Mirion Technologies, Inc.'s (NYSE:MIR) Shareholders Might Be Looking For Exit

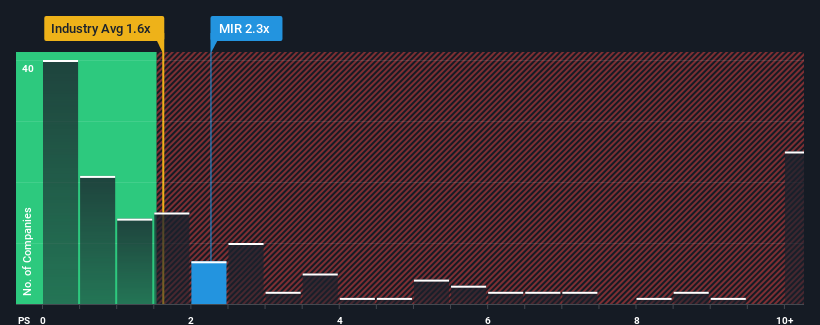

When close to half the companies in the Electronic industry in the United States have price-to-sales ratios (or "P/S") below 1.6x, you may consider Mirion Technologies, Inc. (NYSE:MIR) as a stock to potentially avoid with its 2.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Mirion Technologies

How Mirion Technologies Has Been Performing

Recent revenue growth for Mirion Technologies has been in line with the industry. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Mirion Technologies will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Mirion Technologies?

The only time you'd be truly comfortable seeing a P/S as high as Mirion Technologies' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 54% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 6.4% over the next year. With the industry predicted to deliver 16% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Mirion Technologies' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Mirion Technologies trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Mirion Technologies with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MIR

Mirion Technologies

Provides radiation detection, measurement, analysis, and monitoring products and services in North America, Europe, and the Asia Pacific.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives