- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

A Look at AST SpaceMobile's Valuation Following Landmark Verizon Satellite Connectivity Deal

Reviewed by Kshitija Bhandaru

AST SpaceMobile (ASTS) shares jumped after announcing a definitive agreement with Verizon to bring direct-to-smartphone satellite connectivity for Verizon customers in 2026. This partnership strengthens AST SpaceMobile’s commercial footprint and enhances its technology credibility.

See our latest analysis for AST SpaceMobile.

AST SpaceMobile’s dramatic rally over the past month has turned heads, fueled by the game-changing Verizon partnership and a string of milestones such as pioneering voice and video calls from space. After soaring to an all-time high, momentum remains strong, with an 85.1% one-month share price return and a staggering 202% total shareholder return over the past year. This underscores rapid growth and intensifying investor excitement about its future potential.

If you’re intrigued by the bold moves in space-tech lately, you might want to check out other high-growth names. See the full list here: See the full list for free.

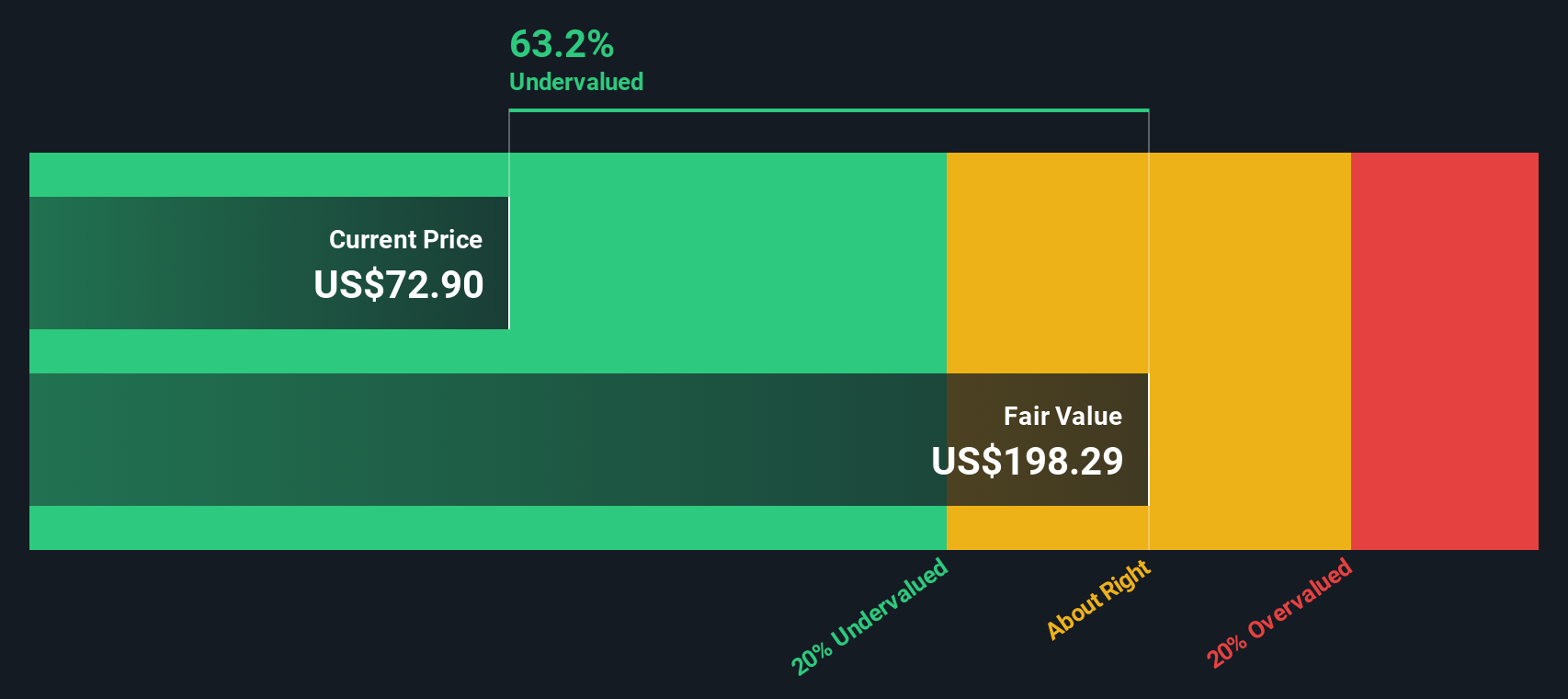

Yet with shares trading at all-time highs on a wave of excitement, is AST SpaceMobile still undervalued at these levels, or could the market already be pricing in years of future growth and flawless execution?

Price-to-Book of 26.2x: Is it justified?

AST SpaceMobile is currently trading at a price-to-book ratio of 26.2x, substantially above both the US telecom industry average and its peer group. The recent share surge has pushed this valuation metric to an elevated level compared to the wider market.

The price-to-book multiple highlights how much investors are willing to pay for each dollar of net assets on AST SpaceMobile's balance sheet. For technology-driven and early-stage companies, high price-to-book ratios often signal strong optimism about future growth prospects or upcoming breakthrough events.

Looking at the numbers, AST SpaceMobile’s 26.2x price-to-book is much higher than the industry average of 1.4x and the peer average of 4.8x. This level of premium suggests that investors are banking on ambitious execution and robust earnings growth materializing over the coming years, far above what is currently typical for the sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 26.2x (OVERVALUED)

However, slowing revenue growth or an inability to achieve profitability could challenge the current optimism and put downward pressure on AST SpaceMobile’s high valuation.

Find out about the key risks to this AST SpaceMobile narrative.

Another View: The SWS DCF Model

While price-to-book signals that AST SpaceMobile may be overvalued compared to its industry, our DCF model tells a different story. Based on SWS DCF analysis, the shares are actually trading at a 58.2% discount to estimated fair value, which suggests the market might be underestimating future cash flows.

Look into how the SWS DCF model arrives at its fair value.

How should investors weigh this sharp divide between multiples and long-term cash flow projections?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AST SpaceMobile for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AST SpaceMobile Narrative

If you see things differently or want to do your own digging, you can quickly build your own view using our tools in just minutes. Do it your way

A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just stop with AST SpaceMobile. The right tools can unlock smarter investing moves, so make sure you’re not missing opportunities the market hasn’t noticed yet.

- Uncover big yield potential by sifting through these 18 dividend stocks with yields > 3% with yields above 3% and strong payout histories.

- Spot bold growth stories when you check out these 24 AI penny stocks at the forefront of artificial intelligence innovation and shaping tomorrow’s technology landscape.

- Seize overlooked bargains by targeting these 877 undervalued stocks based on cash flows supported by robust cash flows and attractive valuations the market may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives