Are Vishay Shares at a Fair Price After Recent 6% Rally in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Vishay Intertechnology stock? You are definitely not alone. With shares closing at $16.08 and a recent 7 day return of 6.1%, there is plenty of buzz around what is next for this well-known electronics manufacturer. If you have been watching the market moves lately, you probably noticed Vishay has shown some fresh momentum, despite a tough longer-term story. One-year and five-year returns stand at -7.5% and -0.3% respectively. Market sentiment seems to be shifting, hinting that either growth expectations are picking up or that investors are reassessing risk as broader industry trends evolve.

But is Vishay actually undervalued, or are investors getting ahead of themselves? According to our valuation scorecard, the company checks the box for undervaluation in 3 out of 6 areas, giving it a value score of 3. That means there is reason for optimism, but also some signals to approach with caution. In the next section, I will walk through each of the main approaches analysts use to assess valuation and show how Vishay stacks up. If you really want an edge, stick around for the end, where I will share what might be an even better way to make sense of all those numbers.

Why Vishay Intertechnology is lagging behind its peers

Approach 1: Vishay Intertechnology Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a staple for valuing companies based on their ability to generate cash in the future. This method projects Vishay Intertechnology's future cash flows, then discounts those figures back to the present day to estimate what the business is worth in today's dollars.

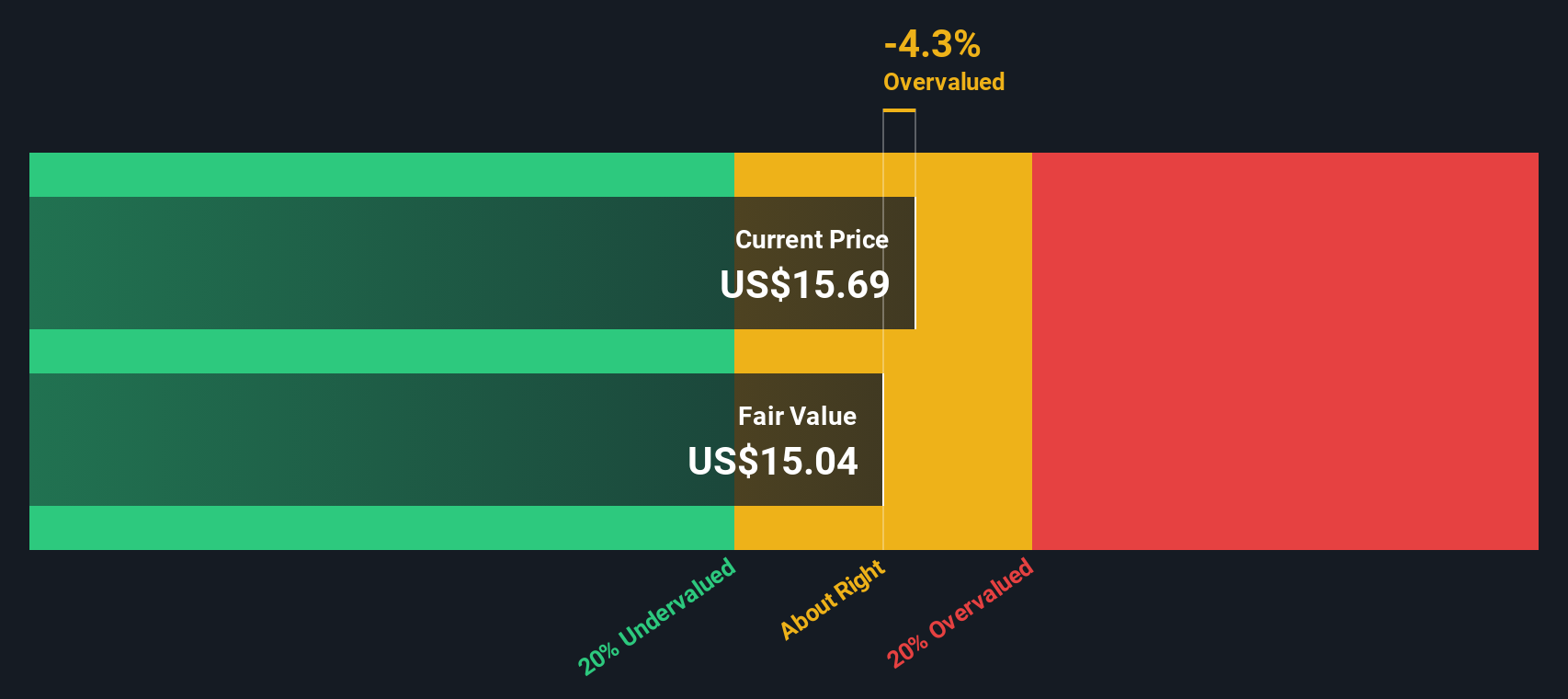

Currently, Vishay's last twelve months Free Cash Flow stands at negative $181 million. Analysts forecast a rebound, projecting Free Cash Flow of $46 million in 2026. Over the next decade, these forecasts, which combine analyst views for the next five years and further estimates extrapolated by Simply Wall St, point to ongoing FCF growth. By 2035, Vishay's discounted Free Cash Flow is estimated to reach approximately $78.7 million.

Based on the 2 Stage Free Cash Flow to Equity model, the calculated fair value for Vishay Intertechnology is $14.68 per share. With the current share price at $16.08, this suggests the stock is trading at roughly a 9.5% premium to its intrinsic DCF value. This signals a mild overvaluation but not to an excessive degree. Investors should note the gap is narrow, so the stock is hovering close to fair value using this approach.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Vishay Intertechnology's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Vishay Intertechnology Price vs Sales

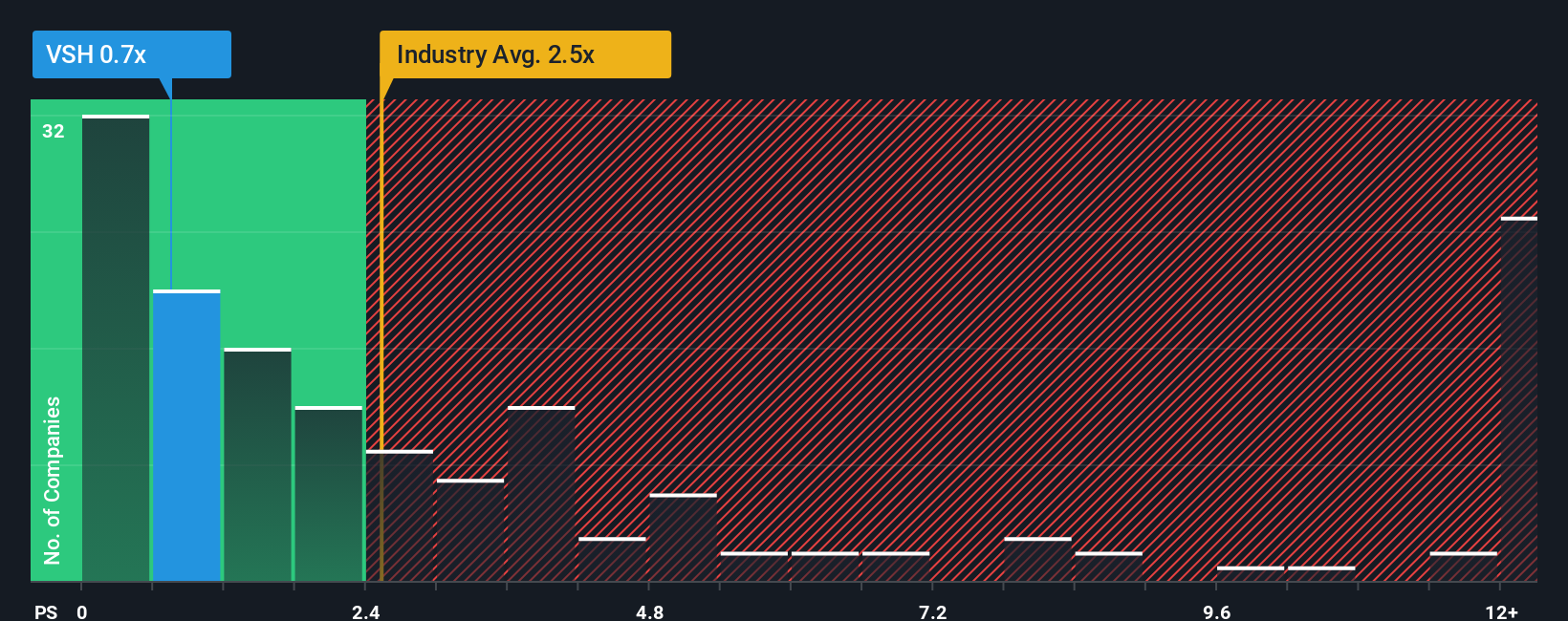

For many electronics companies, including those with fluctuating profits or cyclical earnings, the Price-to-Sales (PS) multiple is often the preferred yardstick. This metric is especially useful for evaluating firms like Vishay Intertechnology, as sales figures provide a clear view of market position and scale, even if earnings swing year to year. Generally, the PS ratio is influenced by growth prospects, market risks, and industry trends. Higher growth companies or those operating in low-risk environments can justify a higher PS multiple, while riskier or slower-growing companies typically trade at a discount.

Vishay currently trades at a Price-to-Sales ratio of 0.74x, which is significantly lower than the industry average of 2.52x and well below the average for direct peers at 2.46x. While these benchmarks offer some context, it is important not to treat them as the definitive measure for a fair valuation.

This is where Simply Wall St's proprietary Fair Ratio is considered. The Fair Ratio goes a step deeper than simple averages by accounting not just for industry comparisons, but also for key factors like Vishay’s profit margins, expected growth, risk profile, and market cap. For Vishay, the Fair Ratio is 0.97x, which is very close to the current PS multiple. This suggests that, after adjusting for all these underlying elements, the market price is almost exactly in line with what would be considered fair value for this company at this stage.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vishay Intertechnology Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own dynamic story about a company like Vishay Intertechnology, where you connect your perspective on its growth potential, risks, and opportunities directly to financial forecasts and an estimated fair value.

Instead of relying only on ratios or analyst consensus, Narratives let you combine the “why” behind the numbers (future revenues, earnings, profit margins, multiple assumptions) with your unique view of the business. Narratives bridge the gap between what’s happening in the real world, such as industry trends, new products, or competitive changes, and the numbers you see in forecasts and price targets.

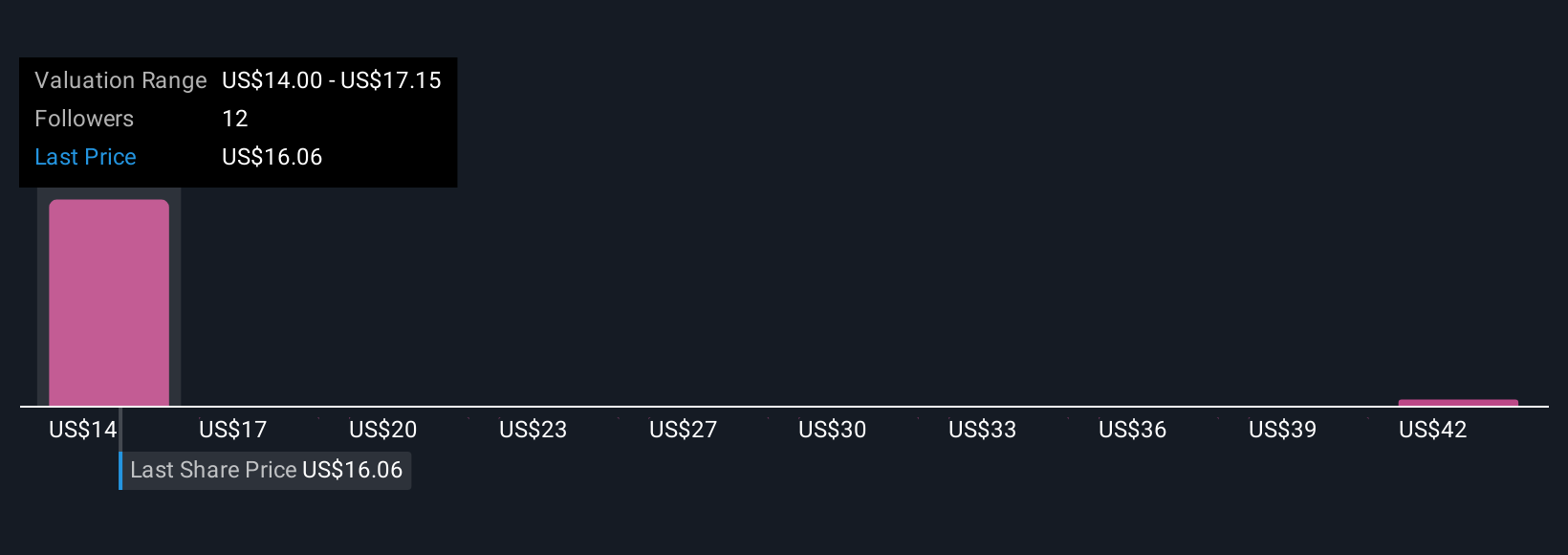

Available on Simply Wall St’s Community page, Narratives are used by millions of investors to make more confident buy or sell decisions by easily comparing their own Fair Value to the current share price. Your Narrative updates automatically as new information arrives, so you’re not left behind when fresh news or earnings change the landscape. For example, some Vishay investors believe surging demand in AI and automotive will propel fair value far above today’s price, while others see ongoing cash flow issues and set a much lower fair value. That is why creating your own Narrative can be so powerful.

Do you think there's more to the story for Vishay Intertechnology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSH

Vishay Intertechnology

Manufactures and sells discrete semiconductors and passive electronic components in the United States, Germany, rest of Europe, Israel, and Asia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives