- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:GSAT

A Look at Globalstar (GSAT) Valuation Following Clear Street’s New Buy Rating and Increased Analyst Interest

Reviewed by Kshitija Bhandaru

Clear Street's recent initiation of coverage on Globalstar (GSAT) with a Buy rating has placed the company squarely in the spotlight and sparked elevated attention from both analysts and investors. Management's visible presence at industry conferences may also be fueling the conversation.

See our latest analysis for Globalstar.

Globalstar’s shares have shown powerful momentum lately, with a 27% share price return over the past month and a substantial 55.7% climb in the past 90 days. While day-to-day moves can be volatile, the spotlight from recent analyst coverage and high-profile conference appearances is clearly resonating with investors. Long-term shareholders have enjoyed an impressive 142% total return over the last year, which underscores the company's strong performance and heightened growth potential.

If this kind of upward trajectory has you curious about what other dynamic companies might be out there, it’s a perfect chance to broaden your perspective and discover fast growing stocks with high insider ownership

The critical question now is whether Globalstar's rapid gains and bullish outlook signal an undervalued growth story waiting to be realized, or if the market has already priced in much of the anticipated upside for investors.

Most Popular Narrative: 27.4% Undervalued

Compared to Globalstar's most recent close of $43.56, the narrative's fair value estimate of $60.00 signals a notable upside. This difference in expectations draws focus on the key drivers that might justify such a premium outlook.

Ongoing upgrades to ground infrastructure and the deployment of next-generation satellites (C-3 system and new launches with SpaceX) will boost network capacity, reach, and performance. This will enable Globalstar to meet rising demand for hybrid and direct-to-device solutions, thus supporting long-term service revenue and higher discretionary earnings.

What is powering this bold price target? The growth story here is about more than just satellites. It hinges on a dramatic shift in earnings, margins, and how fast they can scale revenue. Curious which financial forecast underpins the optimism? Dig deeper to see the projections that fuel this headline valuation.

Result: Fair Value of $60.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high capital expenditure needs and delays in government or enterprise contracts could create volatility and present challenges to Globalstar’s ambitious growth expectations.

Find out about the key risks to this Globalstar narrative.

Another View: What Does the SWS DCF Model Say?

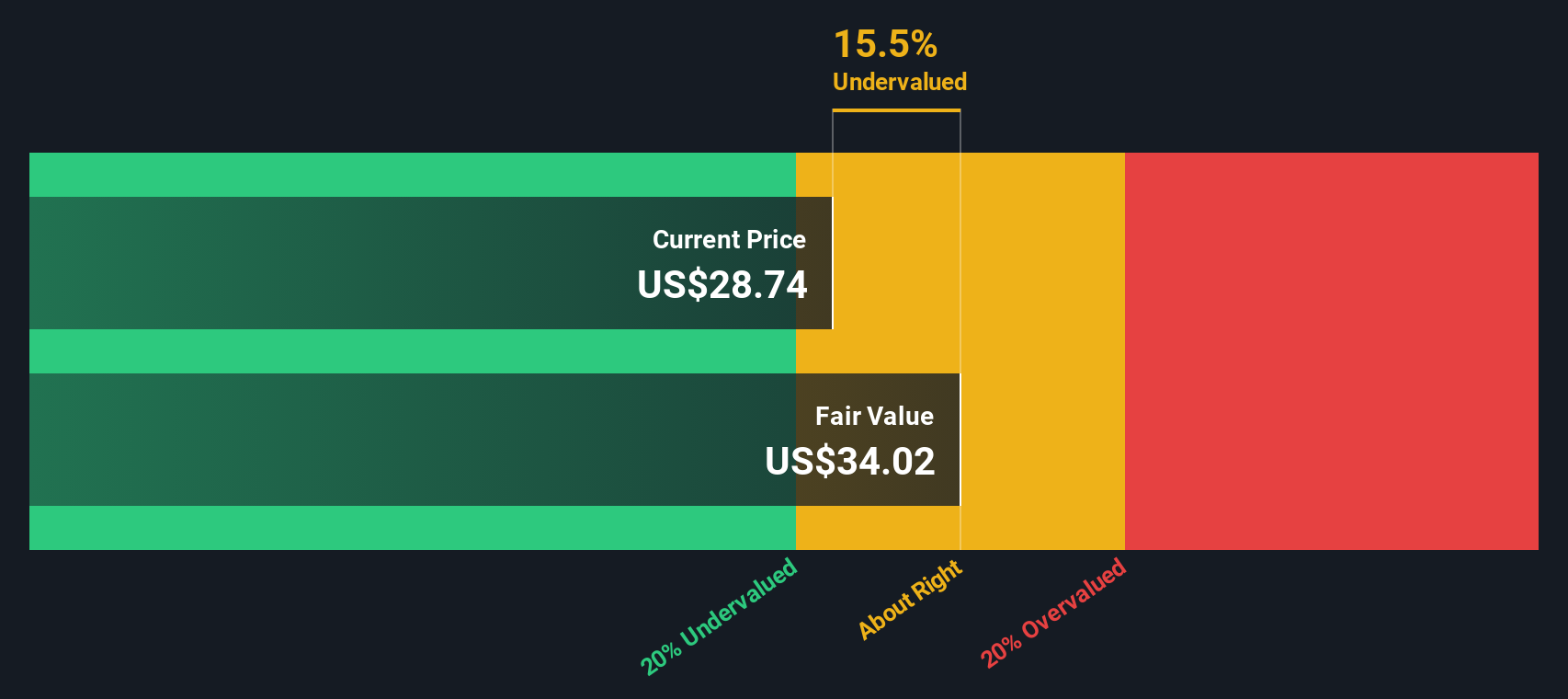

For a fresh perspective, the SWS DCF model suggests Globalstar's current price of $43.56 is actually above its estimated fair value of $34.02. While the earlier narrative points to significant upside, the DCF’s results highlight a possible overvaluation based on future cash flows. Could the optimism be running too far ahead, or is there more growth in store?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Globalstar Narrative

If you want to challenge these conclusions or prefer your own due diligence, you can craft your own Globalstar view in minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Globalstar.

Looking for More Investment Ideas?

Don’t let opportunity pass you by when there are so many dynamic sectors capturing market momentum. Get ahead with fresh ideas tailored to your goals.

- Tap into the growing demand for smarter healthcare by checking out these 33 healthcare AI stocks packed with companies harnessing AI-driven medical breakthroughs.

- Unlock steady income streams by reviewing these 18 dividend stocks with yields > 3% and spotting stocks with consistent and attractive dividend yields above 3%.

- Pounce on tomorrow’s tech leaders with these 24 AI penny stocks featuring companies paving the way in artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSAT

Globalstar

Provides mobile satellite services in the United States, Canada, Europe, Central and South America, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives