Coherent (COHR): Valuation in Focus Following Axon FP Laser Launch for Life Sciences and Research

Reviewed by Simply Wall St

Coherent (COHR) is in the spotlight after unveiling the Axon FP, a new femtosecond laser tailored for life sciences, instrumentation, and metrology. The compact design simplifies complex research setups and appeals to a broad range of users.

See our latest analysis for Coherent.

Coherent’s share price has surged recently, climbing 10.4% over the past week and now showing a 53.1% return year-to-date. Its 1-year total shareholder return stands at 53.8%, with a 307.7% gain over three years. Momentum appears to be building as ongoing innovation such as the Axon FP increases investor confidence in the company’s growth story.

If innovative tech launches like this caught your attention, you might want to check out the full landscape of opportunity with our tech and AI stocks screener See the full list for free.

With shares riding a wave of momentum and innovative products fueling optimism, the big question is whether Coherent is still undervalued or if the recent rally means future growth is already factored in for investors.

Most Popular Narrative: 8.7% Undervalued

Coherent's widely followed narrative estimate places the fair value at $168.74 per share, which is above the latest closing price of $154. This creates a potential gap to be closed, and the numbers behind this valuation may surprise some investors.

"Major investments in internal manufacturing, particularly the world's first 6-inch indium phosphide production line in Texas, are providing scale and cost structure advantages, as well as improved supply chain resiliency. These efforts enable Coherent to boost volumes, lower production costs, and expand gross margins."

What really justifies this bullish price? There is a significant focus on new technologies, profit margin transformation, and substantial revenue growth assumptions driving much of this calculation. The most intriguing details, including how fast the company is projected to grow and which financial levers matter most, are outlined deeper in the full narrative. Don’t miss what is powering this fair value.

Result: Fair Value of $168.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as intensifying competition from low-cost Asian manufacturers and macroeconomic uncertainties could still disrupt Coherent’s growth trajectory and margins.

Find out about the key risks to this Coherent narrative.

Another View: How Does Our DCF Model See Coherent?

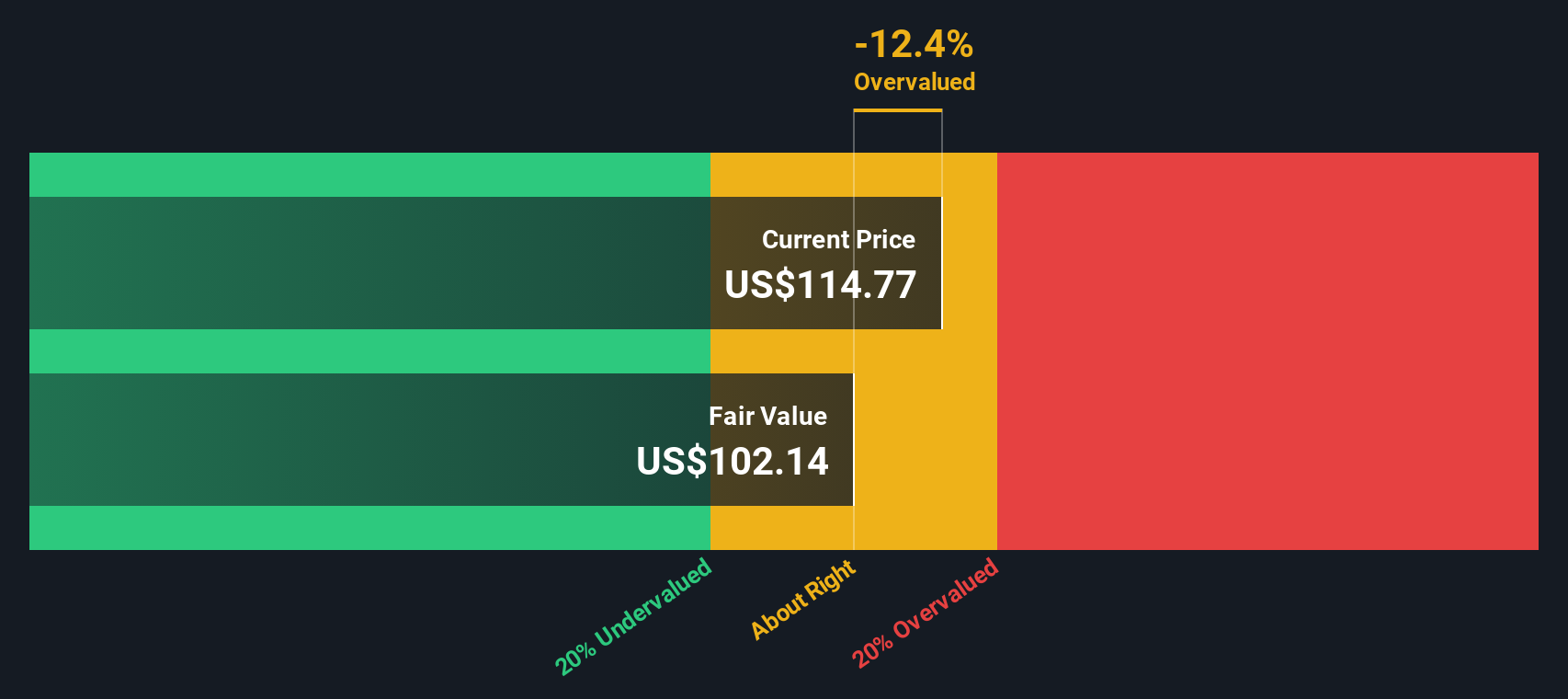

While the most discussed view puts Coherent at 8.7% undervalued based on market multiples, the SWS DCF model tells a more cautious story. According to our DCF analysis, Coherent's shares trade above their estimated fair value, which may indicate potential overvaluation if long-term growth projections are not met. Should investors trust market optimism, or is the DCF's caution flag worth a closer look?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Coherent Narrative

If you feel there is another angle to the story or want to form your own view, you can dive into the numbers and create a personal narrative in just minutes. Do it your way.

A great starting point for your Coherent research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize the edge by searching out overlooked opportunities right now. Doing so could set you apart from the crowd, while missing out means letting others get ahead of you.

- Uncover fresh growth potential by zeroing in on these 932 undervalued stocks based on cash flows packed with underappreciated winners trading below their intrinsic value.

- Tap into real income streams by locking in powerful yields with these 15 dividend stocks with yields > 3% offering returns above 3% for your long-term portfolio.

- Ride the wave of technological change and spot unique opportunities in the future of computing with these 28 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and laser systems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.