Coherent Corp.'s (NYSE:COHR) 32% Share Price Surge Not Quite Adding Up

Coherent Corp. (NYSE:COHR) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. The last month tops off a massive increase of 108% in the last year.

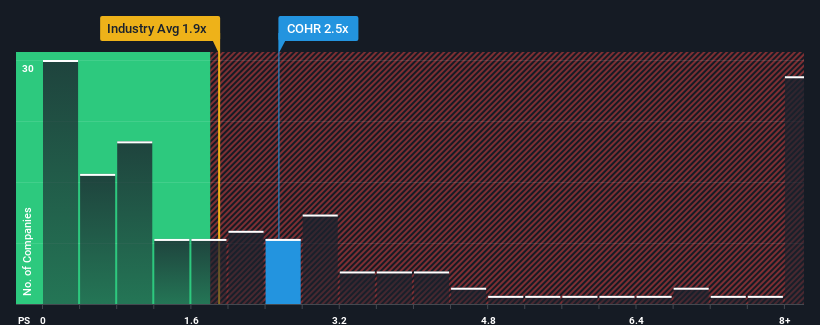

After such a large jump in price, given close to half the companies operating in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider Coherent as a stock to potentially avoid with its 2.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Coherent

What Does Coherent's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Coherent has been very sluggish. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Coherent.How Is Coherent's Revenue Growth Trending?

In order to justify its P/S ratio, Coherent would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.8%. Still, the latest three year period has seen an excellent 52% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 12% each year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% per year, which is not materially different.

With this in consideration, we find it intriguing that Coherent's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Coherent's P/S Mean For Investors?

The large bounce in Coherent's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Coherent currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Coherent that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and optical and laser systems and subsystems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives