Ingram Micro (NYSE:INGM): Assessing Valuation as New India Chief Brings Proven Digital Growth Expertise

Reviewed by Kshitija Bhandaru

Ingram Micro Holding (NYSE:INGM) has named Flavio Moraes Junior as the new Managing Director and Chief Country Executive for India, following his successful leadership at Ingram Micro Brazil. Investors are watching how this change could shape growth prospects in India.

See our latest analysis for Ingram Micro Holding.

Amid Flavio Moraes Junior’s arrival, Ingram Micro Holding’s share price has remained in positive territory for much of the year. This suggests steady momentum and a stable outlook as the company navigates leadership changes and ongoing digital expansion.

If you’re looking to spot what else is taking off in tech, this is a perfect moment to see who else is making moves with our See the full list for free.

With shares now trading around 9 percent below analyst targets and showing a strong value score, is there meaningful upside left for investors here? Or is the current price already reflecting the company's future growth potential?

Price-to-Earnings of 19.3x: Is it justified?

Ingram Micro Holding is currently trading at a price-to-earnings (P/E) ratio of 19.3x, slightly above its peers but well under the industry average. With the last close at $22, the share price seems to offer some value when considering both the industry and company-specific benchmarks.

The P/E ratio represents what investors are willing to pay today for a dollar of expected earnings. For technology-focused distribution companies like Ingram Micro Holding, this is especially relevant given their large revenue streams and fluctuating net profit margins.

At 19.3x earnings, Ingram Micro is less expensive than the overall US Electronic industry average of 24x. This may indicate that the market is underestimating its turnaround or future growth potential. However, it is pricier than a typical peer, which suggests investors might already be anticipating improved profitability or operational efficiencies in the future. Compared to the estimated fair price-to-earnings ratio of 35.5x, the current P/E could signal further room for price expansion if growth aligns with expectations.

Explore the SWS fair ratio for Ingram Micro Holding

Result: Price-to-Earnings of 19.3x (UNDERVALUED)

However, slowing revenue growth and recent share price dips could challenge the bullish outlook if profitability or demand declines in upcoming quarters.

Find out about the key risks to this Ingram Micro Holding narrative.

Another View: The SWS DCF Model

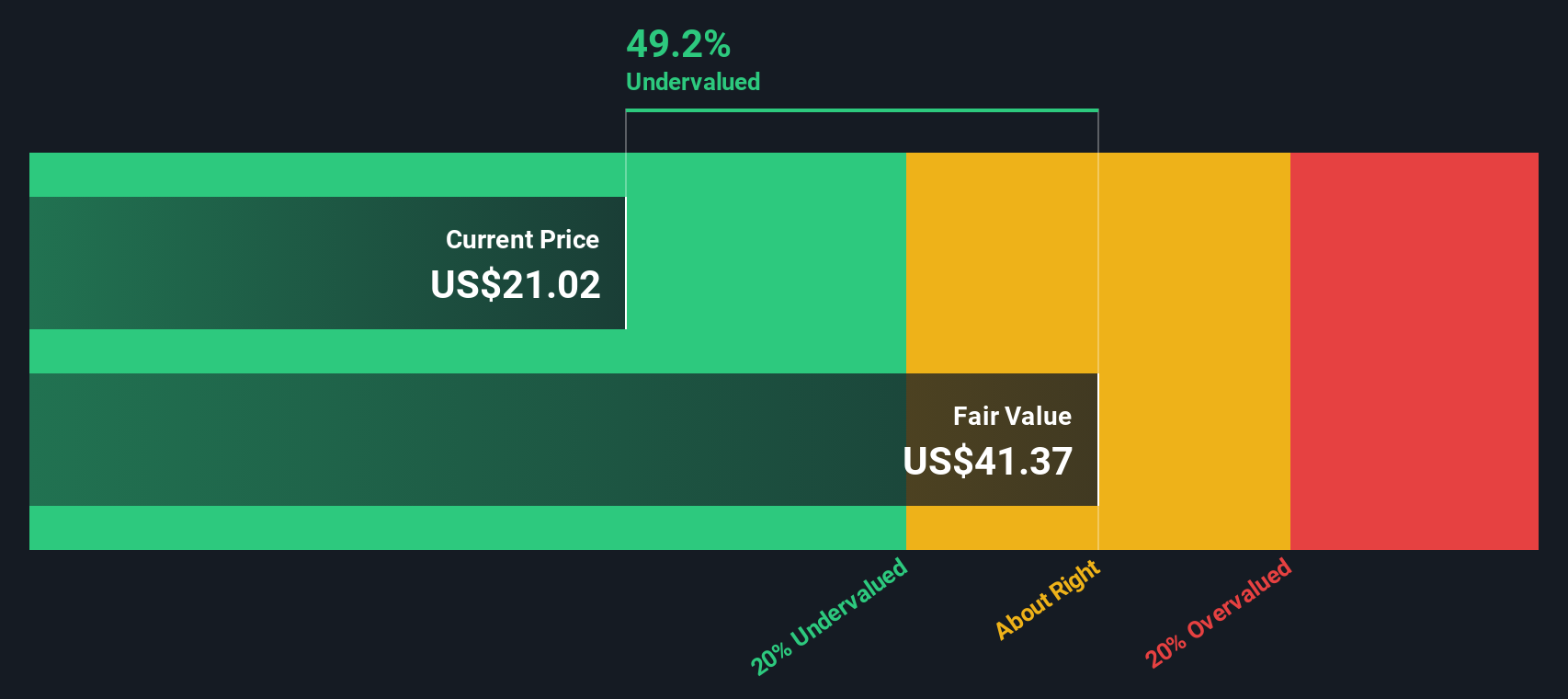

While Ingram Micro Holding's price-to-earnings ratio suggests undervaluation, the SWS DCF model tells an even stronger story. According to this approach, shares are trading around 47% below estimated fair value. This deeper discount could present a rare opportunity, or perhaps the market is seeing risks others are missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ingram Micro Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ingram Micro Holding Narrative

If you see the story differently or want to dive deeper into the numbers yourself, you can quickly build your own perspective in just a few minutes with our Do it your way

A great starting point for your Ingram Micro Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by; so many exciting stocks are waiting to be found. Make your investing journey count by checking out these handpicked ideas today.

- Unleash your portfolio’s potential by capitalizing on these 896 undervalued stocks based on cash flows companies the market has overlooked and spot tomorrow’s winners ahead of the crowd.

- Capture growth in the digital health revolution by analyzing these 32 healthcare AI stocks where artificial intelligence is transforming healthcare and driving real results.

- Supercharge your yield with these 19 dividend stocks with yields > 3% that consistently deliver attractive returns through healthy, sustainable dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INGM

Ingram Micro Holding

Through its subsidiaries, distributes information technology products, cloud, and other services in North America, Europe, the Middle East, Africa, the Asia-Pacific, Latin America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives