- United States

- /

- Communications

- /

- NYSE:UI

Ubiquiti (UI) Increases Shareholder Value With US$500 Million Repurchase Program

Reviewed by Simply Wall St

Ubiquiti (UI) reported a strong performance over the last quarter, marked by an impressive 49% increase in its share price, coinciding with robust sales and net income growth in its recent earnings reports. The company enhanced shareholder value through significant actions such as a dividend increase and a $500 million share repurchase program. While Ubiquiti was removed from several indices, this didn't hinder the company's robust price movement, perhaps due in part to broader market conditions where the S&P 500 and Nasdaq achieved all-time highs amid growing tech sector enthusiasm.

Over the five-year period, Ubiquiti's total shareholder return was an impressive 305.30%. The company has outperformed notably over the past year, exceeding both the US market's 20.5% return and the US Communications industry’s 49.8% return. This highlights the company's robust performance trajectory.

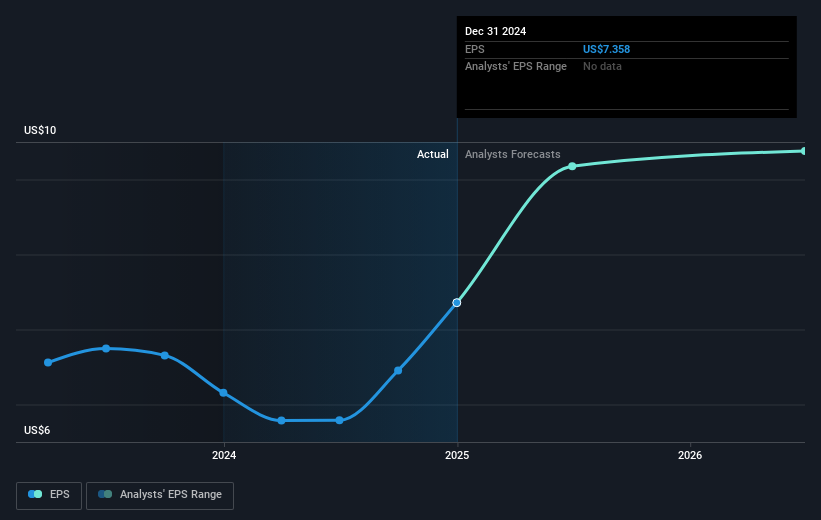

The recent increase in dividends and share repurchase program may positively influence Ubiquiti's revenue and earnings forecasts, as these actions typically signal management's confidence in future cash flows. However, the analyst consensus price target of US$449.50 indicates a potential disconnect with the current share price of US$598.70, suggesting a substantial premium over the assessed fair value. This disparity warrants attention as investors weigh the impact of the company's recent financial strategies against market valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UI

Ubiquiti

Develops networking technology for service providers, enterprises, and consumers in North America, Europe, the Middle East, Africa, Asia Pacific, South America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion