Corning (GLW): Reassessing Valuation After a Strong Year-To-Date Rally and Recent Pullback

Reviewed by Simply Wall St

Corning (GLW) has quietly turned into one of this year’s stronger tech compounders, with the stock up sharply year to date even after a recent pullback. That gains-heavy backdrop now puts valuation and sustainability under the microscope.

See our latest analysis for Corning.

After a stellar run earlier in the year, the recent 9 percent 7 day share price pullback to about $85 still sits within a powerful upswing. The year to date share price return and multi year total shareholder returns both signal that momentum is pausing rather than breaking.

If Corning’s surge has you thinking more broadly about what is working in tech hardware and communications, it could be a good moment to explore high growth tech and AI stocks for other potential winners.

With earnings and cash flows finally inflecting higher, Corning’s valuation sits between a classic value multiple and a full growth multiple. This raises the real question: is this a fresh entry point, or are markets already pricing in the next leg of expansion?

Most Popular Narrative Narrative: 8.5% Undervalued

Corning’s most followed narrative pegs fair value around $93 per share, a shade above the last close of $85.42, framing today’s rally in a different light.

The company sees substantial growth in Optical Communications, particularly in innovations for Gen AI data centers, which are expected to drive incremental revenue and accelerate operating margin improvements toward 20% by the end of 2026. Corning's significant U.S. manufacturing footprint provides a competitive edge and is expected to attract commercial agreements, enhancing sales and net margins despite tariff implications.

Want to see the math behind that upside call? The narrative leans on rapid revenue acceleration and a much richer profit profile than today, plus a punchy future earnings multiple. Curious which assumptions really move the needle in this fair value? Dive in to see how they all stack together.

Result: Fair Value of $93.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on Gen AI and solar demand remaining strong, and on tariffs and trade tensions not eroding margins more than expected.

Find out about the key risks to this Corning narrative.

Another Way of Looking at Value

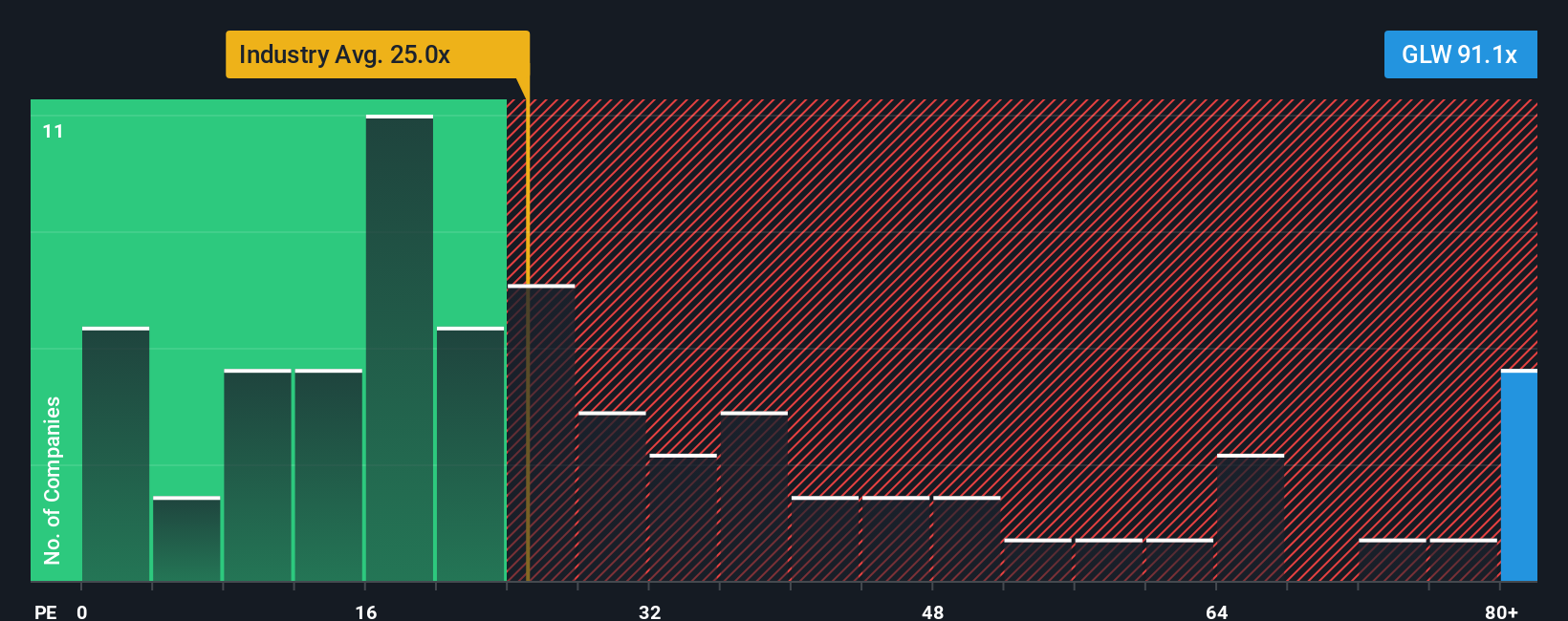

Step away from the narrative fair value and Corning suddenly looks stretched. On a price to earnings basis, the stock trades at 53.6 times versus 24.1 times for the US Electronic industry and a 35.2 times fair ratio, leaving little margin for disappointment if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corning Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a fresh view in minutes: Do it your way.

A great starting point for your Corning research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put your Corning insights to work by hunting for other standout opportunities on the Simply Wall Street Screener so your next winner does not slip past.

- Target higher income potential by scanning these 13 dividend stocks with yields > 3% that combine solid yields with the balance sheets needed to keep paying through different market cycles.

- Ride the next wave of innovation by reviewing these 29 healthcare AI stocks harnessing algorithms to transform diagnostics, treatment pathways, and long term patient outcomes.

- Position yourself early in emerging trends by assessing these 80 cryptocurrency and blockchain stocks building real businesses around blockchain infrastructure, payments, and digital asset ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLW

Corning

Operates in optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses.

High growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion