Europe, Central and South America, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives