- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Pure Storage (NYSE:PSTG) Sees 10% Price Rise Over Past Week

Reviewed by Simply Wall St

Pure Storage (NYSE:PSTG) experienced a significant price move of 10.49% over the past week. This rise could reflect an alignment with broader market trends, as the overall market has seen a growth of 5.4% in the same time frame. While specific events related to Pure Storage weren't highlighted during this period, the company's performance appears consistent with an optimistic market outlook, supported by a forecasted annual earnings growth of 14%. Without specific catalysts, this increase seems to be a part of the wider positive market sentiment, adding weight to the overall uplift.

Buy, Hold or Sell Pure Storage? View our complete analysis and fair value estimate and you decide.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

The recent price movement of Pure Storage (NYSE:PSTG), with a notable increase of 10.49% over the past week, aligns with broader market trends that saw a 5.4% rise. This could potentially enhance market sentiment around Pure Storage and its long-term revenue and earnings prospects. The absence of specific company events suggests this performance may trend with market optimism rather than company-specific news.

Over a longer span, Pure Storage has shown substantial growth, boasting a total return of 219.44% over five years, demonstrating a solid investment case. However, in the past year, Pure Storage underperformed the US market's return of 3.6% and the US Tech industry's 9.4% return. This context provides a balanced view of the company's performance dynamics, reflecting its more recent challenges relative to its historical growth.

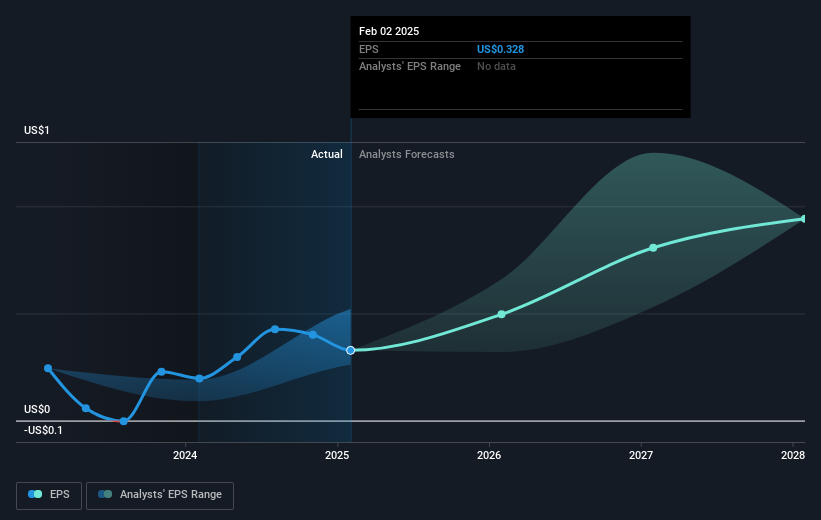

The design win with a top hyperscaler mentioned in the narrative could bolster future revenue operations by expanding market penetration across various tiers. This development, coupled with their E family expansion, positions Pure Storage well for future AI-driven opportunities. Analysts project a revenue growth of 12.3% annually, with earnings increasing significantly from the current US$106.74 million to US$490.1 million by April 2028. This growth is essential to meet or exceed the consensus analyst price target of US$68.91, a 44.8% increase from the current share price of US$38.69, reflecting significant upside potential based on current forecasts.

Our valuation report unveils the possibility Pure Storage's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Engages in the provision of data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives