Is It Too Late To Consider Coherent After Its 406.5% Three Year Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Coherent is still good value after its big run, you are not alone. This is exactly the kind of stock where the story and the numbers do not always line up neatly.

- The share price has been volatile lately, dropping 13.7% over the last week, but still up 22.6% over 30 days, 69.4% year to date, and 75.1% over the past year, with a 406.5% gain over three years.

- Those moves have been shaped by a steady stream of headlines around demand for photonics and laser technologies across industrial, communications, and electronics markets. Investors have been reacting to growing interest in Coherent's role in enabling next generation manufacturing and connectivity, as well as shifting sentiment toward higher growth hardware names.

- Despite that backdrop, Coherent currently scores 0/6 on Simply Wall St's valuation checks. This suggests the market might be pricing in a lot of optimism already. Next we will unpack what different valuation approaches say about the stock today, and later we will look at a more nuanced way to judge whether that price really makes sense.

Coherent scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Coherent Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to a single value in today’s dollars.

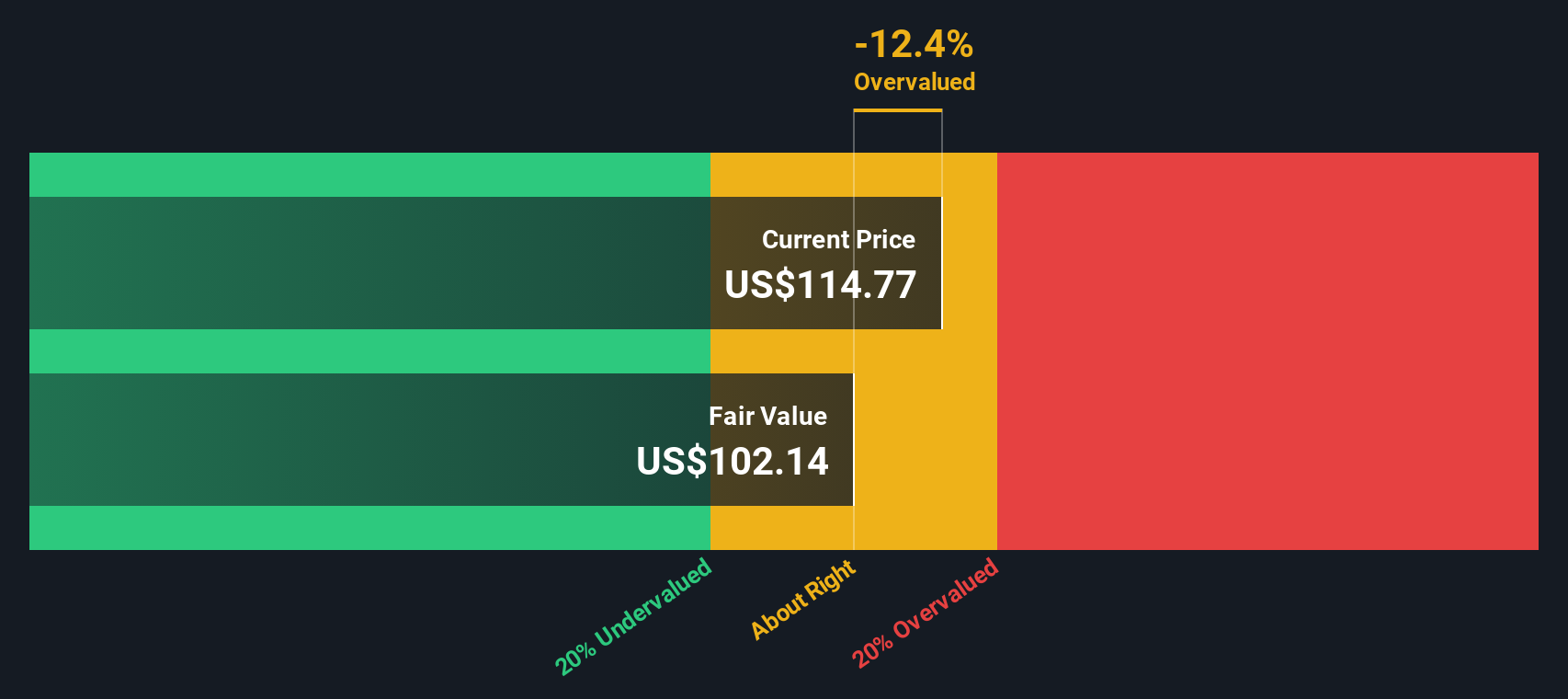

For Coherent, Simply Wall St uses a 2 Stage Free Cash Flow to Equity model. The company generated last twelve month free cash flow of about $75.2 Million, and in this model this is expected to increase as demand for photonics strengthens. By 2028, free cash flow is projected to reach roughly $1.06 Billion, with additional years extrapolated beyond analyst coverage to build a 10 year outlook.

When all those future cash flows are discounted back, the model arrives at an intrinsic value of about $151.72 per share. Compared with the current share price, this implies Coherent is roughly 12.3% overvalued based on the DCF alone, meaning the market is paying a premium for its expected growth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coherent may be overvalued by 12.3%. Discover 914 undervalued stocks or create your own screener to find better value opportunities.

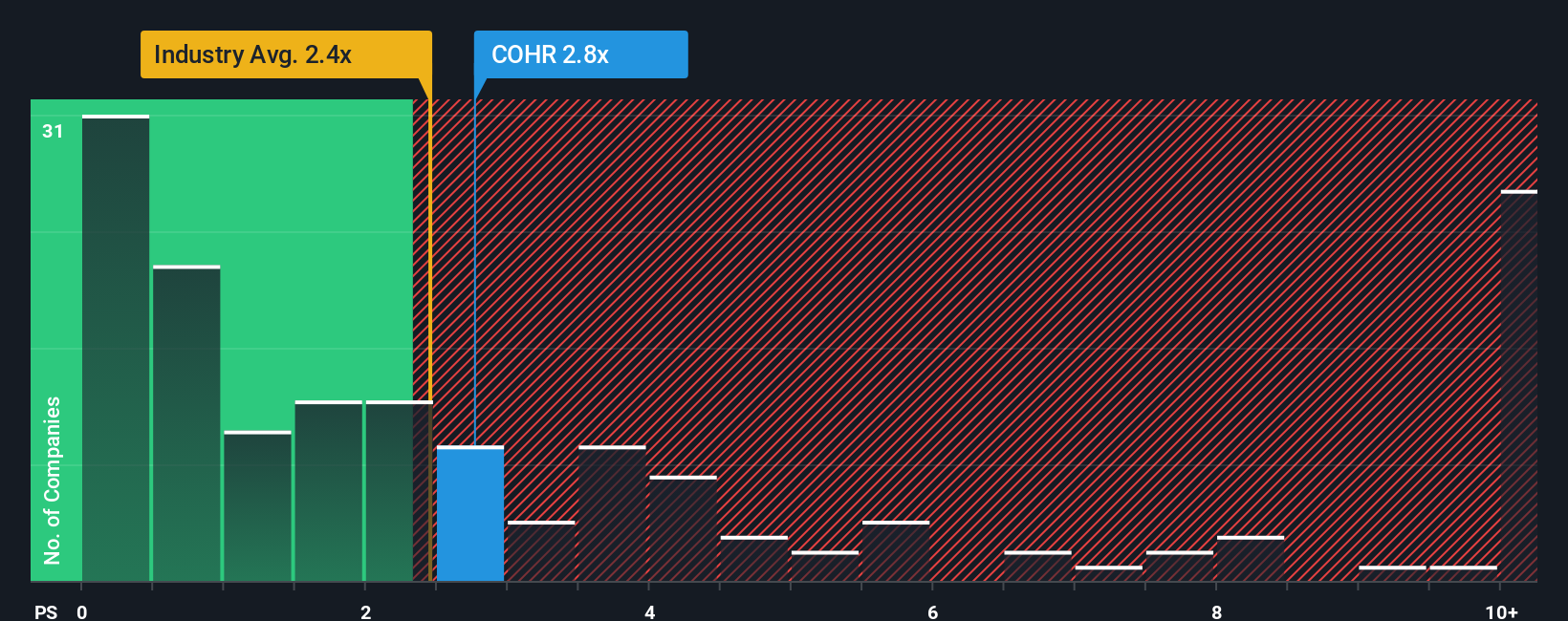

Approach 2: Coherent Price vs Sales

For a business like Coherent, where profitability can be noisy but revenue is more stable and closely tied to market share, the price to sales ratio is a useful way to judge valuation. Investors generally accept paying a higher multiple of sales when a company is growing quickly and operating in an attractive, less risky niche, while slower or riskier businesses typically deserve a lower multiple.

Coherent currently trades at about 4.43x sales, compared with the broader Electronic industry average of roughly 2.52x and a peer average of around 4.18x. Simply Wall St also calculates a Fair Ratio of 3.70x, which reflects what investors might reasonably pay for Coherent’s sales once its growth prospects, profitability, industry, market cap and risk profile are all weighed together.

This Fair Ratio is more informative than a simple comparison with peers or the industry, because it adjusts for the company’s specific strengths and vulnerabilities rather than assuming all hardware names deserve the same treatment. Set against that 3.70x benchmark, Coherent’s current 4.43x sales suggests the market is paying a noticeable premium.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coherent Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple, story driven forecasts that link your view of Coherent’s future revenue, earnings and margins to a calculated fair value. On Simply Wall St’s Community page, millions of investors build Narratives by spelling out the key drivers they expect, turning those expectations into a financial forecast, and then into a fair value that can be compared directly to today’s share price to help inform a decision to buy, hold, or sell. Because Narratives update dynamically when new information such as earnings results, guidance changes, or major product announcements arrives, they stay aligned with the latest facts instead of going stale. For Coherent, one optimistic Narrative might place greater weight on AI datacenter demand, Apple contracts and margin expansion to support a fair value near $175 per share, while a more cautious Narrative could emphasize auto and China risks and indicate a fair value closer to $85, illustrating how different but well structured perspectives can coexist and guide your decisions.

Do you think there's more to the story for Coherent? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and laser systems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)