How Investors May Respond To TE Connectivity (TEL) Upward Earnings Revisions and Analyst Optimism

Reviewed by Sasha Jovanovic

- Recently, TE Connectivity received upward earnings estimate revisions and a strong Zacks Rank, reflecting favorable analyst sentiment and increased investor attention toward the company.

- An interesting aspect is the company's recognition as a cash-rich, high-return-on-equity technology player, which has contributed to its appeal amid expectations for ongoing market volatility and possible interest rate changes.

- We'll examine how renewed analyst optimism, highlighted by upward earnings revisions, could shape TE Connectivity's investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

TE Connectivity Investment Narrative Recap

To own TE Connectivity shares, you need to believe in the company's exposure to structural growth areas like AI, electrification, and high-value industrial applications, while accepting its sensitivity to technology demand and evolving global supply chains. The recent upward earnings estimate revisions and favorable analyst ratings underscore a stronger near-term outlook, but do not fundamentally alter the fact that momentum still hinges on durable demand in transportation and energy end markets. At the same time, customer concentration and geographic dependencies remain the core risks, especially if Asian or AI-driven growth falters.

Among the latest company actions, ongoing share repurchases, such as the nearly US$301.1 million tranche completed by June 2025, stand out as particularly relevant. These repurchases reinforce the company's commitment to returning capital to shareholders and may help support near-term share prices, a factor that connects directly to shifting market sentiment following earnings and guidance revisions.

In contrast, investors should remain alert to the chance that rising customer concentration or shifts in Asian demand could impact revenue stability…

Read the full narrative on TE Connectivity (it's free!)

TE Connectivity's outlook anticipates $20.3 billion in revenue and $3.1 billion in earnings by 2028. This scenario assumes a 7.0% annual revenue growth rate and an increase in earnings of $1.6 billion from the current $1.5 billion.

Uncover how TE Connectivity's forecasts yield a $223.06 fair value, in line with its current price.

Exploring Other Perspectives

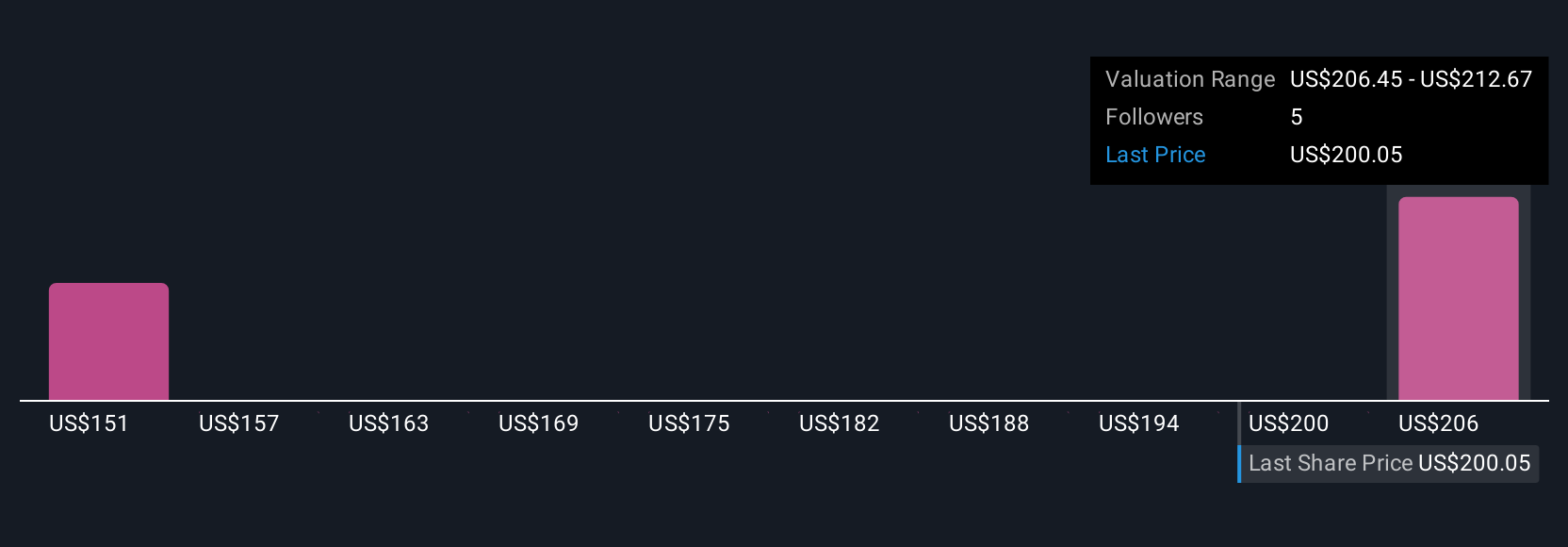

Community fair value estimates for TE Connectivity vary widely from US$138.98 to US$223.06, based on just two distinct analyses from the Simply Wall St Community. Some participants focus on rapidly growing AI and electrification segments, but the risk of slowing Asian or transportation demand could weigh on future margins and sales.

Explore 2 other fair value estimates on TE Connectivity - why the stock might be worth as much as $223.06!

Build Your Own TE Connectivity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TE Connectivity research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free TE Connectivity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TE Connectivity's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TE Connectivity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEL

TE Connectivity

Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives