- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (NYSE:IONQ) Advances Quantum-AI Integration with New Research in AI Fine-Tuning

Reviewed by Simply Wall St

IonQ (NYSE:IONQ) recently announced breakthroughs in applying quantum computing to AI, particularly with hybrid quantum-classical approaches, which could enhance large language models and generative AI. These developments occurred amid the broader market rising with major tech companies posting strong earnings. Over the past month, IonQ's 24% price rise aligns with the positive sentiment driven by tech innovation and strategic partnerships like the MOU with Japan's G-QuAT. While the market maintained upward momentum, IonQ’s advancements and expanded global footprint may have added weight to its impressive growth, reflecting its focus on quantum computing applications.

IonQ has 2 possible red flags we think you should know about.

Over the past three years, IonQ's total return, including share price and dividends, reached 266.13%, underscoring a significant appreciation in shareholder value during this period. This long-term performance outpaced the broader US Tech industry's 20.3% return over the past year, highlighting IonQ's impressive growth trajectory even amidst industry challenges.

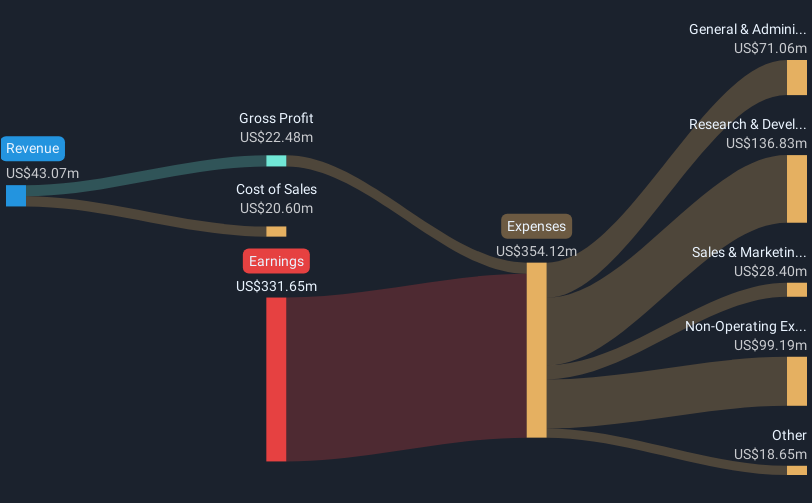

The introduction outlined IonQ's recent advancements in quantum computing and strategic partnerships, which are pivotal in shaping the company's revenue and earnings outlook. Despite experiencing a net loss of US$331.65 million in the last financial year, IonQ's revenue is projected to grow at a robust 38.3% annually, outpacing the US market's average rate of 8.3% per year.

IonQ's recent share price increase, partially reflecting its innovative progress and favorable market sentiment, still lags behind the consensus price target of US$40.60, indicating potential upside according to analysts. However, it's noteworthy that this target is considerably higher than the current price, suggesting a degree of analyst optimism about the company's future prospects that may need cautious evaluation.

Review our historical performance report to gain insights into IonQ's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives