- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:CCOI

Is Cogent Communications (CCOI) Shifting Priorities After Dividend Cut and Insider Selling?

Reviewed by Sasha Jovanovic

- Cogent Communications Holdings recently reported a quarterly net loss of US$41.54 million for the period ended September 30, 2025, alongside a quarterly dividend decrease to US$0.02 per share, payable to shareholders in December.

- The ongoing pattern of insider share sales and cautious analyst sentiment has increased attention to the company's business outlook and governance among investors.

- In light of the continued insider selling following the earnings announcement, we will consider how these developments shape Cogent Communications Holdings' investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Cogent Communications Holdings Investment Narrative Recap

To be a shareholder of Cogent Communications Holdings, one needs to believe in the company's ability to convert surging global internet and data growth into profitable, sustainable revenue streams, even as traditional bandwidth pricing faces competitive pressure. The recent dividend cut and increased quarterly net loss have drawn attention to Cogent's cash flow resilience and raised concerns that may disrupt near-term confidence; however, these developments have not changed the central, most pressing short-term risk, whether core service price declines will continue eroding top-line growth faster than new product demand can offset.

Among recent announcements, the dividend reduction to US$0.02 per share for Q4 2025 is especially relevant. This measure highlights management's response to financial pressures after reporting continued quarterly losses, and it intertwines directly with investor concerns about whether current revenue models and cash flows are robust enough to maintain shareholder returns amid ongoing industry headwinds.

By contrast, investors should be aware that persistent declines in average price per megabit for legacy services could continue to...

Read the full narrative on Cogent Communications Holdings (it's free!)

Cogent Communications Holdings' narrative projects $1.2 billion revenue and $158.2 million earnings by 2028. This requires 10.4% yearly revenue growth and a $374.5 million increase in earnings from -$216.3 million currently.

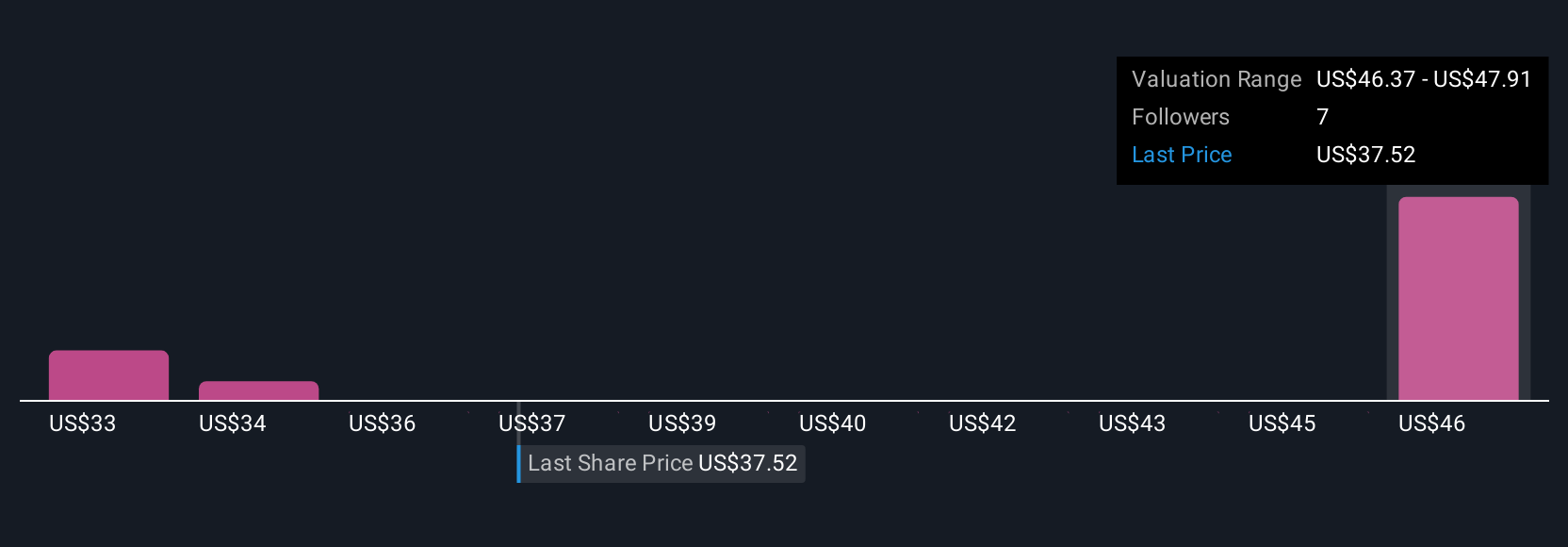

Uncover how Cogent Communications Holdings' forecasts yield a $44.55 fair value, a 167% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Cogent’s fair value from US$35.43 to US$62.84 across 3 viewpoints. Despite this range, falling bandwidth prices remain a central issue for future returns so consider multiple perspectives before acting.

Explore 3 other fair value estimates on Cogent Communications Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Cogent Communications Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cogent Communications Holdings research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Cogent Communications Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cogent Communications Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCOI

Cogent Communications Holdings

Through its subsidiaries, provides high-speed Internet access, private network, and data center colocation space services in North America, South America, Europe, Oceania, and Africa.

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives