- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

3 Stocks Estimated To Be Trading Below Intrinsic Value By At Least 12.6% With Discounts Up To 48.3%

Reviewed by Simply Wall St

As the U.S. stock market experiences a rebound with major indices closing higher, driven by the Federal Reserve's decision to maintain interest rates amidst economic uncertainty, investors are keenly observing potential opportunities within this fluctuating environment. In such conditions, identifying stocks that are trading below their intrinsic value can offer a compelling opportunity for investors seeking to capitalize on market inefficiencies and potentially enhance their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $30.91 | $61.74 | 49.9% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $28.37 | $56.28 | 49.6% |

| Associated Banc-Corp (NYSE:ASB) | $22.83 | $44.95 | 49.2% |

| KBR (NYSE:KBR) | $51.30 | $101.72 | 49.6% |

| Datadog (NasdaqGS:DDOG) | $104.43 | $206.82 | 49.5% |

| Coastal Financial (NasdaqGS:CCB) | $84.44 | $167.69 | 49.6% |

| Viking Holdings (NYSE:VIK) | $40.09 | $78.93 | 49.2% |

| Gaotu Techedu (NYSE:GOTU) | $3.89 | $7.69 | 49.4% |

| Driven Brands Holdings (NasdaqGS:DRVN) | $17.56 | $34.82 | 49.6% |

| Mobileye Global (NasdaqGS:MBLY) | $14.54 | $28.81 | 49.5% |

We're going to check out a few of the best picks from our screener tool.

Coherent (NYSE:COHR)

Overview: Coherent Corp. is engaged in the development, manufacturing, and marketing of engineered materials, optoelectronic components and devices, as well as optical and laser systems for industrial, communications, electronics, and instrumentation markets globally with a market cap of approximately $10.81 billion.

Operations: Coherent's revenue segments include Lasers at $1.44 billion, Materials at $1.52 billion, and Networking at $2.93 billion.

Estimated Discount To Fair Value: 23.5%

Coherent's stock appears undervalued, trading 23.5% below its estimated fair value of US$91.15. Analysts predict a significant price increase, with earnings expected to grow by 87.03% annually over the next three years, surpassing market averages. Recent product innovations in optical and laser technologies could enhance revenue streams and market positioning, despite highly volatile share prices recently observed. Coherent's strategic financial adjustments include reduced interest rates on term loans, potentially improving cash flow management.

- According our earnings growth report, there's an indication that Coherent might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Coherent.

Corning (NYSE:GLW)

Overview: Corning Incorporated operates in the optical communications, display technologies, environmental technologies, specialty materials, and life sciences sectors both in the United States and internationally, with a market cap of approximately $40.49 billion.

Operations: The company's revenue segments include Optical Communications at $4.66 billion, Display Technologies at $3.87 billion, Specialty Materials at $2.02 billion, Environmental Technologies at $1.67 billion, and Life Sciences at $979 million.

Estimated Discount To Fair Value: 12.6%

Corning's stock trades at US$48.76, approximately 12.6% below its estimated fair value of US$55.80, indicating potential undervaluation based on cash flows. Recent strategic moves include a partnership with Suniva and Heliene to supply U.S.-made solar components, potentially enhancing revenue streams amidst forecasted earnings growth of 23.5% annually over three years. However, high debt levels and unsustainable dividend coverage may pose challenges despite raised earnings guidance for Q1 2025 and strong recent financial performance.

- Insights from our recent growth report point to a promising forecast for Corning's business outlook.

- Click here to discover the nuances of Corning with our detailed financial health report.

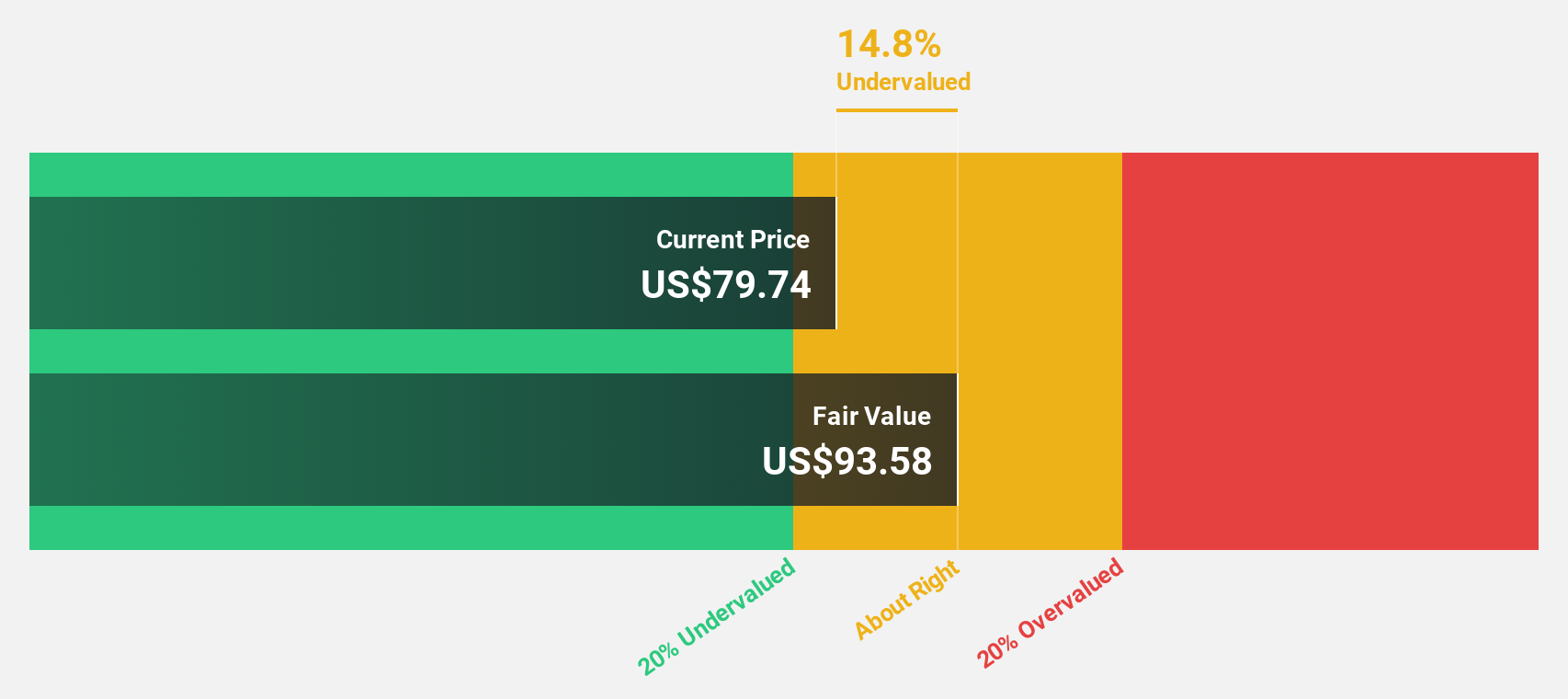

Pure Storage (NYSE:PSTG)

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services globally with a market cap of approximately $16.27 billion.

Operations: The company's revenue is primarily derived from its computer storage devices segment, which generated approximately $3.17 billion.

Estimated Discount To Fair Value: 48.3%

Pure Storage, trading at US$51.52, is significantly undervalued compared to its estimated fair value of US$99.57. Despite recent insider selling, the company's strong cash flow potential is underscored by projected earnings growth of 32.1% annually over three years and a robust share repurchase program worth up to US$250 million. The launch of FlashBlade//EXA positions Pure Storage well in AI and HPC markets, potentially driving future revenue growth beyond the forecasted US$3.515 billion for FY26.

- Our growth report here indicates Pure Storage may be poised for an improving outlook.

- Take a closer look at Pure Storage's balance sheet health here in our report.

Key Takeaways

- Click this link to deep-dive into the 197 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion