Knowles (KN): Valuation Check After Strong Earnings, Cash Generation, Buybacks and Debt Reduction

Reviewed by Simply Wall St

Knowles (KN) just delivered a strong earnings update, with revenue climbing year over year and topping Wall Street expectations, yet the stock slipped 4.1% as investors digested the details.

See our latest analysis for Knowles.

Even with that post earnings pullback, Knowles still has a 1 year to date share price return of about 17% and a 1 year total shareholder return of roughly 21%. This suggests underlying momentum is gradually building as investors reassess its growth and balance sheet strength.

If this earnings story has you thinking more broadly about opportunities in the sector, it is a good moment to explore high growth tech and AI stocks for other tech names showing similar momentum.

With revenue up, cash flowing, and the shares still trading at a discount to analyst targets, should investors view Knowles as undervalued, or assume the market is already pricing in the company’s next leg of growth?

Most Popular Narrative Narrative: 11.7% Undervalued

With Knowles last closing at $23.41 against a narrative fair value of $26.50, the story centers on whether future earnings can justify that gap.

The expansion of specialty film production and the launch of new product lines, such as inductors, are set to increase Knowles' total addressable market, providing incremental growth opportunities that should support revenue acceleration and potentially higher margins as these initiatives scale.

Curious how steady, mid single digit revenue growth, sharply rising margins, and shrinking share count combine into that valuation math? The full narrative spells out the earnings leap and lower future multiple that still backs this higher fair value.

Result: Fair Value of $26.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from higher factory costs or slower traction in new specialty products could quickly weaken the undervaluation case.

Find out about the key risks to this Knowles narrative.

Another View on Valuation

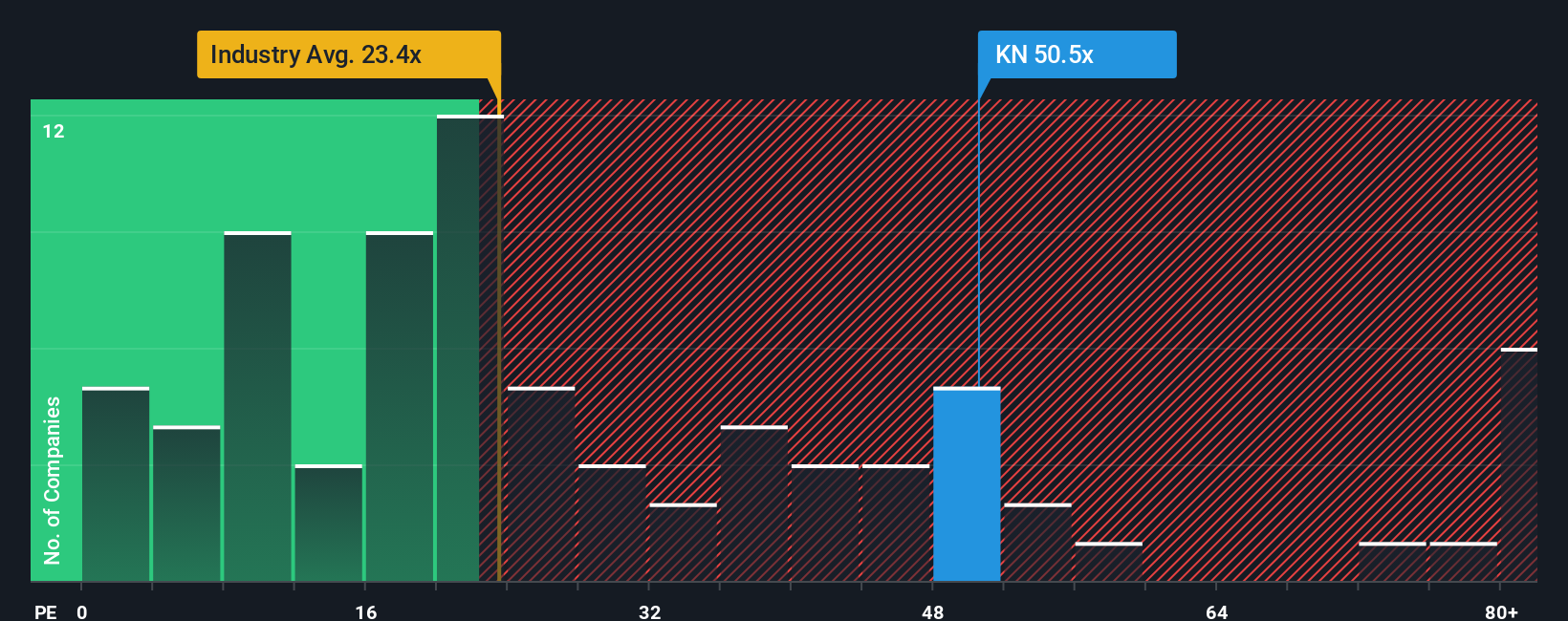

While the narrative fair value suggests upside, a simple earnings lens paints a tougher picture. Knowles trades on a price to earnings ratio of 55.7x, well above the US Electronic industry at 24.3x, peers at 31x, and even its own fair ratio of 32.9x. This implies meaningful de rating risk if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Knowles Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a complete, personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Knowles.

Ready for more investment ideas?

Knowles may fit your thesis today, but investors often keep a bench of fresh contenders ready. Use the Simply Wall Street Screener now so you do not miss the next standout opportunity.

- Target potential bargains trading below intrinsic value by scanning these 907 undervalued stocks based on cash flows that combine solid fundamentals with attractive pricing.

- Explore the AI theme by reviewing these 26 AI penny stocks with strong growth prospects and real traction, not just hype.

- Strengthen an income-focused approach by looking at these 15 dividend stocks with yields > 3% that offer regular payouts and the potential for long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knowles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KN

Knowles

Offers capacitors, radio frequency (RF) and microwave filters, balanced armature speakers, and medtech microphones in Asia, the United States, Europe, rest of Americas, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026