The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. For example, the NCR Corporation (NYSE:NCR) share price is up 28% in the last year, clearly besting the market return of around 16% (not including dividends). That's a solid performance by our standards! Unfortunately the longer term returns are not so good, with the stock falling 14% in the last three years.

View our latest analysis for NCR

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year NCR grew its earnings per share, moving from a loss to a profit.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

However the year on year revenue growth of 7.0% would help. Many businesses do go through a faze where they have to forgo some profits to drive business development, and sometimes its for the best.

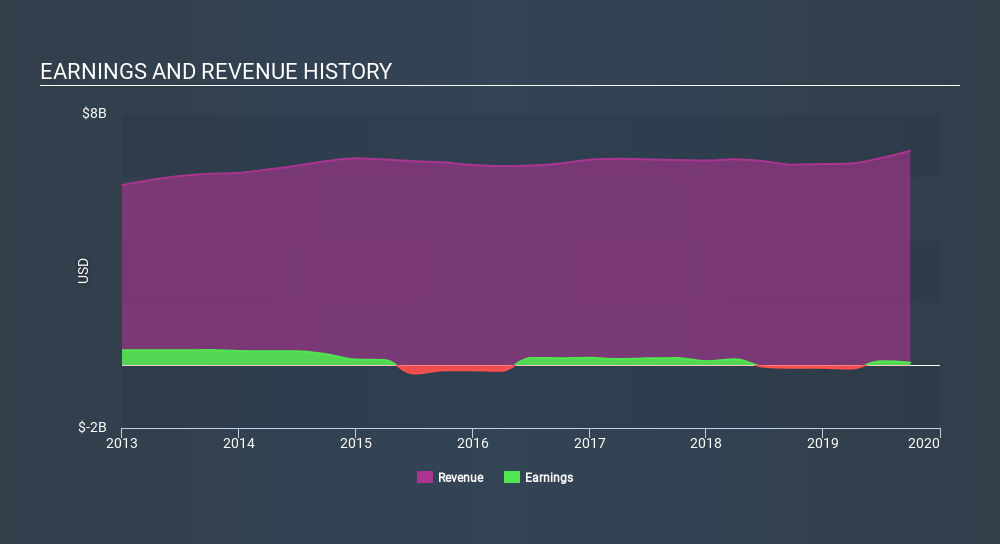

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that NCR has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on NCR

A Different Perspective

It's nice to see that NCR shareholders have received a total shareholder return of 28% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 2.9% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. If you would like to research NCR in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:VYX

NCR Voyix

Provides digital commerce solutions for retail stores and restaurants in the United States, the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives