- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:CNSL

Should You Use Consolidated Communications Holdings's (NASDAQ:CNSL) Statutory Earnings To Analyse It?

As a general rule, we think profitable companies are less risky than companies that lose money. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Consolidated Communications Holdings' (NASDAQ:CNSL) statutory profits are a good guide to its underlying earnings.

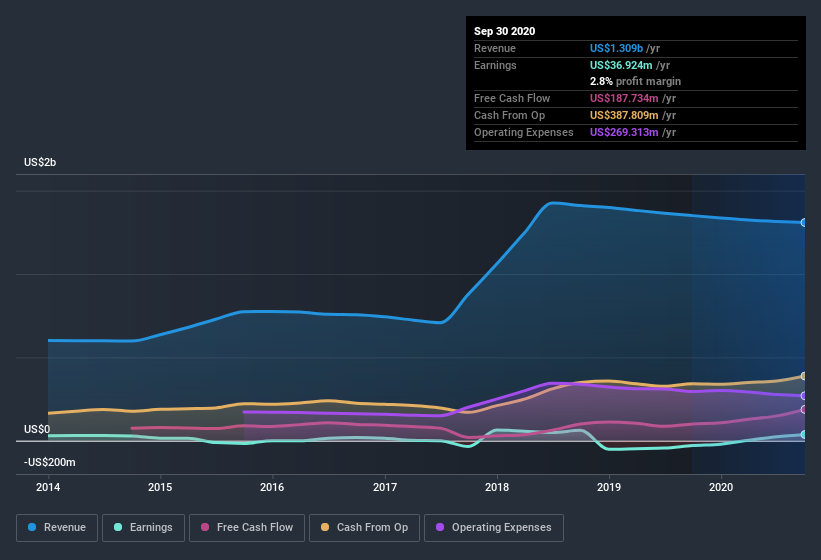

While Consolidated Communications Holdings was able to generate revenue of US$1.31b in the last twelve months, we think its profit result of US$36.9m was more important. The good news is that the company managed to grow its revenue over the last three years, and also move from loss-making to profitable.

Check out our latest analysis for Consolidated Communications Holdings

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. In this article we will consider how Consolidated Communications Holdings' decision to issue new shares in the company has impacted returns to shareholders. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Consolidated Communications Holdings increased the number of shares on issue by 10% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Consolidated Communications Holdings' EPS by clicking here.

A Look At The Impact Of Consolidated Communications Holdings' Dilution on Its Earnings Per Share (EPS).

Three years ago, Consolidated Communications Holdings lost money. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if Consolidated Communications Holdings' earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Consolidated Communications Holdings' Profit Performance

Consolidated Communications Holdings issued shares during the year, and that means its EPS performance lags its net income growth. Because of this, we think that it may be that Consolidated Communications Holdings' statutory profits are better than its underlying earnings power. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Consolidated Communications Holdings at this point in time. Every company has risks, and we've spotted 2 warning signs for Consolidated Communications Holdings (of which 1 is a bit concerning!) you should know about.

This note has only looked at a single factor that sheds light on the nature of Consolidated Communications Holdings' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Consolidated Communications Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CNSL

Consolidated Communications Holdings

Provides broadband and business communication solutions for consumer, commercial, and carrier channels in the United States.

Fair value very low.

Similar Companies

Market Insights

Community Narratives