Vishay Intertechnology's (NYSE:VSH) Dividend Will Be $0.10

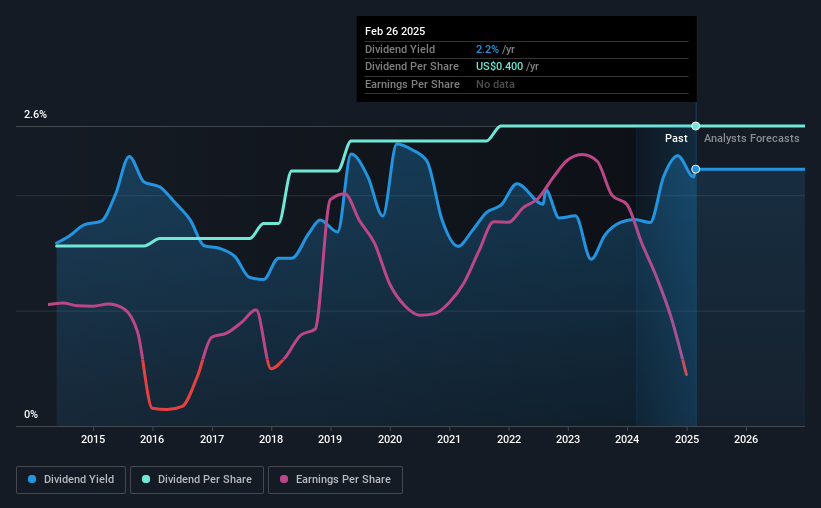

The board of Vishay Intertechnology, Inc. (NYSE:VSH) has announced that it will pay a dividend on the 27th of March, with investors receiving $0.10 per share. Based on this payment, the dividend yield on the company's stock will be 2.2%, which is an attractive boost to shareholder returns.

See our latest analysis for Vishay Intertechnology

Vishay Intertechnology's Long-term Dividend Outlook appears Promising

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Even though Vishay Intertechnology is not generating a profit, it is still paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Analysts expect a massive rise in earnings per share in the next year. Assuming the dividend continues along recent trends, we think the payout ratio will be 24%, which makes us pretty comfortable with the sustainability of the dividend.

Vishay Intertechnology Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2015, the annual payment back then was $0.24, compared to the most recent full-year payment of $0.40. This implies that the company grew its distributions at a yearly rate of about 5.2% over that duration. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

The Dividend Has Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Vishay Intertechnology has impressed us by growing EPS at 7.0% per year over the past five years. Even though the company isn't making a profit, strong earnings growth could turn that around in the near future. As long as the company becomes profitable soon, it is on a trajectory that could see it being a solid dividend payer.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 1 warning sign for Vishay Intertechnology that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VSH

Vishay Intertechnology

Manufactures and sells discrete semiconductors and passive electronic components in the United States, Germany, rest of Europe, Israel, and Asia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026