Coherent (COHR): Evaluating Valuation Following Launch of Next-Gen EDGE FL30 Industrial Laser

Reviewed by Simply Wall St

If you have been watching Coherent (NYSE:COHR), the company’s recent debut of the EDGE FL30 fiber laser probably caught your eye. This new 30 kW laser is not just another product launch; it marks a leap in industrial laser technology, with features designed to boost efficiency and reliability for metal cutting. With the world premiere set for FABTECH 2025 in Chicago, Coherent is not only showcasing innovation but may also be signaling a more ambitious push within the industrial laser space. This could have implications for how investors view its long-term growth story.

While the EDGE FL30 has been grabbing headlines, it comes on the back of a year where Coherent’s stock has shown signs of gathering momentum. After a rally of 40% over the past twelve months and a 22% gain in the past three months, shares reflect optimism that the company’s fresh product pipeline and strategic moves may be gaining traction. At the same time, the past month’s dip hints at ongoing volatility and perhaps some investor caution, even as recent events such as Coherent joining the STARFIRE Hub for fusion energy development point to expanding opportunities in both industrial and clean tech markets.

The big question now is whether the market is underestimating the value of these technological advances or if expectations for future growth are already built into today’s price.

Most Popular Narrative: 12.5% Undervalued

The prevailing narrative views Coherent as undervalued, with the consensus price target implying notable upside compared to today's share price. This perspective is supported by expectations of strong growth driven by industry tailwinds and strategic developments in advanced manufacturing.

The ongoing expansion of AI datacenter infrastructure and high-performance computing is propelling structural growth in demand for advanced optical transceivers (800G, 1.6T, and beyond), optical circuit switches, and related photonics components. This is fueling robust sequential order growth and sustained revenue momentum in Coherent's datacom and communications business.

Want to know what’s powering this robust valuation? The narrative is built on bold growth forecasts and positive profit projections, setting the stage for numbers you might not expect. Interested in which assumptions could make Coherent’s story one of the sector’s most compelling? Discover the surprising drivers that analysts believe will push this stock to new highs.

Result: Fair Value of $113.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, mounting competition from low-cost Asian manufacturers and ongoing macroeconomic uncertainty could disrupt Coherent’s growth trajectory and challenge these bullish expectations.

Find out about the key risks to this Coherent narrative.Another View: Peer Comparison Tells a Different Story

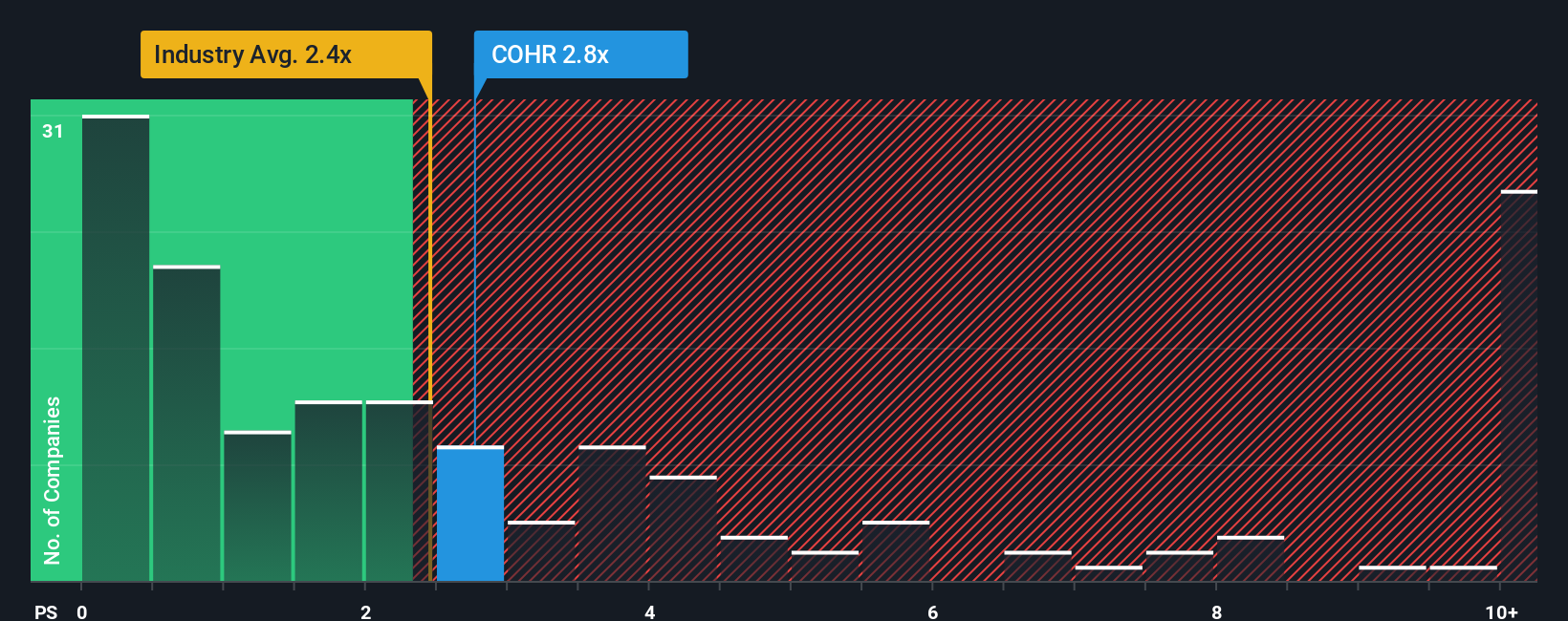

Looking at Coherent’s valuation next to the industry using a sales-based approach, the stock appears expensive compared to its sector. This challenges the undervalued case and raises the question: which perspective will play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coherent Narrative

If you want to challenge the prevailing viewpoints or would rather dig into the numbers on your terms, it takes just a few minutes to craft your own perspective. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Coherent.

Looking for More Investment Ideas?

Don’t miss your chance to uncover standout opportunities. Let the Simply Wall Street Screener guide you to sectors and stocks you might never have considered.

- Spot fast-growing companies making waves in healthcare innovation when you check out our selection of healthcare AI stocks.

- Capitalize on the next surge in tech by reviewing a hand-picked collection of AI penny stocks showing unstoppable momentum.

- Secure access to hidden gems with strong potential by browsing through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and laser systems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives