Corning (NYSE:GLW) Projects Q2 2025 Core Sales of US$3.85 Billion with Growing EPS

Reviewed by Simply Wall St

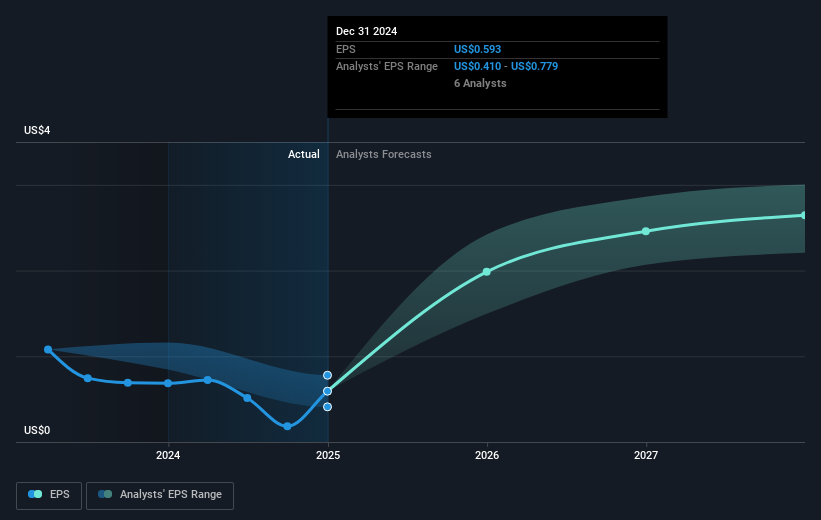

Corning (NYSE:GLW) recently shared optimistic corporate guidance for the second quarter of fiscal year 2025, projecting strong growth in core earnings per share, despite the temporary impact of tariffs and higher production costs. This news was coupled with their first-quarter earnings report, which highlighted a significant increase in sales year-over-year, though net income and earnings per share fell compared to the previous year. This news coincided with upward movements in the broader market, including a 7.1% rise over the past week, suggesting that Corning's updates likely supported the positive sentiment leading to the 8% rise in its share price.

The recent announcement of optimistic guidance for Corning's second quarter of fiscal year 2025 suggests potential positive implications for revenue growth and core earnings per share. This aligns with the company's ongoing Springboard plan and advancements in Gen AI Optical Products, anticipated to enhance operating margins and add substantial sales by 2026. However, challenges such as tariffs and production costs could temper short-term profitability, emphasizing the importance of strategic execution going forward.

Corning's shares have returned 150.46% over the past five years, indicating solid long-term performance, despite recent earnings pressures. Over the past year, Corning's share performance has not only exceeded the US market's 7.7% return but also surpassed the US Electronic industry's 3.8% return, underscoring resilience amid sector challenges. This strong positioning reflects an ability to capitalize on sectoral trends and partnerships, further supported by an expected revenue growth of 9.9% annually over the next three years.

This announcement could strategically impact future forecasts, specifically concerning projected earnings of US$2.3 billion by 2028. Current share price movements, a result of recent market optimism, align closely with analysts' price target of US$52.92, representing a 21.1% increase from today's share price of US$41.75. The anticipated revenue gains across various segments could justify this target, provided risks related to government programs, currency fluctuations, and capital expenditures are effectively managed.

Jump into the full analysis health report here for a deeper understanding of Corning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLW

Corning

Engages in the optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses in the United States and internationally.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives