- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

What AST SpaceMobile (ASTS)'s Verizon Satellite Deal Means for Shareholders

Reviewed by Sasha Jovanovic

- On October 8, 2025, AST SpaceMobile announced a definitive commercial agreement with Verizon to provide direct-to-cellular satellite connectivity to Verizon customers across the U.S. starting in 2026, aiming to enhance coverage using its low Earth orbit satellite network.

- This deal enables everyday smartphones to access space-based broadband without additional hardware, marking a shift in how mobile coverage can reach remote and underserved areas.

- We’ll examine how the Verizon partnership and direct-to-smartphone satellite technology shape AST SpaceMobile’s investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is AST SpaceMobile's Investment Narrative?

For anyone considering AST SpaceMobile, the big idea to buy into is the company’s vision of providing direct satellite connectivity to standard smartphones, without new hardware, by partnering with telecom giants and launching a new wave of satellites. The recent Verizon agreement is a major validation, directly addressing a key catalyst: credible, large-scale commercial adoption. Shares have hit all-time highs, showing investor excitement, and this deal could accelerate the timeline for meaningful revenue, shifting some focus away from concerns about ongoing financial losses or dilution risk linked to recent equity offerings. However, the intense need for capital persists, and operational execution risks remain high as AST SpaceMobile must scale up production and launch dozens of satellites successfully. While the Verizon partnership tackles market access, investors should still weigh continuing cash burn, funding needs, and short track record of management.

But even with momentum, ongoing funding requirements are something investors need to watch closely.

Exploring Other Perspectives

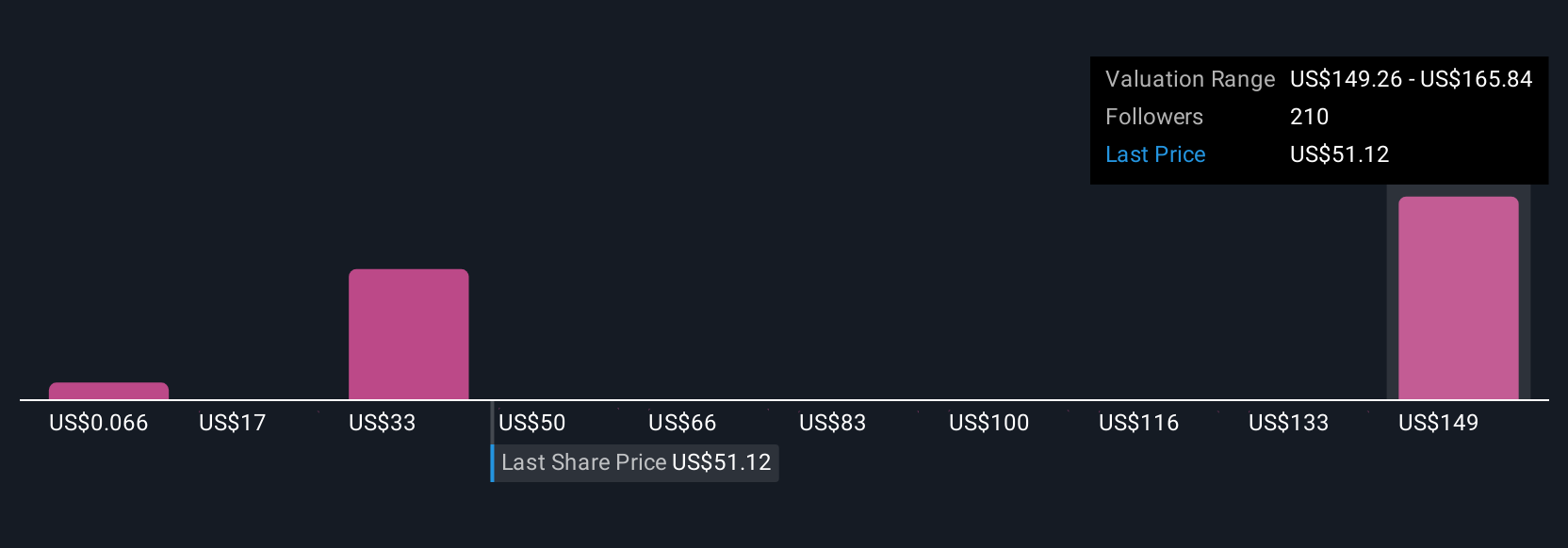

Explore 67 other fair value estimates on AST SpaceMobile - why the stock might be worth over 2x more than the current price!

Build Your Own AST SpaceMobile Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AST SpaceMobile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AST SpaceMobile's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives