- United States

- /

- Communications

- /

- NYSE:UI

Can Ubiquiti's (UI) Debt Discipline and Rising Earnings Reveal Its True Investment Narrative?

Reviewed by Simply Wall St

- In recent news, Ubiquiti Inc. was highlighted for its modest and manageable debt load, supported by a low net debt to EBITDA ratio of 0.26 and strong interest coverage.

- A 41% increase in EBIT further illustrates the company's financial strength and enhanced ability to manage future debt obligations.

- We'll explore how Ubiquiti's robust earnings growth and conservative debt management help shape its broader investment narrative.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

What Is Ubiquiti's Investment Narrative?

Being a shareholder in Ubiquiti means believing in its ability to pair robust earnings growth with disciplined financial management, even as industry expectations shift. The latest report confirming a low net debt to EBITDA ratio and a strong rise in EBIT places the company’s balance sheet in a healthier spot than some past analyst commentary suggested, possibly cushioning the risk once associated with its higher debt levels. In terms of short term catalysts, recent momentum in earnings and consistent dividends could remain at the forefront, though the company's removal from several Russell indices may temporarily limit institutional buying and increase volatility. For now, the positive update on debt and earnings doesn't appear to fundamentally change the risk profile but helps reassure around previous worries tied to leverage, leaving operational performance and growth expectations as the areas most worth monitoring.

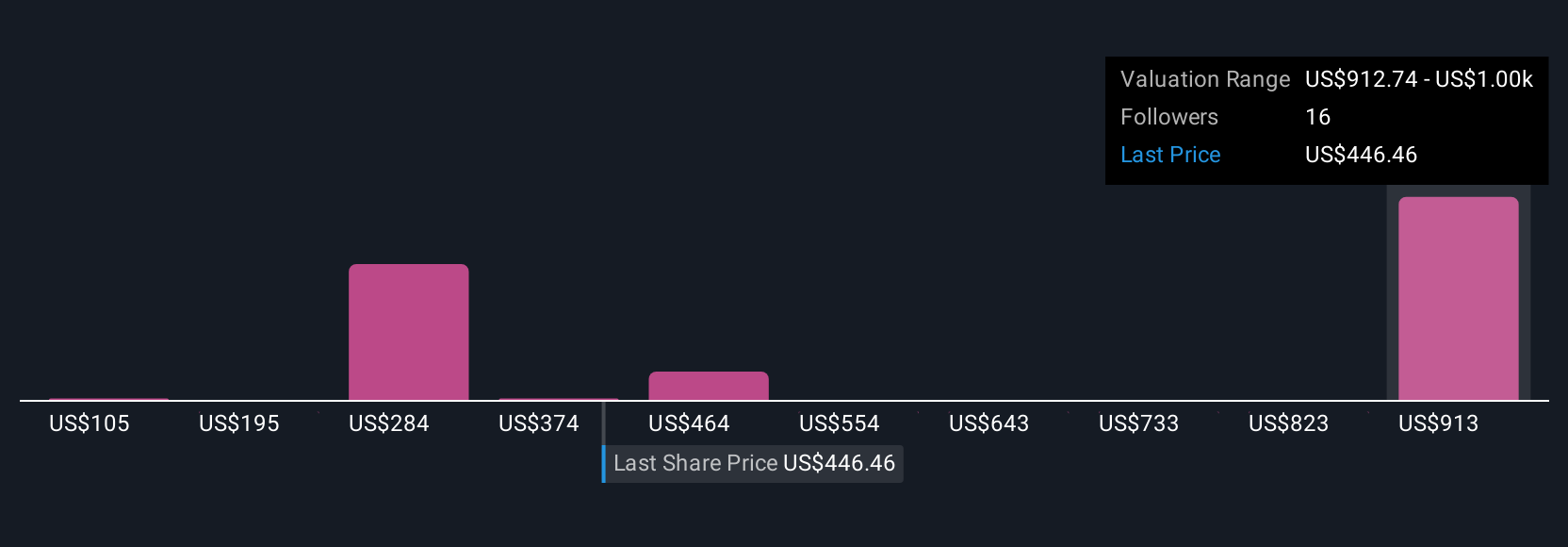

Despite improved debt coverage, index removal brings new questions about trading volumes and fund flows. Despite retreating, Ubiquiti's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 9 other fair value estimates on Ubiquiti - why the stock might be worth less than half the current price!

Build Your Own Ubiquiti Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ubiquiti research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ubiquiti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ubiquiti's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UI

Ubiquiti

Develops networking technology for service providers, enterprises, and consumers.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives