As the United States market experiences record highs in major indices like the S&P 500 and Nasdaq, buoyed by strong earnings reports and robust economic data, investors are keenly observing developments in trade negotiations that could impact future growth. In this dynamic environment, high-growth tech stocks stand out for their potential to capitalize on technological advancements and favorable market conditions, making them noteworthy options for those looking to diversify their portfolios amidst ongoing economic shifts.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.17% | 38.20% | ★★★★★★ |

| Ardelyx | 21.16% | 61.61% | ★★★★★★ |

| Circle Internet Group | 30.80% | 60.64% | ★★★★★★ |

| TG Therapeutics | 26.05% | 39.12% | ★★★★★★ |

| AVITA Medical | 27.39% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.97% | 59.13% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 72.64% | ★★★★★★ |

| Lumentum Holdings | 21.33% | 105.07% | ★★★★★★ |

Click here to see the full list of 222 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

SoundHound AI (SOUN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SoundHound AI, Inc. develops independent voice artificial intelligence solutions for various industries including automotive, TV, and IoT to enhance conversational experiences globally, with a market cap of $5.15 billion.

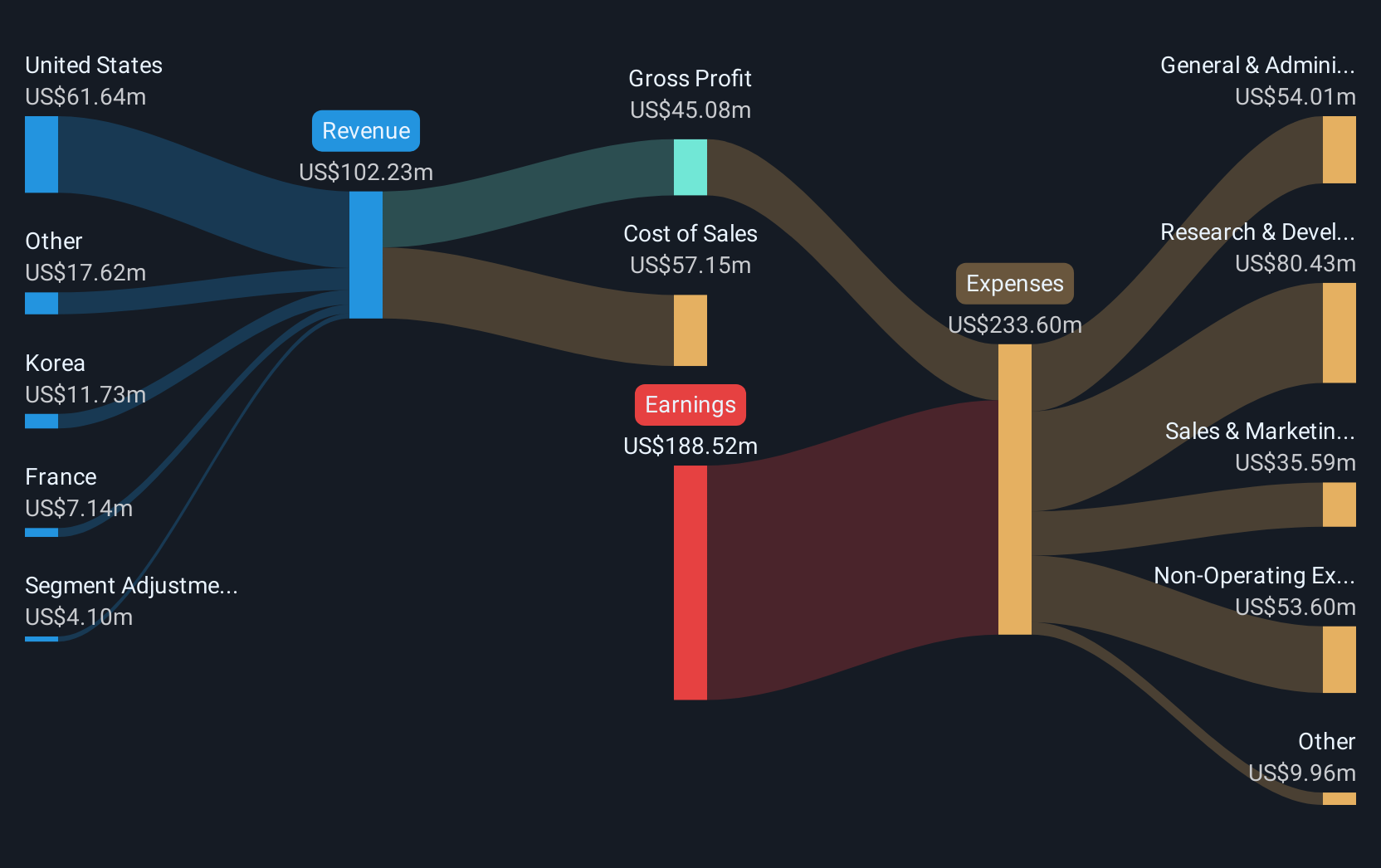

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $102.23 million. It operates across industries such as automotive, TV, and IoT, focusing on enhancing conversational experiences with its voice AI solutions in multiple countries including the United States, Korea, France, Japan, and Germany.

SoundHound AI, with a projected annual revenue growth of 31.6%, is outpacing the US market's average of 9%. Despite being unprofitable, it's expected to see earnings increase by 29% annually over the next three years. A recent strategic alliance with Peter Piper Pizza showcases its voice AI technology in practical, customer-facing applications, enhancing service efficiency across numerous locations. This move not only diversifies SoundHound’s application landscape but also strengthens its position in conversational AI amidst a volatile share price and significant insider selling.

- Take a closer look at SoundHound AI's potential here in our health report.

Explore historical data to track SoundHound AI's performance over time in our Past section.

Jabil (JBL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jabil Inc. offers manufacturing services and solutions on a global scale, with a market capitalization of $24.04 billion.

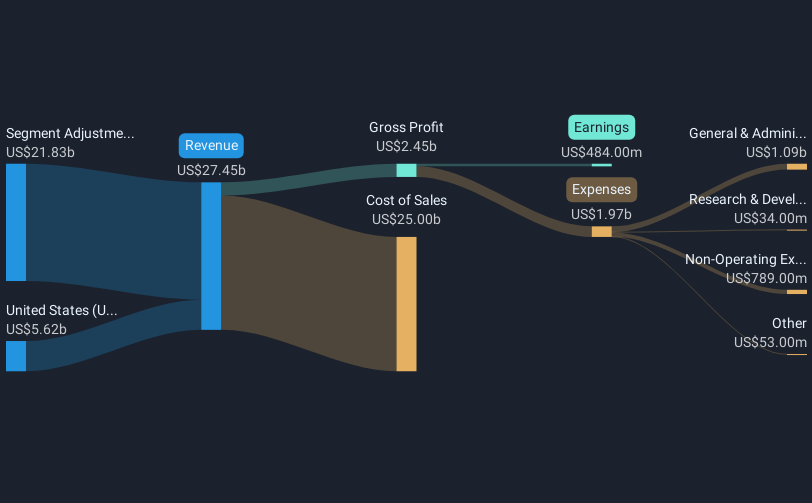

Operations: The company operates globally, delivering comprehensive manufacturing services and solutions. It has a market capitalization of approximately $24.04 billion.

Jabil's recent strategic initiatives, including a significant share repurchase program and an expanded collaboration with Endeavour Energy for AI-ready infrastructure, underscore its commitment to growth in the tech sector. Despite a forecasted annual revenue growth of 6.1%, which trails the US market average of 9%, Jabil's earnings are expected to surge by 23.3% annually over the next three years, outpacing broader market expectations. This financial trajectory is bolstered by a robust $500 million investment in domestic manufacturing facilities aimed at enhancing cloud and AI infrastructure capabilities, set to be operational by mid-2026. These moves reflect Jabil's proactive stance in adapting to dynamic tech demands and maintaining competitiveness in a rapidly evolving industry.

- Click here and access our complete health analysis report to understand the dynamics of Jabil.

Gain insights into Jabil's past trends and performance with our Past report.

MNTN (MNTN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MNTN, Inc. is a performance TV software company that offers advertising services in the United States with a market capitalization of $2.17 billion.

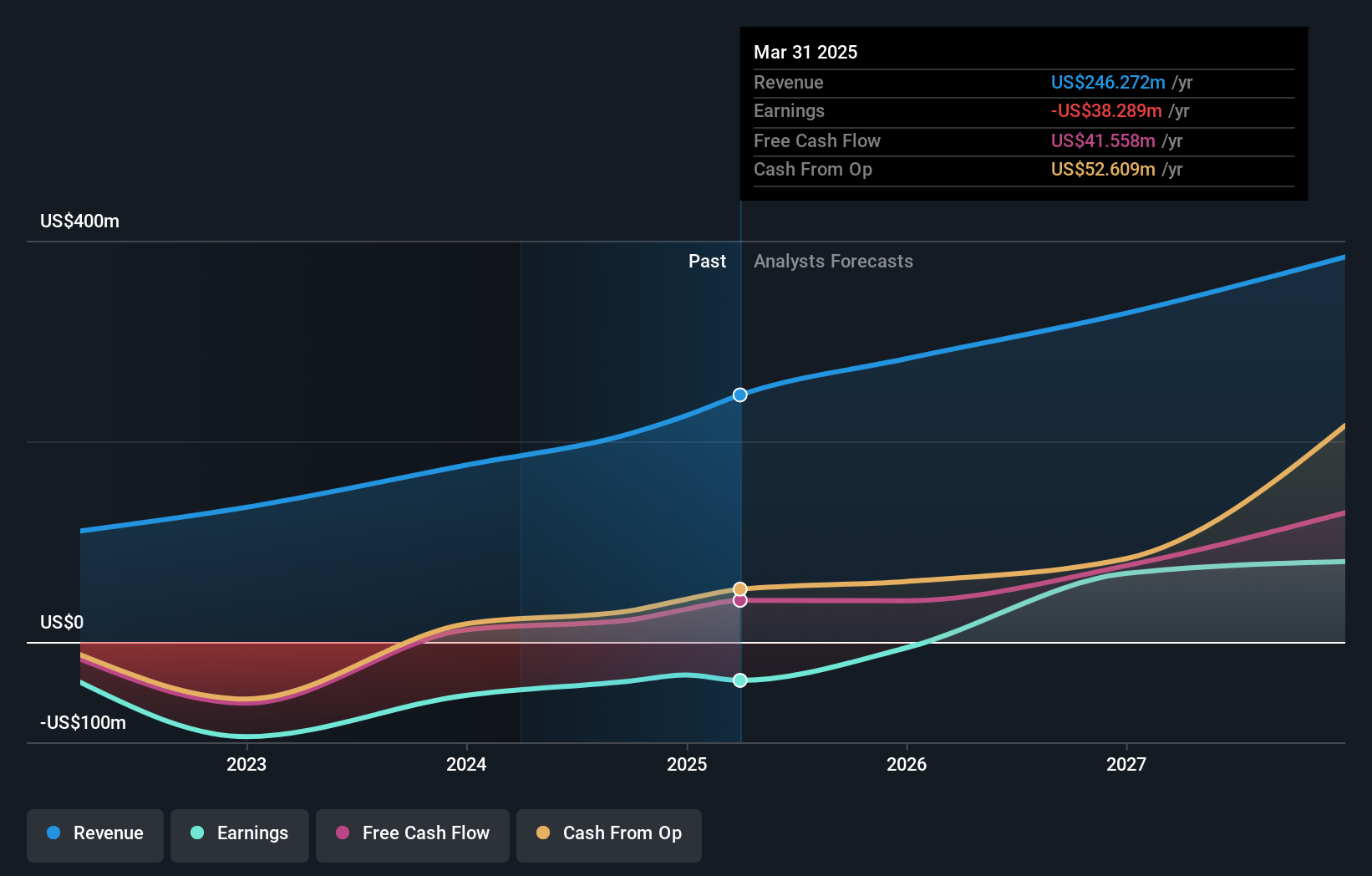

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $246.27 million.

MNTN's strategic partnership with ZoomInfo, announced on July 1, 2025, positions it at the forefront of transforming B2B marketing by integrating streaming TV ads into digital campaigns. This collaboration targets a $39 billion advertising market and leverages ZoomInfo's extensive database to enhance ad precision and effectiveness. Despite MNTN's current unprofitability and a highly volatile share price over the past three months, its revenue is expected to grow at an annual rate of 14.8%, outstripping the US market average of 9%. Moreover, earnings are projected to surge by approximately 74.5% annually over the next three years as it moves towards profitability. The company’s recent IPO raised $187.2 million, underscoring investor confidence and providing capital for further innovation and market expansion.

- Click here to discover the nuances of MNTN with our detailed analytical health report.

Review our historical performance report to gain insights into MNTN's's past performance.

Turning Ideas Into Actions

- Embark on your investment journey to our 222 US High Growth Tech and AI Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Jabil

Provides engineering, manufacturing, and supply chain solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)