- United States

- /

- Capital Markets

- /

- NYSE:FRGE

March 2025's Top Penny Stock Picks

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility, marked by recent selloffs in major tech stocks and concerns over tariffs, investors are reassessing their strategies. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or newer companies, these stocks present an underappreciated chance for growth at lower price points.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.73 | $393.17M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $3.41 | $2.08B | ✅ 3 ⚠️ 3 View Analysis > |

| Cango (NYSE:CANG) | $4.20 | $457.12M | ✅ 4 ⚠️ 1 View Analysis > |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.88 | $79.34M | ✅ 5 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ✅ 1 ⚠️ 5 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $3.56 | $467.35M | ✅ 5 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.57 | $77.35M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.8494 | $5.88M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $138.01M | ✅ 3 ⚠️ 1 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8704 | $77.26M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 761 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

FingerMotion (NasdaqCM:FNGR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FingerMotion, Inc. is a mobile data specialist company that offers a mobile payment and recharge platform system in China, with a market cap of $89.14 million.

Operations: The company generates revenue primarily from its Wireless Communications Services segment, totaling $33.57 million.

Market Cap: $89.14M

FingerMotion, Inc., a mobile data specialist, has an $89.14 million market cap and generates US$33.57 million in revenue primarily from its Wireless Communications Services segment. Despite being unprofitable with increasing losses over the past five years, FingerMotion's short-term assets of US$31.7 million exceed its liabilities, providing some financial stability. The company's net debt to equity ratio is satisfactory at 14.9%. Recent events include appointing CT International LLP as auditors and reporting Q3 sales growth to US$8.53 million while reducing net loss compared to the previous year’s quarter results.

- Take a closer look at FingerMotion's potential here in our financial health report.

- Gain insights into FingerMotion's past trends and performance with our report on the company's historical track record.

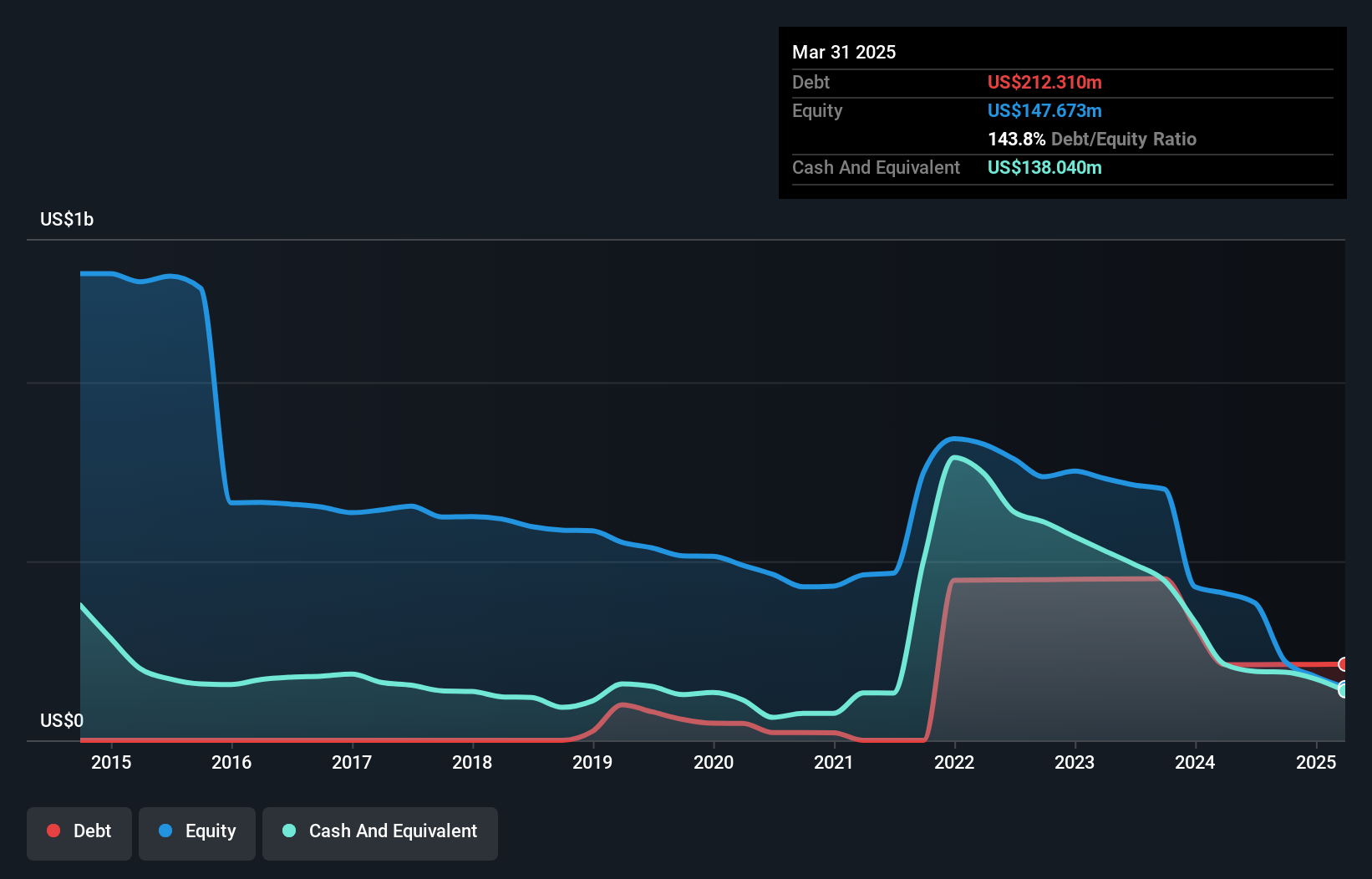

3D Systems (NYSE:DDD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3D Systems Corporation offers 3D printing and digital manufacturing solutions across various regions including the Americas, Europe, the Middle East, North Africa, the Asia Pacific, and Oceania with a market cap of $375.67 million.

Operations: The company's revenue is divided into two main segments: Healthcare, generating $200.56 million, and Industrial, contributing $243.39 million.

Market Cap: $375.67M

3D Systems, with a market cap of US$375.67 million, operates in the 3D printing sector with revenue from Healthcare (US$200.56 million) and Industrial (US$243.39 million) segments. Despite its innovative strides in digital dentistry and strategic alliances like the one with Daimler Buses for remote spare part printing, the company remains unprofitable and has seen increasing losses over five years at 33.5% annually. Short-term assets of US$460 million exceed liabilities, offering some financial cushion amidst high share price volatility and an experienced management team averaging 2.3 years tenure.

- Dive into the specifics of 3D Systems here with our thorough balance sheet health report.

- Gain insights into 3D Systems' future direction by reviewing our growth report.

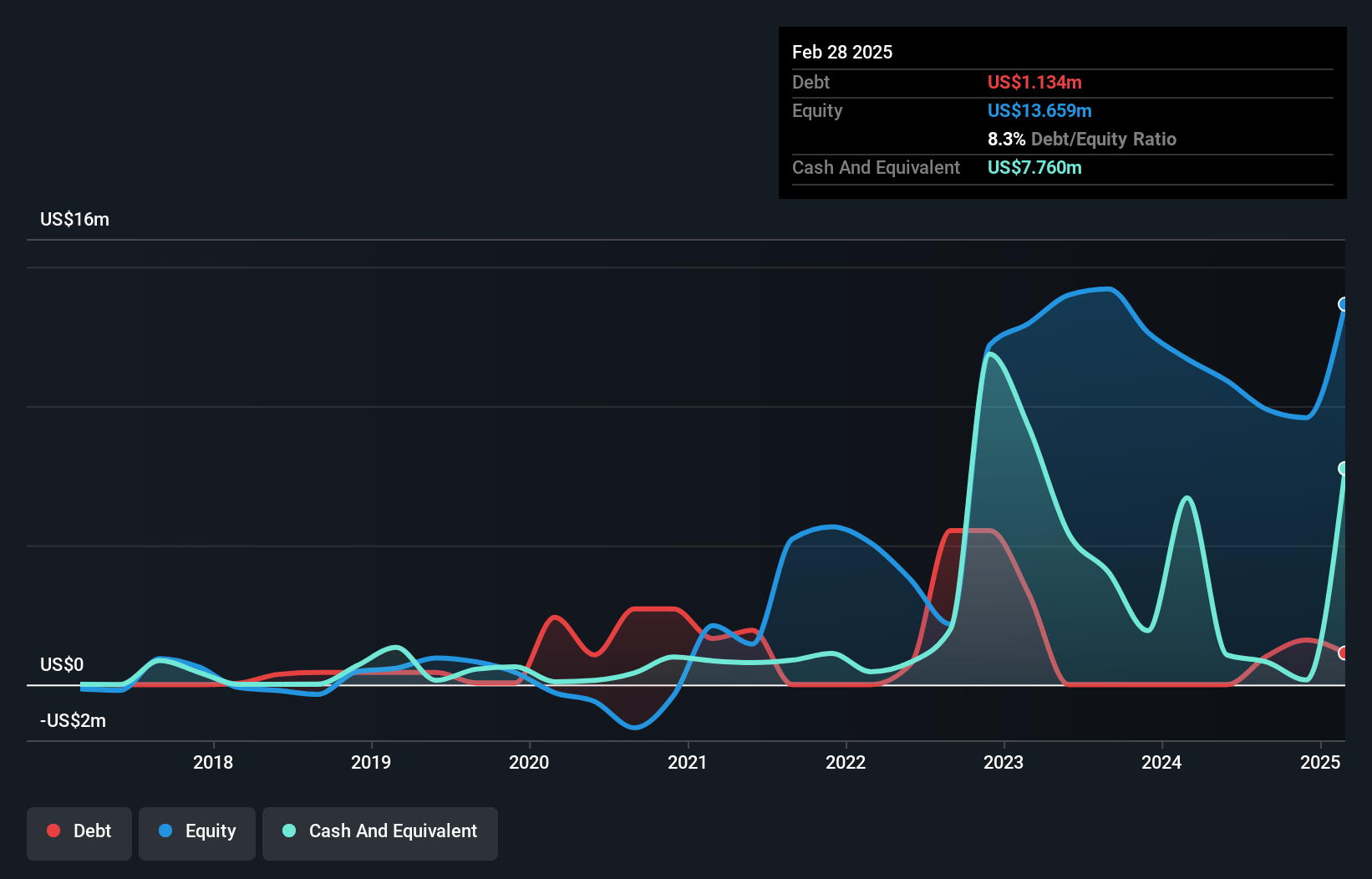

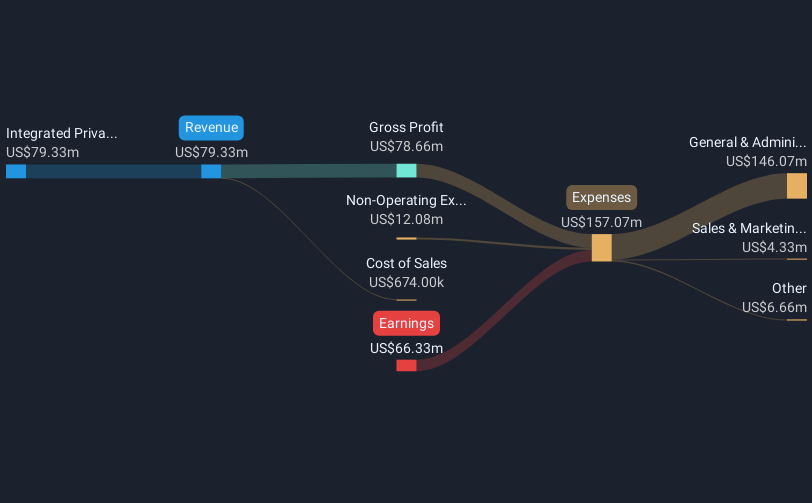

Forge Global Holdings (NYSE:FRGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Forge Global Holdings, Inc. operates a financial services platform in California and has a market capitalization of approximately $116.70 million.

Operations: The company generates revenue from its Integrated Private Markets Service Provider segment, which amounted to $79.33 million.

Market Cap: $116.7M

Forge Global Holdings, with a market cap of US$116.70 million, operates in the financial services sector and generated US$79.33 million in revenue from its Integrated Private Markets Service Provider segment. Despite being unprofitable with a negative return on equity of -29.92%, the company is debt-free and has sufficient cash runway for over three years if current cash flow trends continue. Recent strategic partnerships, such as with Yahoo Finance, aim to enhance investor access to private market data and opportunities, while executive changes bring experienced leadership to navigate challenges like NYSE compliance issues related to share price minimums.

- Click here to discover the nuances of Forge Global Holdings with our detailed analytical financial health report.

- Explore Forge Global Holdings' analyst forecasts in our growth report.

Make It Happen

- Click here to access our complete index of 761 US Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FRGE

Forge Global Holdings

Operates a financial services platform in California.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives