- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

3 Growth Companies With High Insider Ownership And 13% Revenue Growth

Reviewed by Simply Wall St

As the U.S. stock market experiences a pullback with major indices like the S&P 500 and Dow Jones facing consecutive losses, investors are increasingly cautious amid concerns over an AI bubble and tepid labor data. In such uncertain times, growth companies with high insider ownership can offer a compelling option as they often align management's interests with those of shareholders, potentially leading to sustained revenue growth despite broader market challenges.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.9% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Karman Holdings (KRMN) | 17.3% | 78.5% |

| Credo Technology Group Holding (CRDO) | 10.4% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.4% | 27.1% |

Here we highlight a subset of our preferred stocks from the screener.

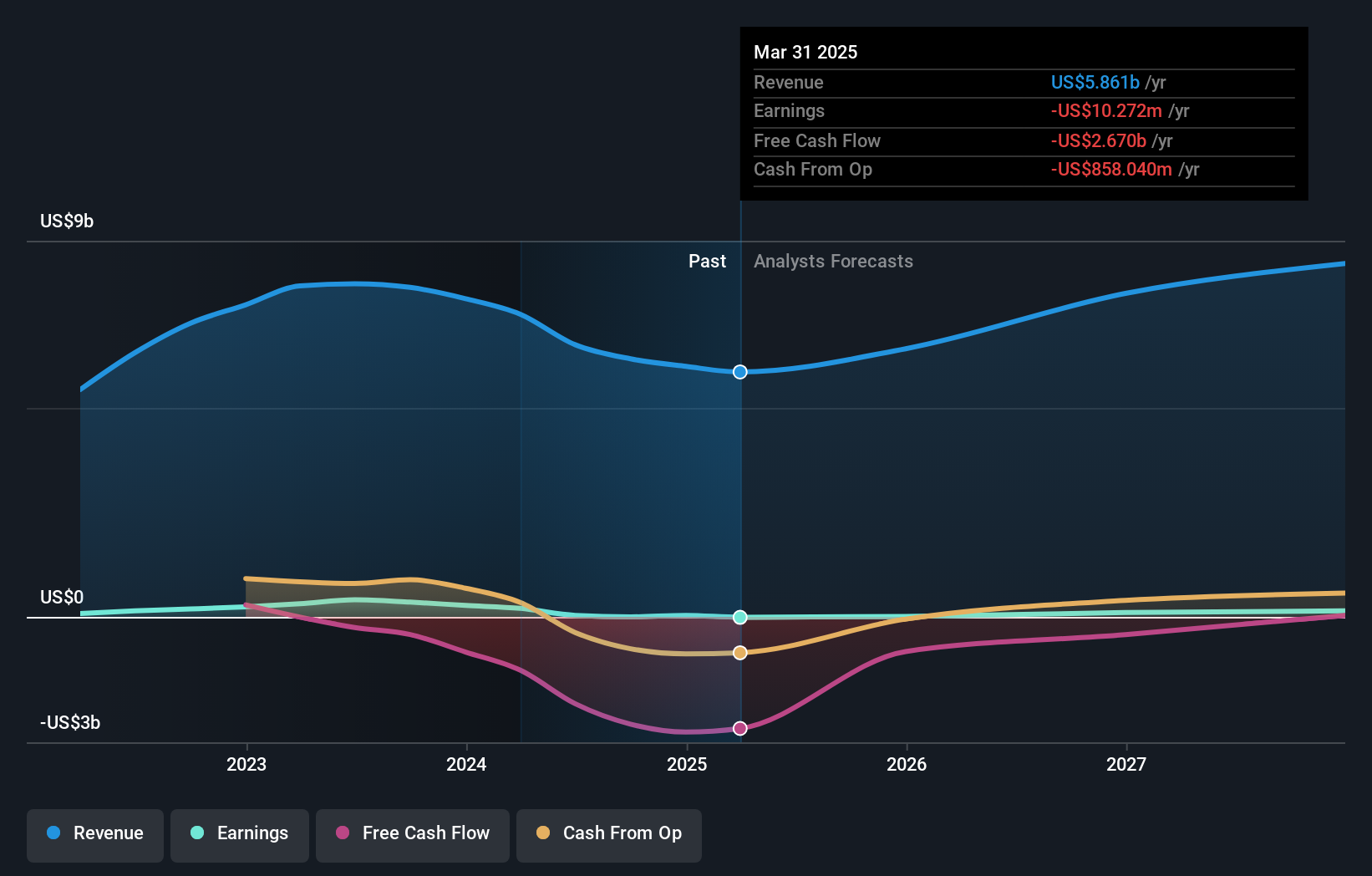

Canadian Solar (CSIQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canadian Solar Inc. is a company that, along with its subsidiaries, offers solar energy and battery storage products and solutions across Asia, the Americas, Europe, and internationally, with a market cap of approximately $1.53 billion.

Operations: Canadian Solar Inc.'s revenue segments include solar energy and battery energy storage products and solutions across various regions globally.

Insider Ownership: 21.2%

Revenue Growth Forecast: 13.9% p.a.

Canadian Solar demonstrates significant growth potential with earnings forecasted to increase substantially over the next three years, outpacing the broader U.S. market. Recent strategic initiatives include forming joint ventures and reshoring manufacturing to North America, enhancing its domestic supply chain. Despite a volatile share price and low return on equity forecasts, Canadian Solar trades below estimated fair value and anticipates substantial revenue in Q4 2025 between US$1.3 billion and US$1.5 billion, reflecting ongoing business expansion efforts.

- Get an in-depth perspective on Canadian Solar's performance by reading our analyst estimates report here.

- The analysis detailed in our Canadian Solar valuation report hints at an deflated share price compared to its estimated value.

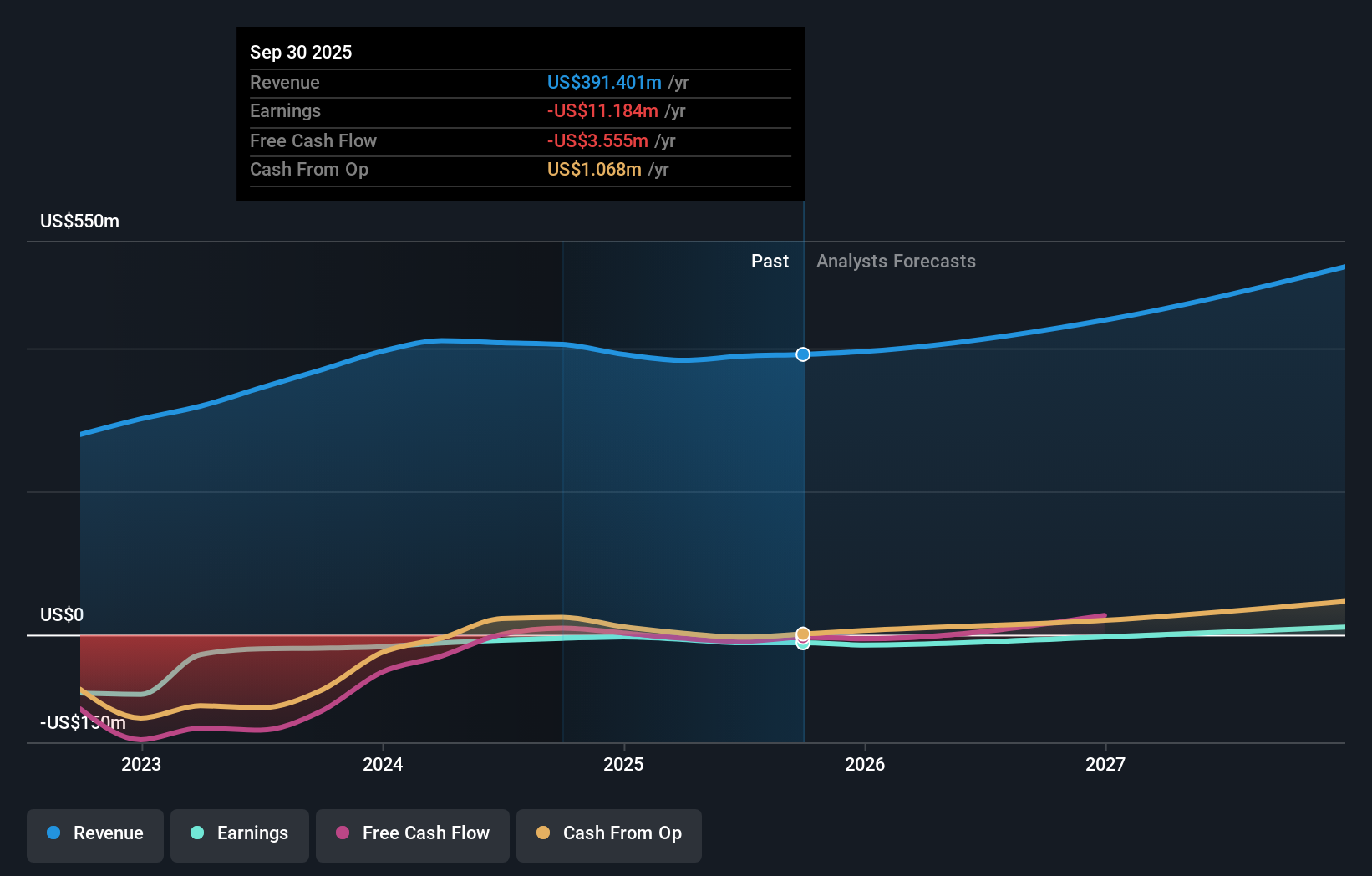

BRC (BRCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BRC Inc., with a market cap of $305.65 million, operates in the United States through its subsidiaries by purchasing, roasting, and selling coffee and coffee accessories.

Operations: The company's revenue is primarily derived from its Consumer Products Business, which generated $391.40 million.

Insider Ownership: 16.4%

Revenue Growth Forecast: 12.5% p.a.

BRC Inc. has seen substantial insider buying in the past three months, indicating confidence from its leadership despite recent financial challenges. The company reported a slight increase in Q3 sales to US$100.71 million but faced a net loss of US$0.486 million. It trades significantly below estimated fair value and is expected to achieve profitability within three years, with revenue growth forecasted at 12.5% annually, outpacing the broader U.S. market growth rate of 10.6%.

- Navigate through the intricacies of BRC with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, BRC's share price might be too pessimistic.

SmartRent (SMRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SmartRent, Inc. is an enterprise real estate technology company offering management software and applications to various stakeholders in the rental property sector both in the United States and internationally, with a market cap of approximately $387.86 million.

Operations: The company's revenue primarily comes from its Electronic Security Devices segment, which generated $151.22 million.

Insider Ownership: 10.4%

Revenue Growth Forecast: 13.4% p.a.

SmartRent has experienced significant insider buying recently, reflecting strong confidence from its leadership. The company is trading at a substantial discount to its estimated fair value and is forecasted to achieve profitability within three years, with revenue growth expected to outpace the broader U.S. market. Recent executive changes include the appointment of Sangeeth Ponathil as Chief Information Officer, who will focus on technology strategy and infrastructure modernization to support SmartRent’s expansion in IoT solutions.

- Unlock comprehensive insights into our analysis of SmartRent stock in this growth report.

- The valuation report we've compiled suggests that SmartRent's current price could be quite moderate.

Make It Happen

- Delve into our full catalog of 204 Fast Growing US Companies With High Insider Ownership here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in Asia, the Americas, Europe, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Lionheart Phase One: Why Execution Now Matters More Than Dilution

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion