- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:GSAT

Globalstar (GSAT): Exploring Valuation Following Recent Share Price Surge

Reviewed by Kshitija Bhandaru

Globalstar (GSAT) shares have moved higher lately, and investors are taking notice of its momentum given the backdrop of solid recent returns. The company’s stock has jumped 46% in the past week and is up 69% over the past 3 months, driven by interest in space-based connectivity plays.

See our latest analysis for Globalstar.

After a volatile stretch earlier in the year, Globalstar seems to be regaining momentum. Strong recent share price returns suggest that investors are warming up to the company’s longer-term story. While its shorter-term share price movement has been impressive, the 1-year total shareholder return of 1.34% and a five-year total return nearing 8% indicate that Globalstar is transitioning from pure speculation into a more solid, long-term play.

If you’re interested in uncovering even more market opportunities beyond satellite and space, this is the perfect moment to discover fast growing stocks with high insider ownership

With shares racing higher and expectations running hot, the big question for investors is whether Globalstar’s gains signal more upside ahead or if the market has already factored in all of its future growth potential.

Most Popular Narrative: 19.8% Undervalued

Globalstar’s latest narrative suggests a fair value of $52.50 per share, which is notably higher than its last close. Analysts envision upside if projections materialize. This market enthusiasm is based on high expectations for future growth and industry momentum.

Ongoing upgrades to ground infrastructure and the deployment of next-generation satellites (C-3 system and new launches with SpaceX) are expected to boost network capacity, reach, and performance. This will enable Globalstar to meet rising demand for hybrid and direct-to-device solutions, supporting long-term service revenue and higher discretionary earnings.

Curious about what is sparking analysts’ bold optimism? The foundation of this fair value forecast lies in a dramatic improvement in profitability and an earnings multiple that may surprise even seasoned investors. The narrative highlights a connection between unprecedented operational ambition and financial turnaround. Think you know the numbers that support this price? Take a closer look and uncover the full story.

Result: Fair Value of $52.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high capital costs or delays in government contracts may present challenges to Globalstar's growth story and could result in greater earnings volatility in the future.

Find out about the key risks to this Globalstar narrative.

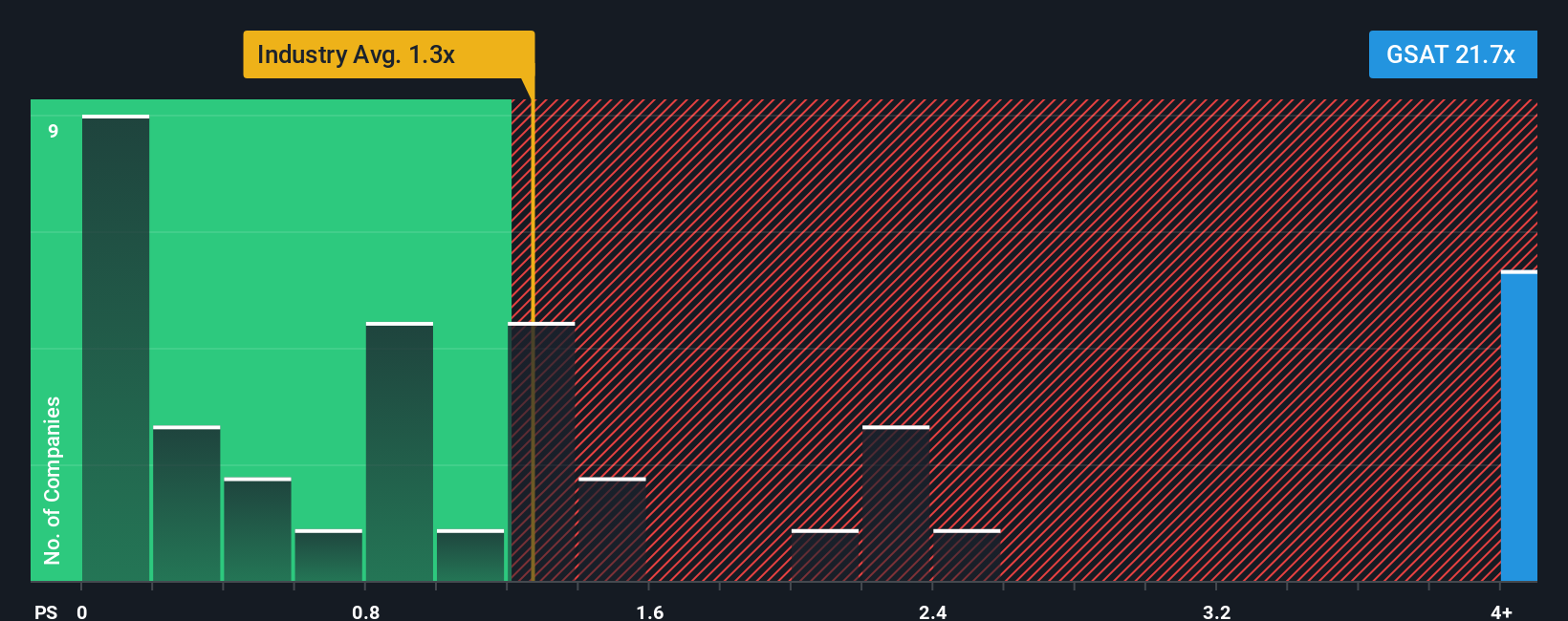

Another View: Multiples Paint a Different Picture

Looking through the lens of price-to-sales, Globalstar appears expensive. Its ratio is 19.6x, far above the US Telecom industry average of 1.2x, its peers at 1.4x, and the fair ratio of 1.9x. This substantial gap points to significant valuation risk if market sentiment shifts. Will investors continue to pay up, or is a correction on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Globalstar Narrative

If you see things differently or want to dig into the numbers yourself, take a few minutes to shape your own perspective. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Globalstar.

Looking for more investment ideas?

Don’t let fresh opportunities slip by. The market is full of compelling stocks in fast-changing sectors, and smart investors know there’s always more to find.

- Capture big yields with these 19 dividend stocks with yields > 3% and see which companies are offering dividend returns above 3% while maintaining financial health.

- Join the early tech trend by checking out these 24 AI penny stocks. These companies are poised for growth as artificial intelligence transforms areas such as healthcare and finance.

- Strengthen your strategy with these 901 undervalued stocks based on cash flows. These are stocks priced below their cash flow value and potentially ready for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSAT

Globalstar

Provides mobile satellite services in the United States, Canada, Europe, Central and South America, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives