- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:FYBR

Frontier Stock Rises 7.8% YTD as Investors Weigh Valuation After Q1 Earnings

Reviewed by Simply Wall St

If you have been watching Frontier Communications Parent stock and wondering what to do next, you are not alone. Plenty of investors are trying to figure out where this story leads, especially after a year marked by both steady gains and a few surprises. Frontier's share price closed at $37.53 most recently, up 0.7% over the last week and 1.1% in the past month. For those looking back a bit further, the momentum is clearer: shares have jumped 7.8% year to date, and if you stretch the timeline to the last three years, you are looking at a 54.7% return. That kind of long-term growth is hard to ignore, and it is fueling a fresh debate about whether the current price is a bargain, fair value, or running a bit ahead of itself.

Some of this activity reflects wider trends in the telecom sector, as investors reassess risk and growth opportunities in the wake of evolving infrastructure needs and digital demand. Against that backdrop, questions about valuation are front and center. By the numbers, Frontier comes in with a value score of 2 out of 6 on major undervaluation checks, suggesting the stock appears undervalued on a couple of metrics but not broadly across the board.

If you are weighing whether to jump in, add to your position, or hold off, let us break down how analysts typically gauge a company's valuation. We will walk through the major methods and then wrap up with a perspective that might give you an even sharper edge in sizing up Frontier's worth.

Frontier Communications Parent scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Frontier Communications Parent Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its expected future cash flows and discounting them to today’s dollars. For Frontier Communications Parent, the DCF approach uses a two-stage Free Cash Flow to Equity model. This begins with detailed analyst projections and then extrapolates for later years.

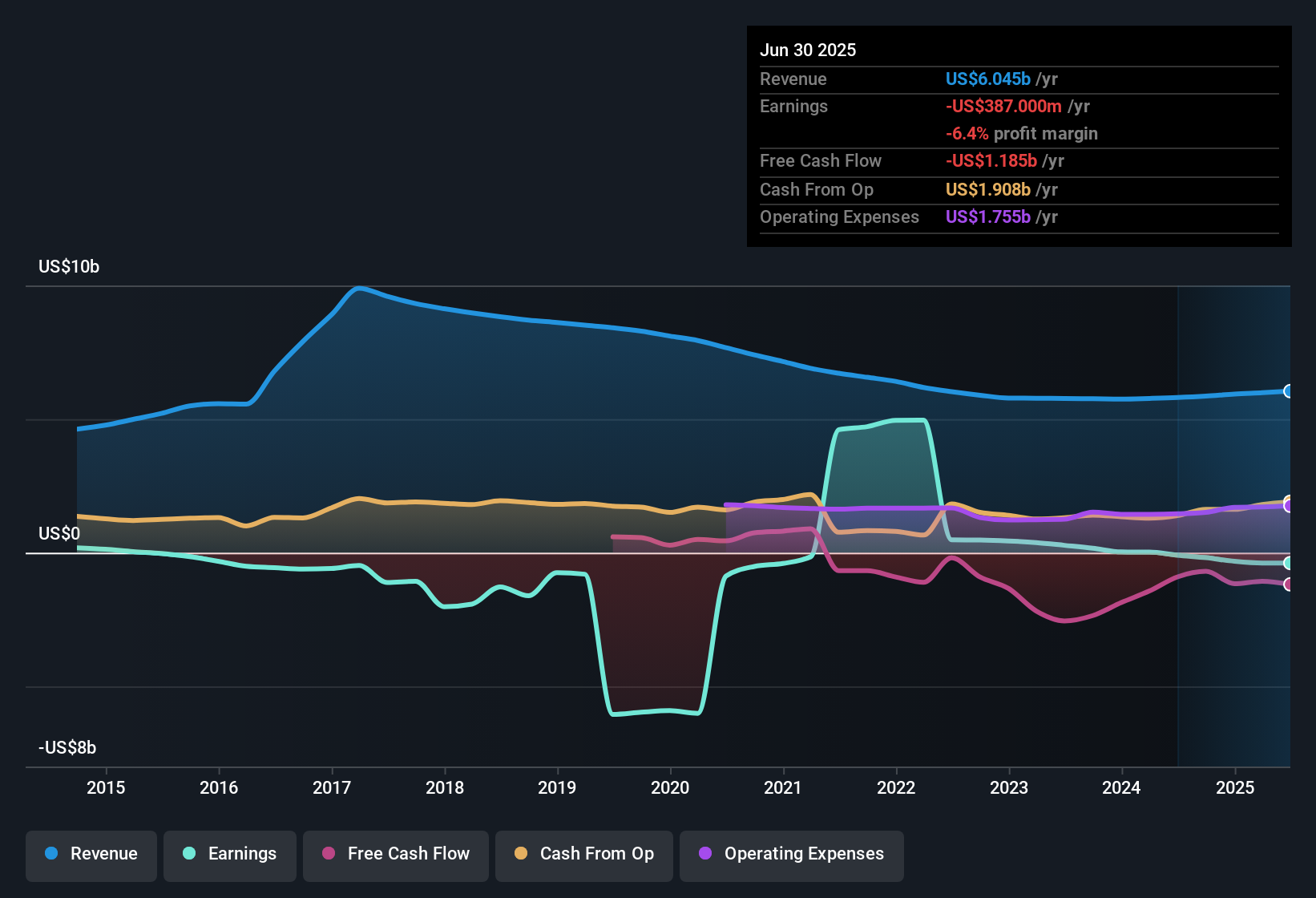

Currently, Frontier’s last twelve months of Free Cash Flow stands at -$1,264 million, indicating negative cash generation. However, analyst estimates see things turning around over time. Free Cash Flow is projected to rise into positive territory, reaching $971 million by the end of 2029. By 2035, Simply Wall St’s extrapolations expect Free Cash Flow to grow past $1.9 billion, using more modest growth rates as projections move further out.

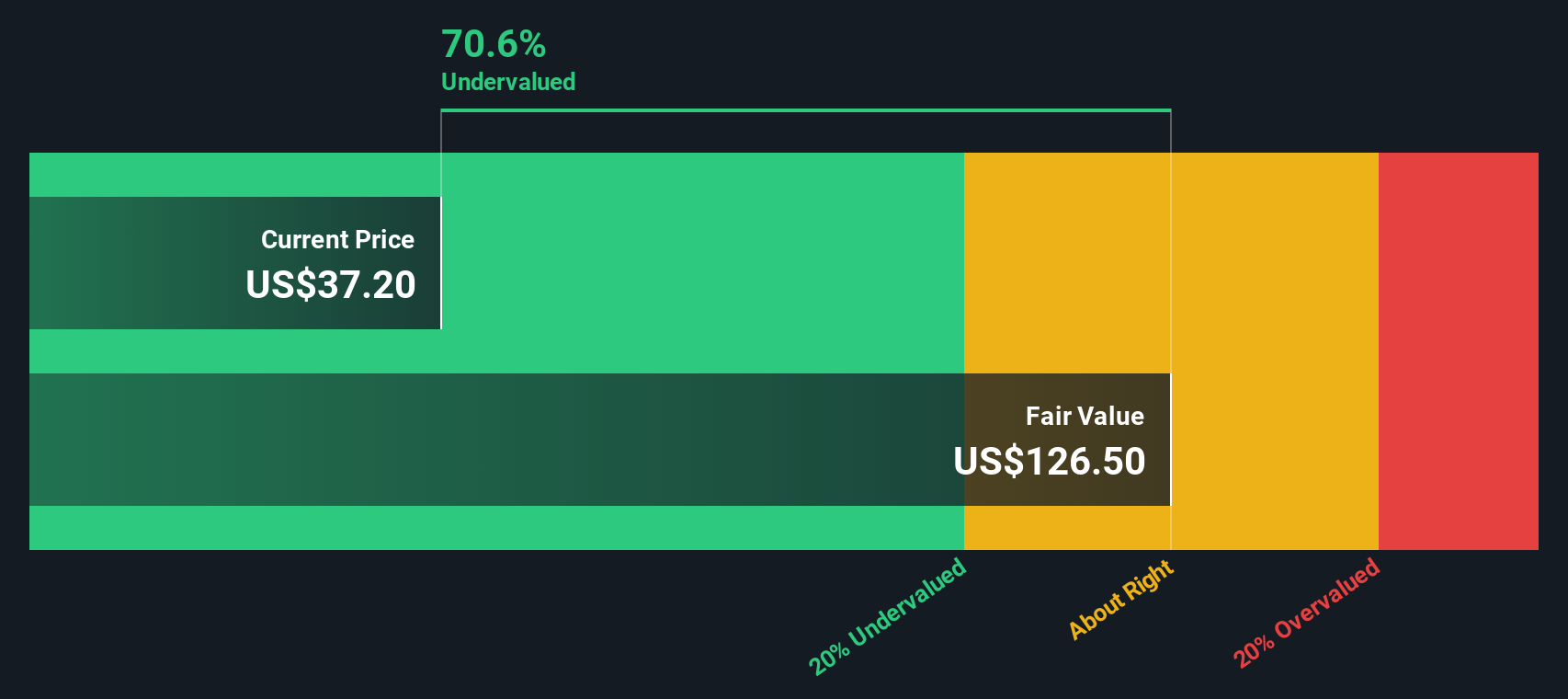

After discounting all these future cash flows back to today’s value and summing them up, the model arrives at an intrinsic value of $129.05 per share. Compared to the current price of $37.53, this suggests the stock is trading at a 70.9% discount to fair value. In other words, the DCF model points to Frontier being deeply undervalued at this time.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Frontier Communications Parent.

Approach 2: Frontier Communications Parent Price vs Sales

For companies like Frontier Communications Parent, where current earnings are negative, the Price-to-Sales (P/S) ratio is often a more reliable valuation tool than the Price-to-Earnings (P/E) ratio. The P/S multiple can provide a clearer perspective on how much investors are willing to pay for each dollar of sales, particularly when profits are inconsistent or temporarily negative.

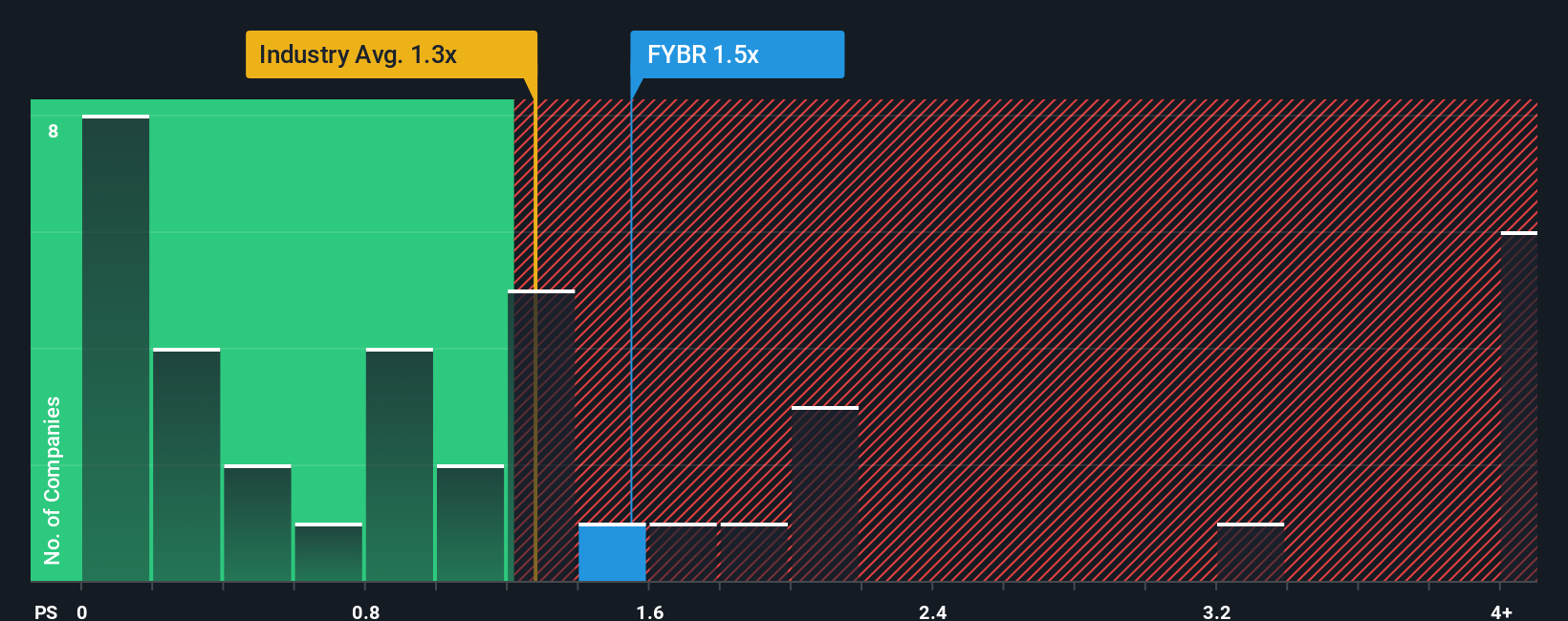

The “right” P/S ratio can shift based on growth prospects, risk, profit margins, and overall industry dynamics. Fast-growing, high-margin companies might command a higher ratio, while slower, riskier firms tend to trade at lower values. Comparing Frontier’s current P/S ratio of 1.55x to the Telecom industry average of 1.33x and peer average of 1.36x suggests the stock trades at a slight premium. However, these comparisons only tell part of the story.

Simply Wall St takes things a step further with its Fair Ratio, which is a customized benchmark that incorporates the company’s earnings growth outlook, risk profile, profit margin, market cap, and position within the industry. This makes the Fair Ratio, which comes to 1.20x for Frontier, a more meaningful way to judge value than simple peer or industry averages. Compared to the actual P/S of 1.55x, the stock appears somewhat expensive relative to its fundamentals and opportunity set.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Frontier Communications Parent Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply a story you create about a company that connects your perspective—what you believe about its future—to the numbers. By describing your own outlook on things like future revenue, profit margins, and risks, you build a financial forecast which then links directly to a fair value estimate.

Narratives go beyond standard models by letting you add your personal take and easily see how your story compares to others. They are accessible for free on Simply Wall St's Community page, where millions of investors share and compare their Narratives for thousands of companies, including Frontier Communications Parent. Narratives make it straightforward to decide when to buy or sell by showing how your Fair Value stacks up against the current price, and they automatically update as new news or earnings reports emerge.

For example, you might believe Frontier’s future growth will outpace the market, justifying a fair value well above today's price, while another investor expects slower growth and values it much lower. This flexible approach provides a clearer, more dynamic way to make investment decisions and stay ahead when the facts change.

Do you think there's more to the story for Frontier Communications Parent? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FYBR

Frontier Communications Parent

Provides communications and technology services for consumer and business customers in the United States.

Slightly overvalued with very low risk.

Similar Companies

Market Insights

Community Narratives