Coherent (NYSE:COHR) Launches Silicon Photonics Transceiver Driving 10% Share Price Rise

Reviewed by Simply Wall St

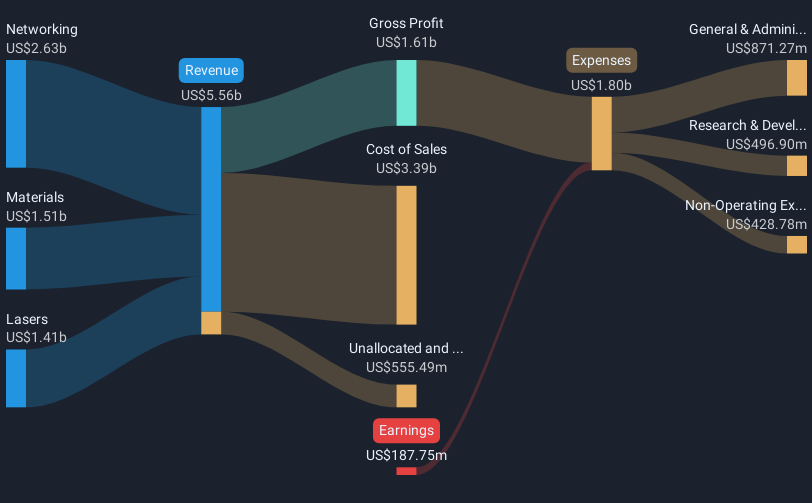

Coherent (NYSE:COHR) saw a 10% rise in its stock price over the last week, a period marked by the company's announcement of its new 2x400G-FR4 Lite optical transceiver, which is designed for AI-driven data centers and high-speed networks. This product rollout, emphasizing energy efficiency and high-volume deployment, aligns with market trends favoring tech innovations, particularly in AI and machine learning. While broader market movements have demonstrated fluctuations, particularly in major indices like the S&P 500 stabilizing after prior losses, Coherent’s advancements in silicon photonics seem to have captured investor interest, contributing to the company's positive share performance.

Buy, Hold or Sell Coherent? View our complete analysis and fair value estimate and you decide.

Over the last five years, Coherent (NYSE:COHR) has delivered a remarkable total shareholder return of 134.19%, including share price appreciation and dividends. Despite the firm being unprofitable with increasing losses at an annual rate of 43.4%, its revenues are expected to grow 10% annually, outpacing the U.S. market's 8.4%. A robust forecast for profitability within the next three years, surpassing average market growth, further bolsters investor confidence.

A key development occurred in late 2024 when Coherent expanded a Texas manufacturing facility with a $33 million investment, aligning with the CHIPS and Science Act. Additionally, Coherent's share buyback program in January 2024, which saw the repurchase of over 1.4 million shares, likely contributed to enhancing shareholder value. Furthermore, executive appointments like Sherri R. Luther as CFO in October 2024 potentially signal strengthened corporate governance, adding to the positive investor sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and optical and laser systems and subsystems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives