Why Coherent (COHR) Is Up 5.2% After Optical Breakthroughs and Major Credit Expansion

Reviewed by Sasha Jovanovic

- In late September 2025, Coherent Corp. announced a series of groundbreaking product innovations in optical communications and implemented substantial refinancing to expand its credit facilities, boosting its total revolving credit facility to US$700 million and securing US$1.25 billion in new term loans. These advancements, combined with multiple industry awards at ECOC 2025, underline Coherent’s strengthened position in high-performance photonics for AI, datacenter, and telecom markets.

- The combination of Coherent’s major product breakthroughs and expanded financial resources signals a step-change in its ability to compete and innovate within high-growth, bandwidth-intensive markets across data infrastructure.

- We'll explore how Coherent's latest optical communications breakthroughs may influence its long-term investment narrative and future growth prospects.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Coherent Investment Narrative Recap

To be a Coherent shareholder, you need confidence in the rise of AI datacenters and advanced optical components driving steady demand for photonics innovations. The September 2025 refinancing sharply increases Coherent’s liquidity, enhancing its balance sheet and flexibility, but does not fundamentally change the key short-term catalyst, delivering consistent order growth in the data infrastructure segment, or immediately address the biggest risk, which remains heightened competition and pricing pressure from low-cost Asian manufacturers.

The launch of Coherent’s QSFP28 Dual Laser 100G ZR solution stands out as particularly relevant, offering a technological edge for network operators aiming to boost bandwidth using existing infrastructure. This breakthrough highlights how Coherent is targeting growth in bandwidth-hungry markets, but competitive risks and potential margin pressure are still important considerations.

In contrast, investors should be aware that …

Read the full narrative on Coherent (it's free!)

Coherent's narrative projects $7.7 billion in revenue and $732.0 million in earnings by 2028. This requires 9.8% yearly revenue growth and a $812.6 million earnings increase from current earnings of -$80.6 million.

Uncover how Coherent's forecasts yield a $113.37 fair value, in line with its current price.

Exploring Other Perspectives

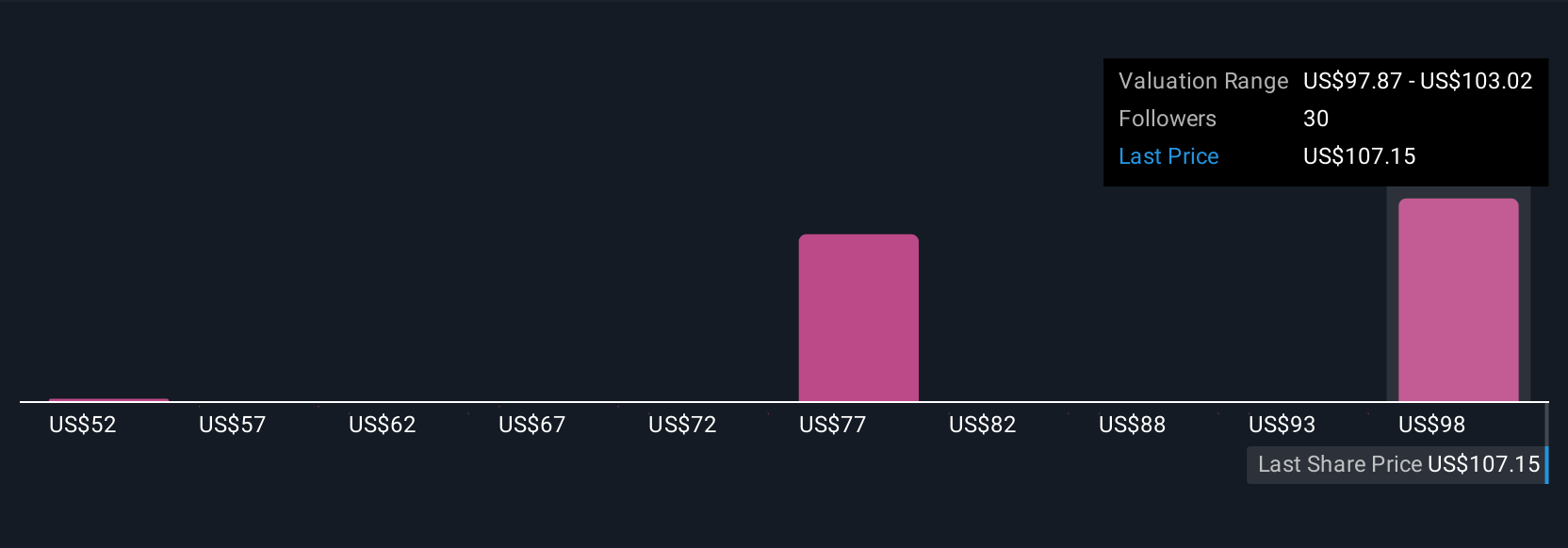

Seven fair value estimates from the Simply Wall St Community range from US$51.56 to US$113.37, reflecting diverse outlooks. With competition from Asian manufacturers remaining intense, your analysis can benefit by considering several alternative viewpoints on future profitability and market share.

Explore 7 other fair value estimates on Coherent - why the stock might be worth less than half the current price!

Build Your Own Coherent Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coherent research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Coherent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coherent's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and laser systems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives