Ralliant (RAL): Assessing Valuation After Recent Period of Steady Financial Performance

Reviewed by Kshitija Bhandaru

See our latest analysis for Ralliant.

Ralliant’s share price has inched higher over the past month, following some steady progress and a few low-key corporate updates this quarter. However, share price momentum has cooled compared to earlier in the year. This suggests investors are reassessing near-term growth versus recent gains, with the 30-day share price return just above 3% amid a more subdued year-to-date performance.

If you’re interested in finding other companies that combine momentum with strong insider ownership, now’s a perfect opportunity to discover fast growing stocks with high insider ownership

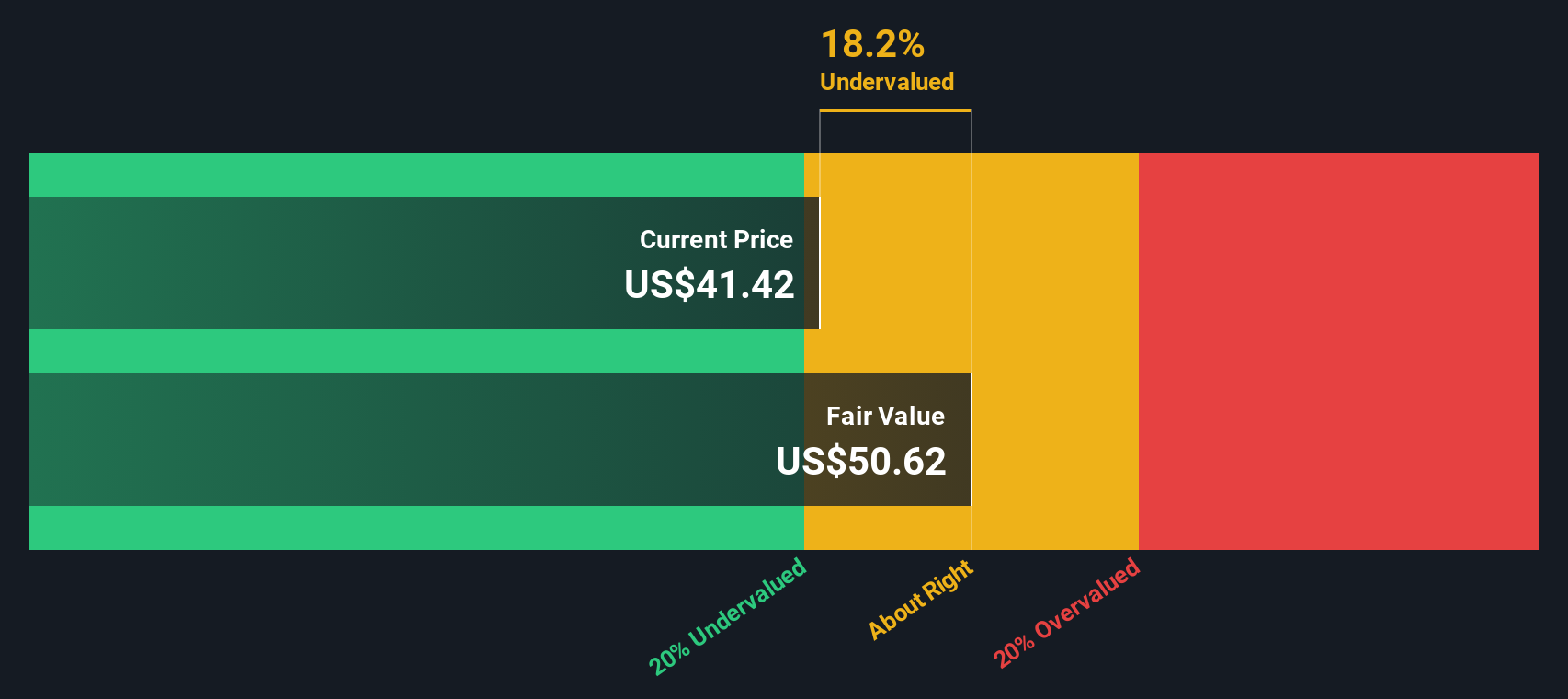

Ralliant’s current valuation leaves investors wondering if the stock remains undervalued when compared to its fundamentals, or if the recent price action means that any upside from future growth is already reflected in the price.

Price-to-Earnings of 17.5x: Is it justified?

Ralliant’s shares currently trade at a price-to-earnings (P/E) ratio of 17.5x, which looks attractive compared to the industry benchmark after a period of share price consolidation. At its last close of $44.22, investors are paying much less per dollar of earnings than they would for many of Ralliant’s peers.

The price-to-earnings ratio shows how much investors are willing to pay for each dollar of a company’s earnings. In the tech sector, where growth expectations can be a significant driver of valuation, the P/E offers a quick reality check on whether those prospects are already reflected in the price.

With Ralliant notably below the peer average P/E of 24.3x and the broader peer group’s 25.8x, the market appears to be underpricing its potential profit generation relative to competitors. This discount could signal skepticism about future earnings momentum or present an opportunity for those who believe the company can exceed prevailing forecasts.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17.5x (UNDERVALUED)

However, slowing year-to-date returns and ongoing investor caution around future earnings could weigh on sentiment. This may potentially limit near-term share price upside.

Find out about the key risks to this Ralliant narrative.

Another View: Discounted Cash Flow Perspective

While Ralliant appears undervalued when looking at earnings multiples, our DCF model offers another angle. The SWS DCF model suggests Ralliant’s fair value is $50.88, around 13.1% above its current price. This raises the question: does the DCF perspective highlight hidden value that simple ratios cannot capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ralliant for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ralliant Narrative

If you’re not convinced by these analyses, or want to take a hands-on approach, you can easily craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ralliant.

Looking for More Investment Ideas?

Don't let opportunities pass you by. Open new doors to your portfolio by tapping into unique investment themes that other investors might overlook.

- Boost your passive income by checking out these 19 dividend stocks with yields > 3% offering yields above 3% and backed by solid financials.

- Ride the AI transformation by spotting early movers in the industry with these 24 AI penny stocks primed for rapid growth and innovation.

- Capitalize on market mispricings by evaluating these 904 undervalued stocks based on cash flows with strong cash flow potential that could deliver outsized long-term gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RAL

Ralliant

Engages in the design, development, manufacture, sale, and service of precision instruments and engineered products in the United States, China, Western Europe, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives