Keysight Technologies (NYSE:KEYS) Reports Mixed Q1 2025 Results as Stock Dips 5%

Reviewed by Simply Wall St

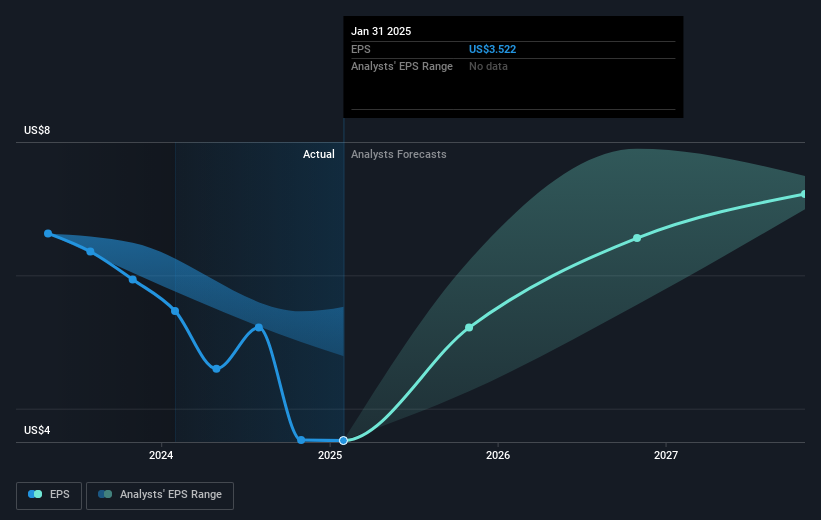

Keysight Technologies (NYSE:KEYS) recently reported its Q1 2025 earnings, showing a slight decline in net income and earnings per share despite a modest increase in sales, illustrating mixed results during a period in which the market has faced challenges, contributing to a share price decline of 4.89% over the past quarter. This downturn occurred amidst a volatile market backdrop, highlighted by a mixed performance across major U.S. indices and increased investor uncertainty surrounding new tariff announcements. The broader tech sector, including chip stocks, showed weakness, possibly impacting Keysight. Recent developments, such as the unveiling of their AI-enabled sensing capabilities and participation in 6G research projects, highlight their ongoing innovation efforts, yet these have not offset short-term pressures on the stock. As investors digest these varied factors, Keysight remains poised to address both opportunities and headwinds in the evolving tech landscape.

Click to explore a detailed breakdown of our findings on Keysight Technologies.

In the past five years, Keysight Technologies achieved a total return of 63.75% including share price appreciation and dividends, illustrating considerable growth despite recent challenges. This period was marked by significant developments, such as the company securing a Federal Communications Commission Spectrum Horizons Experimental license in 2022 to pioneer 6G technology. Keysight also expanded its portfolio with innovative product launches, like the LPDDR6 design and test solution in 2025, enhancing system performance. Moreover, the company engaged in strategic alliances to bolster its technological advancements, notably with Samsung Research in 2022 for 6G development. Leadership changes, including the appointment of Satish Dhanasekaran as CEO in 2022, underscored a commitment to innovation.

Despite these advancements, Keysight's 1-year performance lagged behind both the broader U.S. market and the electronic industry. The company reported a significant earnings decline over the past year, contrasting with its historical earnings growth. Profit margins also decreased to 12.2% from 18.1%, reflecting short-term pressures impacting the stock's recent momentum. Nonetheless, Keysight continues its pursuit of cutting-edge technology solutions, which has supported its long-term growth trajectory.

- Analyze Keysight Technologies' fair value against its market price in our detailed valuation report—access it here.

- Understand the uncertainties surrounding Keysight Technologies' market positioning with our detailed risk analysis report.

- Shareholder in Keysight Technologies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keysight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEYS

Keysight Technologies

Offers electronic design and test solutions worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives