- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ATNI

Improved Revenues Required Before ATN International, Inc. (NASDAQ:ATNI) Stock's 25% Jump Looks Justified

ATN International, Inc. (NASDAQ:ATNI) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 40% in the last twelve months.

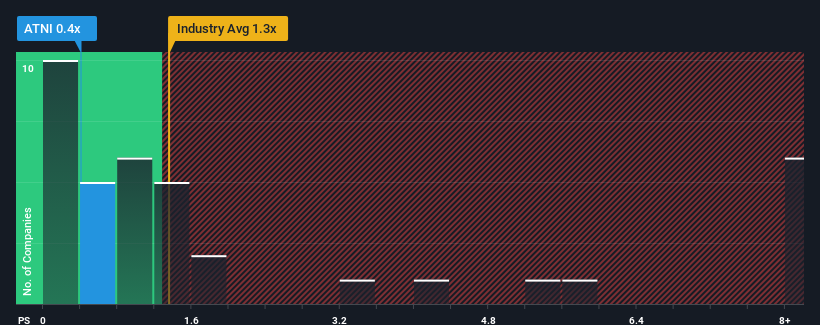

Even after such a large jump in price, ATN International may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Telecom industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for ATN International

How ATN International Has Been Performing

While the industry has experienced revenue growth lately, ATN International's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on ATN International will help you uncover what's on the horizon.How Is ATN International's Revenue Growth Trending?

ATN International's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 4.3% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 21% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 1.0% as estimated by the three analysts watching the company. With the industry predicted to deliver 28% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why ATN International's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From ATN International's P/S?

The latest share price surge wasn't enough to lift ATN International's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of ATN International's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware ATN International is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ATNI

ATN International

Through its subsidiaries, provides digital infrastructure and communications services to residential, business, and government customers in the United States, Guyana, the US Virgin Islands, Bermuda, and internationally.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives