- United States

- /

- Tech Hardware

- /

- NYSE:HPE

Does Hewlett Packard Enterprise Still Offer Value After Its Strong Multi Year Share Price Run?

Reviewed by Bailey Pemberton

- If you are wondering whether Hewlett Packard Enterprise (HPE) is still a smart buy at today’s price, you are not alone. This article is designed to walk you through what the numbers are really saying about its value.

- HPE’s share price has climbed 108.7% over the last 5 years and 46.7% over 3 years, even though the stock is only up 5.7% over the last year and has slipped 10.2% over the past month.

- Recent headlines have focused on HPE’s push deeper into hybrid cloud and edge computing, along with strategic partnerships that aim to make its recurring, service-based revenue more reliable. Investors have also been watching its AI and networking initiatives, which help explain why sentiment has been resilient despite some near term volatility.

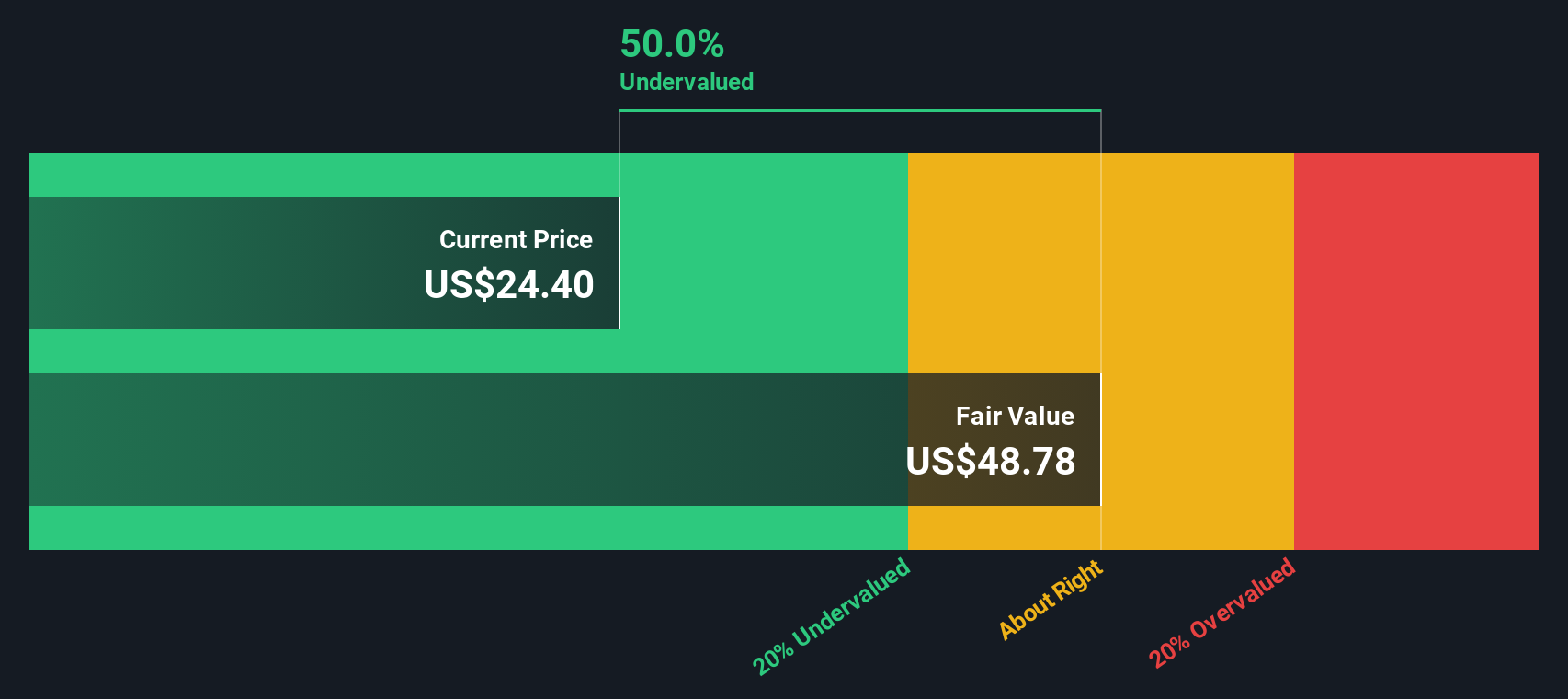

- On our valuation checks, HPE scores a solid 4/6. This suggests some aspects of the market may still be underestimating the business. Next, we will compare what different valuation approaches imply for HPE, and then circle back to a more intuitive way to think about its value that we will reveal at the end of the article.

Approach 1: Hewlett Packard Enterprise Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in $ terms. For Hewlett Packard Enterprise, the model used is a 2 Stage Free Cash Flow to Equity approach, which first captures a higher growth phase and then tapers to steadier, long term growth.

HPE’s latest twelve month free cash flow is slightly negative at about $0.34 billion, but analysts expect this to shift meaningfully into positive territory. Projections, which combine analyst estimates for the next few years with Simply Wall St extrapolations, see free cash flow rising to around $4.50 billion by 2035. When all of these future cash flows are discounted back to today, the model arrives at an intrinsic value of roughly $33.94 per share.

Compared with the current share price, this implies that HPE is about 35.4% undervalued on a DCF basis. This suggests the market may not be fully pricing in its future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hewlett Packard Enterprise is undervalued by 35.4%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

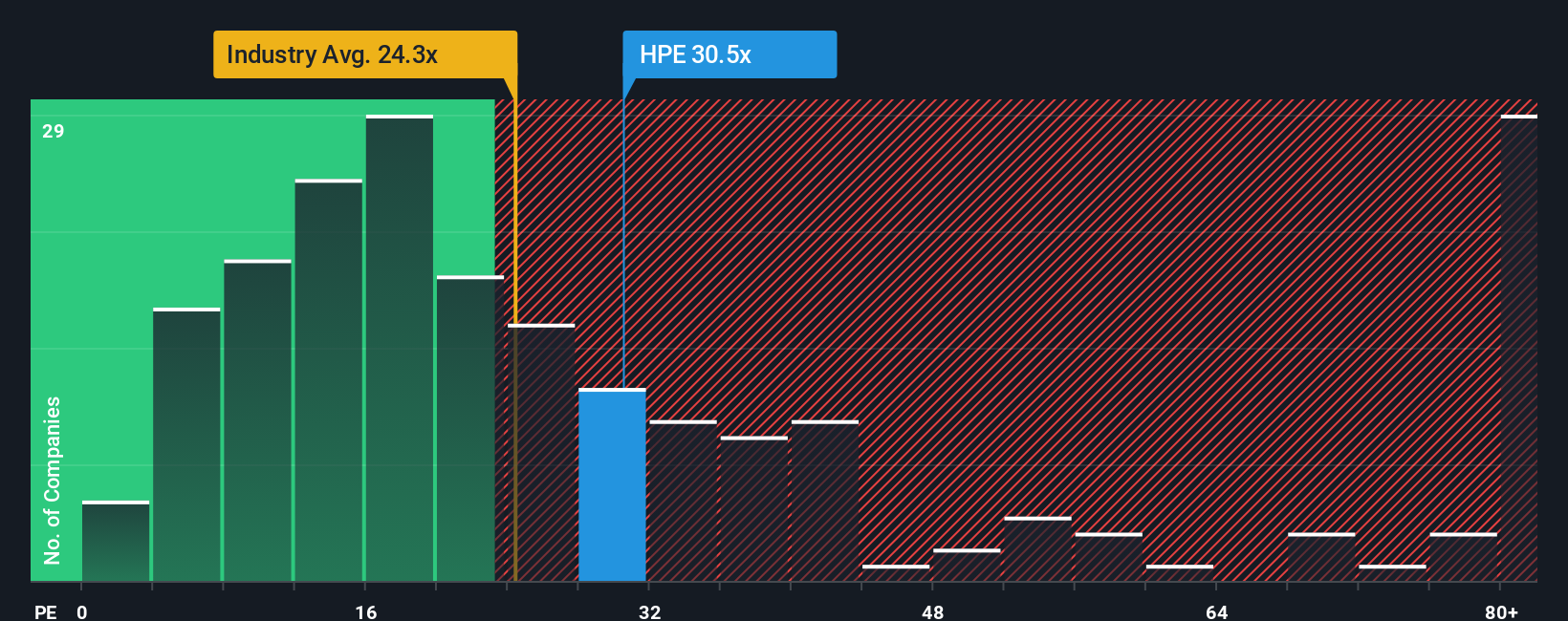

Approach 2: Hewlett Packard Enterprise Price vs Earnings

For profitable companies like Hewlett Packard Enterprise, the price to earnings, or PE, ratio is a practical way to gauge whether investors are paying a reasonable price for today’s earnings power. In general, businesses with stronger, more reliable growth and lower perceived risk can justify a higher PE multiple, while slower growing or riskier names tend to trade on lower multiples.

HPE currently trades on a PE of about 25.5x. That sits above both the broader Tech industry average of roughly 22.5x and the peer group average of around 20.9x, which suggests the market is already assigning HPE a premium versus many competitors. However, Simply Wall St’s proprietary Fair Ratio model, which estimates what a stock’s multiple should be after adjusting for its specific growth outlook, profitability, risk profile, industry and market cap, points to a materially higher “fair” PE of about 39.7x.

Because this Fair Ratio is well above HPE’s actual PE, the multiple analysis indicates that, even after its recent run, the stock still trades below what would be expected given its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

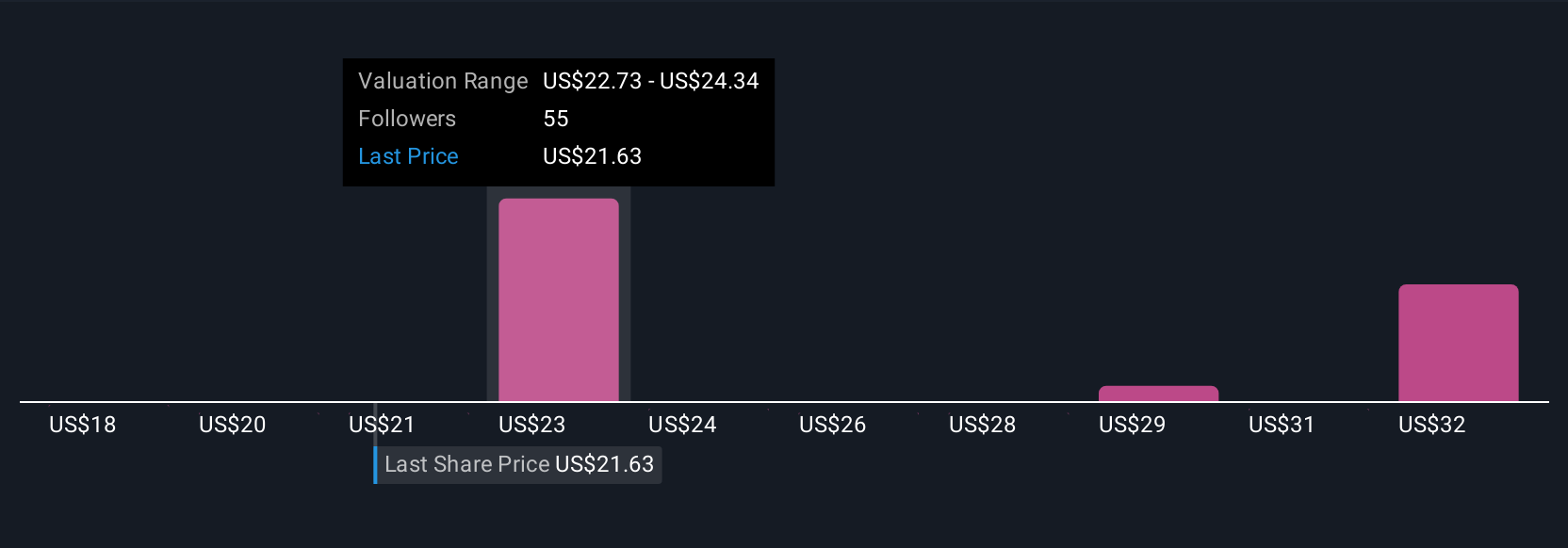

Upgrade Your Decision Making: Choose your Hewlett Packard Enterprise Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to attach your story about Hewlett Packard Enterprise to the numbers by linking your view of its future revenue, earnings and margins to a financial forecast, a fair value, and a clear buy or sell signal on Simply Wall St’s Community page. On this page, millions of investors compare their own Fair Value to the current price and see that Narratives update dynamically as fresh news, earnings, or regulatory developments emerge. One investor might build a bullish HPE Narrative around accelerating AI networking growth, successful Juniper integration and higher long term margins that, in their view, justifies a fair value closer to the top of the current price target range. Another, more cautious investor might focus on legacy hardware headwinds, integration and debt risks, and assign a lower fair value nearer the bottom of the range. Both can transparently see how their assumptions, not just the headline multiple, drive their conclusions.

Do you think there's more to the story for Hewlett Packard Enterprise? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hewlett Packard Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPE

Hewlett Packard Enterprise

Provides solutions that allow customers to capture, analyze, and act upon data seamlessly.

Moderate risk, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026