- United States

- /

- Tech Hardware

- /

- NYSE:DELL

What Does OpenAI’s $100B Server Plan Mean for Dell’s Current Valuation?

Reviewed by Bailey Pemberton

If you have been watching Dell Technologies and wondering whether now is the right time to jump in or take some profits, you are not alone. The stock has been on quite a ride lately, closing most recently at $145.76. That is not just a random spike either. It comes after an 8.9% jump in the last week and a massive 16.8% climb over the past month. Year to date, Dell shares are up 25.1%, and over the past year, they have gained 24.6%. But that is nothing compared to the company’s three- and five-year returns of over 350%. Clearly, something is driving this tech heavyweight’s impressive run.

Much of the recent buzz traces back to big-picture developments in AI and the digital landscape. Dell’s close ties with OpenAI, especially news that OpenAI expects to spend a staggering $100 billion on backup servers, have put the company in a prime spotlight. Dell’s connections to headline-grabbing stories, from its involvement in deals around major platforms like TikTok to its role in building critical digital infrastructure, continually reaffirm its relevance and growth narrative.

But while rapid price appreciation gets attention, the real question on many investors’ minds is whether the current price truly reflects Dell’s fundamental value. That is where valuation scores come in handy. By running Dell through a battery of six common valuation checks, the company stands out, being undervalued in five out of six, giving it a standout value score of 5. So how does each method stack up, and is there a smarter way to judge Dell’s worth? Let’s break down the approaches, and by the end, I will share an even better way to frame Dell’s value story.

Approach 1: Dell Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model aims to determine the value of a company by forecasting its future cash flows, then discounting those amounts back to today’s dollars. This approach tries to estimate how much the company is worth based on the money it is expected to generate for shareholders in the years ahead.

For Dell Technologies, the current Free Cash Flow (FCF) over the last twelve months stands at approximately $4.59 billion. Analyst projections have Dell’s FCF rising to $8.52 billion by 2030, reflecting significant growth in cash generation capacity. Notably, forecasts for the first five years use direct analyst estimates, while projections beyond that are cautiously extrapolated further into the future.

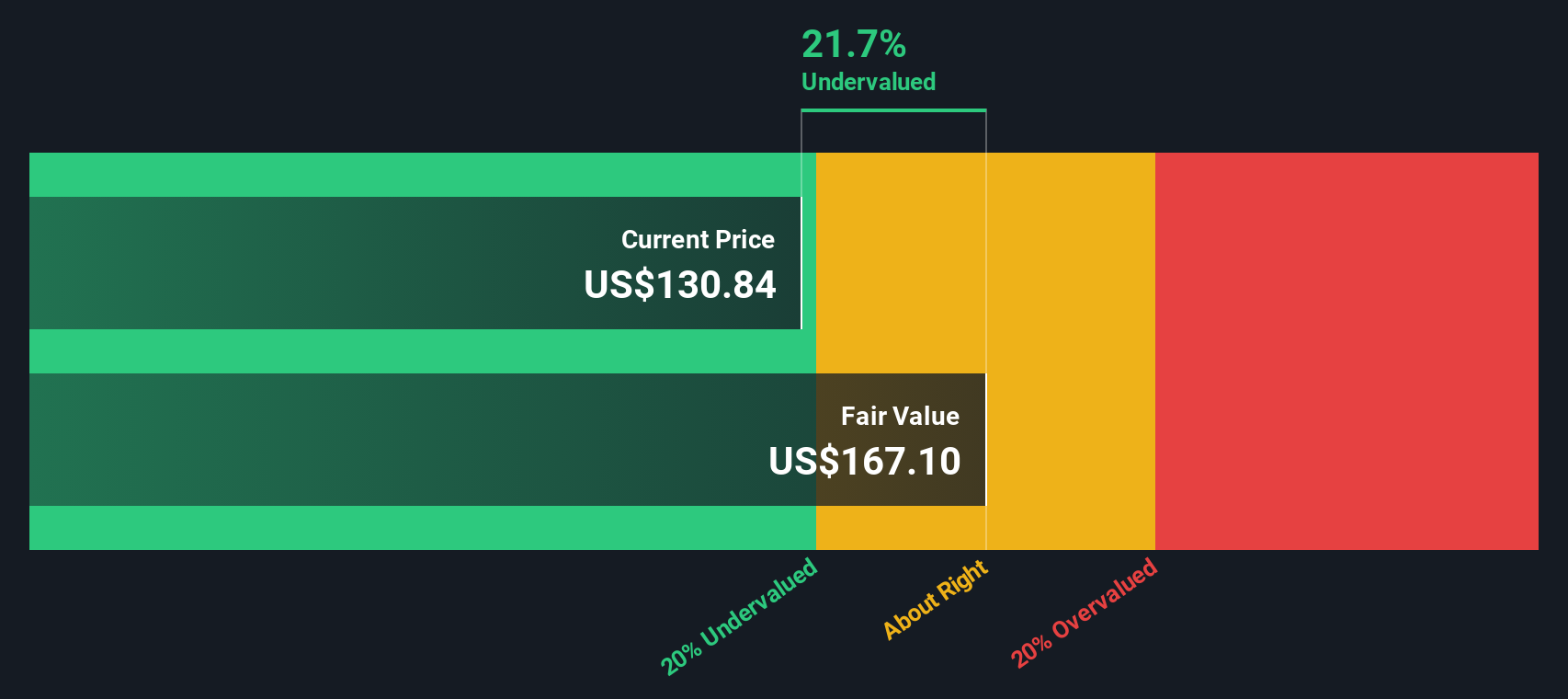

Using these cash flow estimates, the DCF model calculates Dell’s fair value at $193.55 per share. Given the current market price of $145.76, this implies the stock is trading at a substantial 24.7% discount to its intrinsic value. This suggests notable undervaluation according to this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dell Technologies is undervalued by 24.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Dell Technologies Price vs Earnings (PE Ratio)

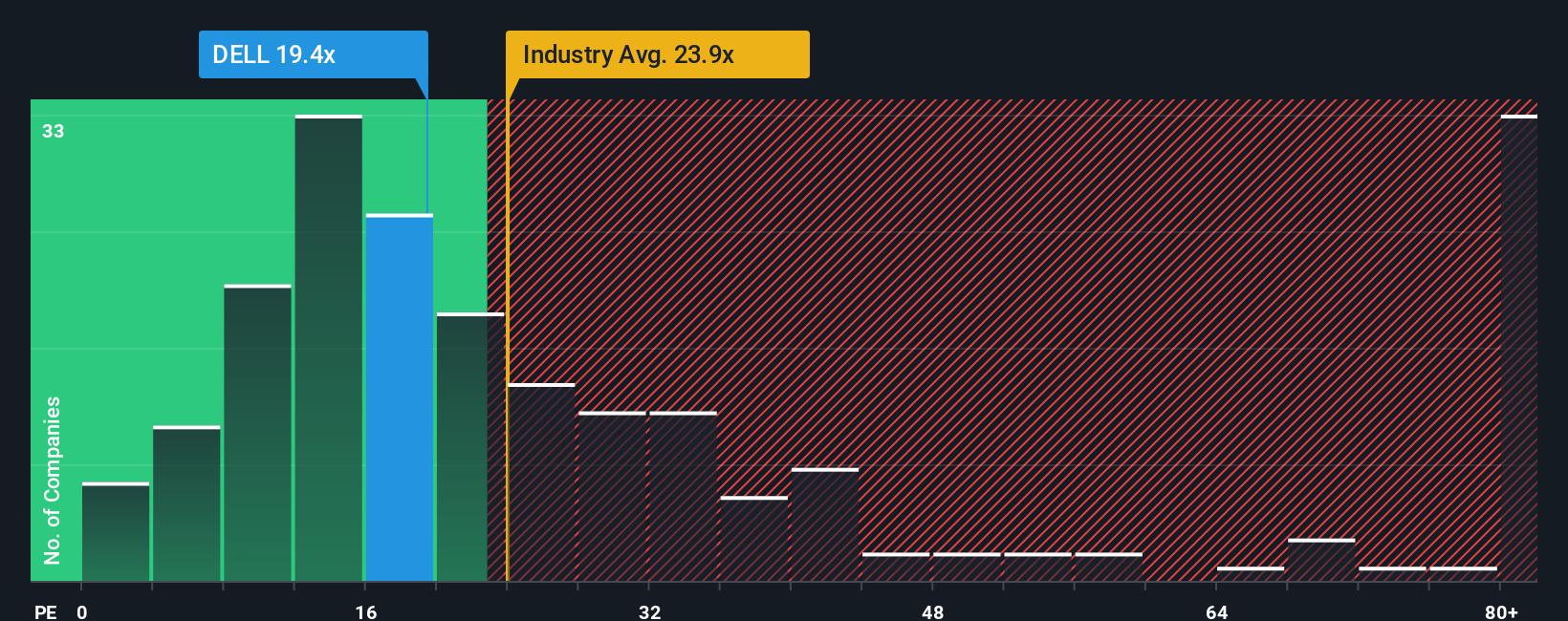

For established, profitable companies like Dell Technologies, the Price-to-Earnings (PE) ratio is a tried-and-true way to measure value. The PE ratio is especially useful here because it tells investors how much they are paying for each dollar of earnings, providing a quick comparison point to industry benchmarks and peers. When a company is solidly profitable, as Dell is, the PE ratio serves as an accessible gauge of what the market thinks future growth and risk are worth.

Growth expectations and risk play a big role in what counts as a “normal” or “fair” PE ratio. Faster-growing companies or those seen as less risky often command higher PEs, while slower-growing or riskier firms tend to trade at lower multiples. In Dell’s case, its current PE stands at 20x, notably below both the tech industry average of 24x and the average of its closest peers, which is about 25x. On the surface, this suggests Dell is trading at a discount to the broader sector.

Beyond these basic comparisons, Simply Wall St uses a proprietary Fair Ratio to get a more tailored view. This metric considers not just industry norms and peer multiples, but also Dell’s unique features, such as profit margins, earnings growth, company size, and specific risk factors. Because it goes further than simple averages, the Fair Ratio can offer a more objective anchor for what Dell should be worth based on its own fundamentals.

Dell’s Fair Ratio comes in at 37.28x, which is far above its current PE of 20x. Compared to this custom metric, Dell’s stock appears undervalued even after accounting for its growth outlook and risk profile. In other words, the market does not seem to be giving Dell full credit for its strengths.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dell Technologies Narrative

Earlier, we mentioned there is an even better way to understand valuation, and that is by using Narratives. A Narrative is more than just a number; it is a story that combines your perspective on a company with your own expectations for its future, such as estimates for revenue growth, earnings, and margins. Narratives allow you to connect Dell Technologies’ big-picture trends and news to a financial forecast, making your personal estimate of fair value more transparent and actionable.

On Simply Wall St’s platform, Narratives are available to everyone through the Community page, empowering millions of investors to factor in both the latest financials and the stories behind them. The key strength of Narratives is their flexibility. They update whenever new information arrives, such as quarterly earnings or breaking news, helping you see in real time how Dell’s value moves as its story evolves.

This approach makes investment decisions more accessible: instead of relying on generic analyst targets, you can compare your own fair value (rooted in your Narrative) to the current market price and decide confidently when to buy or sell. For example, some investors project Dell's fair value as high as $180, reflecting strong optimism about AI and data center growth; others see it as low as $104, highlighting margin risks and cyclicality. This range demonstrates how diverse Narratives enable smarter, more personalized calls for every investor.

Do you think there's more to the story for Dell Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DELL

Dell Technologies

Designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Dentsply Sirona Stock: Dental Technology Built for Cycles, Not Headlines

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion