- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Pure Storage (NYSE:PSTG) Sees 34% Price Surge In Last Month

Reviewed by Simply Wall St

Pure Storage (NYSE:PSTG) recently announced key partnerships with Nutanix and Varonis Systems, aiming to bolster its offerings in integrated solutions and data security. These collaborations likely supported the company's 34% share price increase over the last month. The partnership with Nutanix enhances infrastructure solutions, while the collaboration with Varonis focuses on advanced data security features. During this period, the broader market also rose by 3.9%, potentially complementing Pure Storage's gains. The strategic initiatives align with market trends, emphasizing agility and security amid evolving IT demands. The company's improved market positioning resonates well with investor expectations.

Buy, Hold or Sell Pure Storage? View our complete analysis and fair value estimate and you decide.

The recent partnerships of Pure Storage with Nutanix and Varonis Systems could significantly influence the company's narrative, as they potentially enhance its infrastructure solutions and data security offerings. This strategic alignment may expand Pure Storage's market reach, particularly beneficial in a climate where data management efficiency and security are increasingly pivotal. Such integrations likely support a boost in future revenue streams and operational scale, which are vital as Pure Storage anticipates a tenfold rise in unstructured data demands due to AI advancements.

Over the past five years, Pure Storage's total return, including dividends, reached a striking 269.68%. This long-term growth contrasts with its one-year market underperformance, where the company trailed behind the US Tech industry, which returned 11.4%. The historical performance underscores robust shareholder gains and marks a backdrop against which current initiatives should be seen.

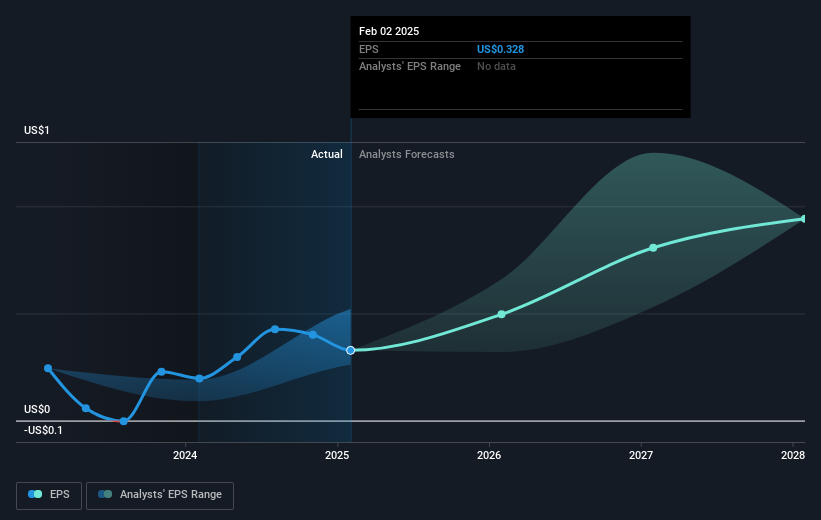

The enhancement of Pure Storage's offerings through the recent collaborations could positively influence revenue and earnings forecasts. Specifically, design wins with leading hyperscalers and product expansions in response to AI demand are poised to drive significant future revenue growth. While analyst forecasts indicate earnings reaching US$564 million by 2028, the current initiatives could bolster these expectations, contingent on execution and market dynamics.

Currently, Pure Storage's share price of US$47.58 reflects a considerable 29% discount to the consensus analyst price target of US$67.06. This disparity suggests potential upside if the company's forecasts align with market assumptions. Investors may need to weigh these potential gains against existing operational and geopolitical risks that could affect the company's margin stability and growth prospects.

Examine Pure Storage's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026