- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

Has AST SpaceMobile’s 236% Surge in 2025 Already Priced In Its Satellite Ambitions?

Reviewed by Bailey Pemberton

- If you are wondering whether AST SpaceMobile is still a smart bet after its massive run or if you have already missed the real upside, this breakdown will help you figure out what the current price is actually baking in.

- The stock has rocketed, climbing 29.3% over the last week and an eye catching 235.7% year to date, on top of a huge 1601.4% gain over three years that has dramatically changed how the market sees its potential.

- Much of this momentum has followed high profile milestones in its space based mobile broadband ambitions, including market excitement around progress on its satellite deployments and partnerships with major telecom operators. Investors are now trying to decide whether these developments justify the dramatic shift in expectations or if sentiment has simply run ahead of fundamentals.

- Despite all that, AST SpaceMobile only scores a 2 out of 6 on our valuation checks. This suggests the market may be paying up in some areas while overlooking value in others. Next, we will compare what different valuation methods are saying about the stock before finishing with a more powerful way to think about its true worth.

AST SpaceMobile scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AST SpaceMobile Discounted Cash Flow (DCF) Analysis

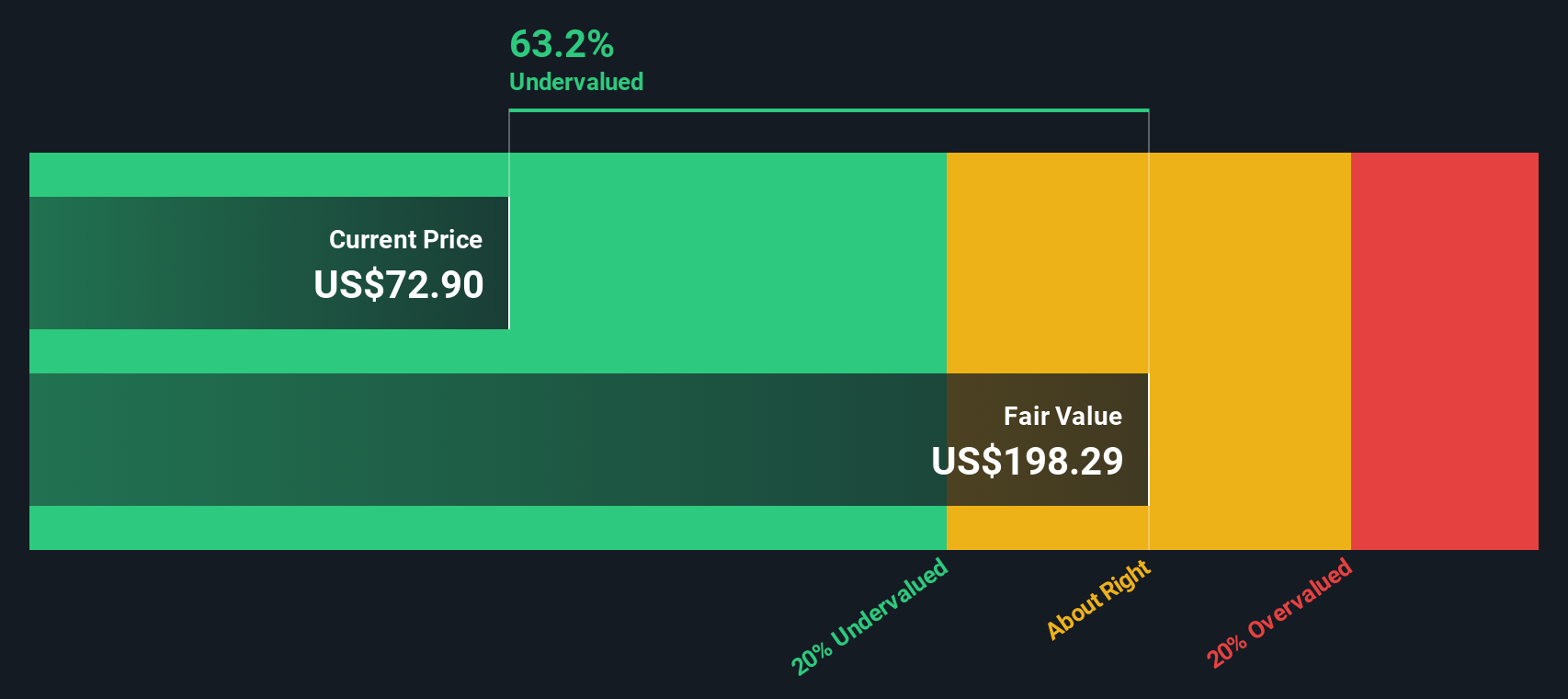

The Discounted Cash Flow model estimates what a company is worth by extrapolating its future cash flow projections and discounting them back to today using a required return. For AST SpaceMobile, the latest twelve month Free Cash Flow is deeply negative at around $1,078 Million, reflecting heavy investment and early stage losses. Analyst forecasts and Simply Wall St extrapolations suggest this will gradually flip, with Free Cash Flow projected to reach roughly $4,396 Million by 2035 as the business scales its satellite network.

Using a 2 Stage Free Cash Flow to Equity model based on these projections, the DCF arrives at an estimated intrinsic value of about $194.42 per share. Compared with the current share price, this implies a substantial 62.6% discount, indicating the market is still pricing in a lot of execution risk despite the recent rally.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AST SpaceMobile is undervalued by 62.6%. Track this in your watchlist or portfolio, or discover 911 more undervalued stocks based on cash flows.

Approach 2: AST SpaceMobile Price vs Book

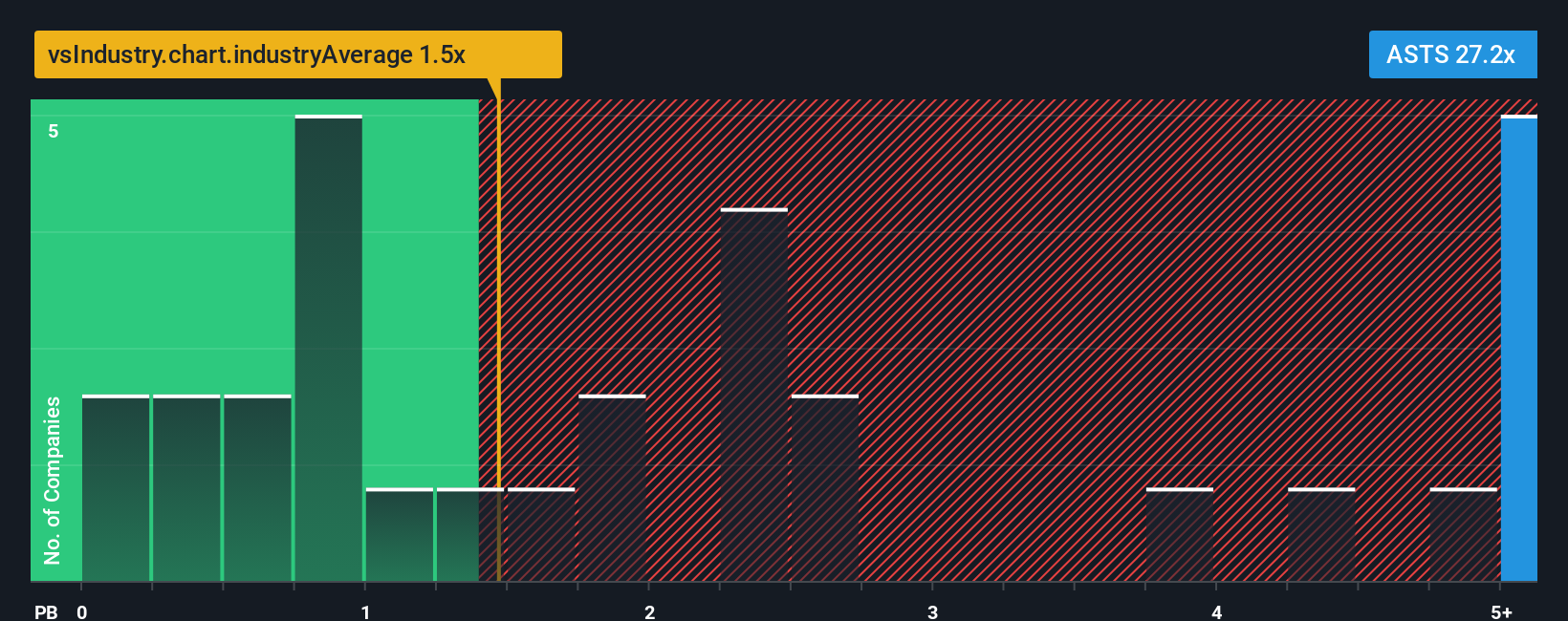

For asset heavy or early stage companies that are not yet consistently profitable, the price to book ratio can be a more useful yardstick than earnings based multiples, because it anchors valuation to the net assets backing the business rather than volatile or negative profits. In general, faster growth and lower perceived risk justify a higher normal price to book multiple, while slower growth and higher risk usually mean investors should demand a discount.

AST SpaceMobile currently trades at about 16.45x book value, which is far richer than the broader Telecom industry average of roughly 1.25x and also well above its peer group, which sits near 6.92x. Simply Wall St also considers a proprietary Fair Ratio, which estimates what a reasonable price to book should be after factoring in AST SpaceMobile’s growth outlook, risk profile, profitability trajectory, industry and market capitalization. This Fair Ratio is typically more informative than a simple comparison with peers or sector averages, because it adjusts for the company’s unique mix of strengths and vulnerabilities.

On this basis, AST SpaceMobile’s current 16.45x multiple stands meaningfully above its Fair Ratio, pointing to a stock price that is ahead of what fundamentals alone would justify.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

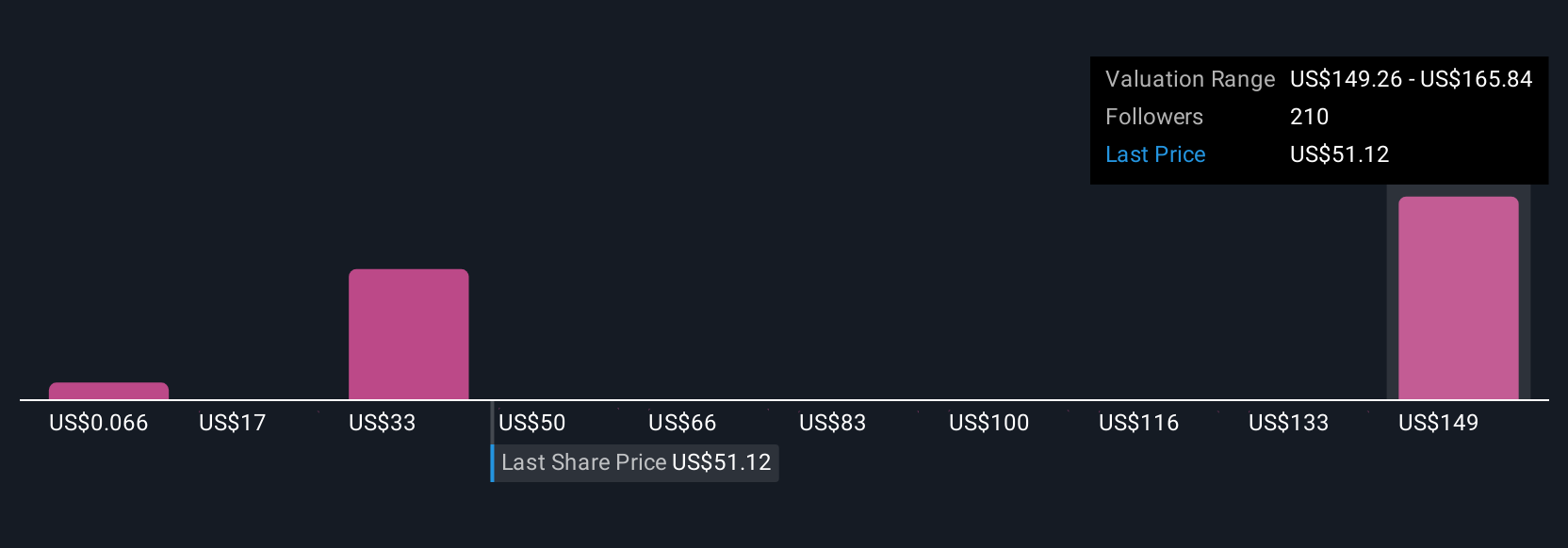

Upgrade Your Decision Making: Choose your AST SpaceMobile Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to your numbers by linking your view of a company’s future revenue, earnings and margins to a concrete fair value estimate. A Narrative on Simply Wall St starts with your perspective on AST SpaceMobile’s opportunity and risks, translates that story into a financial forecast, and then compares its resulting fair value to the current share price so you can quickly see whether it looks like a buy, hold or sell. Narratives live inside the Community page on the Simply Wall St platform, making them easy to explore, create and adjust, and they update dynamically when fresh information like earnings releases, satellite deployment news or new partnerships is added. For example, one AST SpaceMobile Narrative might assume aggressive network rollout, rising margins and a much higher fair value, while another might bake in slower adoption and a far more conservative fair value.

Do you think there's more to the story for AST SpaceMobile? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026