Is Coherent’s (COHR) Advanced Laser Push the Catalyst for Its Next Industrial Leap?

Reviewed by Simply Wall St

- In recent weeks, Coherent Corp. unveiled major new laser products targeting e-mobility, electronics, and precision manufacturing, and joined a major fusion energy collaboration with Lawrence Livermore National Laboratory. These developments highlight Coherent's continued leadership in photonics innovation and its growing influence across both commercial industrial and emerging energy sectors.

- The announcement of new integrated welding and fiber laser solutions supporting next-generation EV and electronics manufacturing stands out as a potential inflection point for Coherent's industrial segment.

- We'll now examine how Coherent's advanced laser launches and energy collaboration could influence its growth outlook and future earnings story.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Coherent Investment Narrative Recap

Belief in Coherent centers on its ability to stay at the forefront of photonics innovation, translating cutting-edge technology launches into durable revenue streams, especially in industrial and communications markets. While the recent wave of product announcements, especially in EV lasers and fusion energy, reinforces this vision, near-term catalysts remain most closely linked to demand for advanced optical transceivers tied to AI datacenters. Core risks, such as pricing pressure from low-cost Asian competitors and margin compression in transceivers, are not immediately mitigated by these launches but underscore the need for ongoing execution.

The unveiling of the WELD2D MP laser welding scanner for EV and electronics manufacturing directly supports Coherent’s industrial segment ambitions. This addition to their portfolio demonstrates a clear push to capture share in high-growth applications aligned with the structural drivers behind their recent double-digit sales growth, though it may not offset existing margin risks in the near term.

In contrast, investors also need to be alert to pricing trends in optical transceivers that could impact profitability if...

Read the full narrative on Coherent (it's free!)

Coherent's narrative projects $7.7 billion revenue and $732.0 million earnings by 2028. This requires 9.8% yearly revenue growth and an $812.6 million earnings increase from the current earnings of -$80.6 million.

Uncover how Coherent's forecasts yield a $113.37 fair value, a 10% upside to its current price.

Exploring Other Perspectives

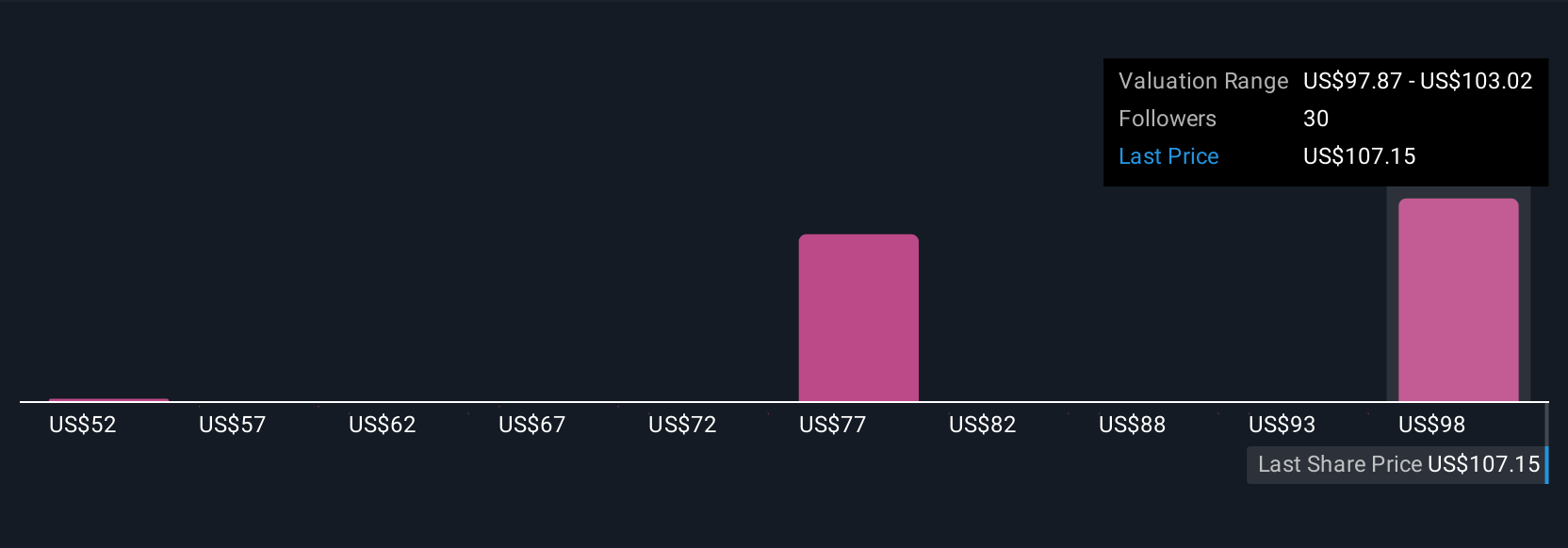

Seven members of the Simply Wall St Community estimate Coherent’s fair value between US$51.56 and US$113.37, reflecting wide-ranging views. With ongoing competition posing a margin risk, it’s important to explore multiple outlooks before forming your own view.

Explore 7 other fair value estimates on Coherent - why the stock might be worth as much as 10% more than the current price!

Build Your Own Coherent Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coherent research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Coherent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coherent's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and laser systems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives