Assessing Coherent’s (COHR) Valuation as Innovation Awards Highlight Leadership in Optical Networking Tech

Reviewed by Kshitija Bhandaru

Coherent (COHR) is attracting fresh investor attention after taking home two top innovation awards at ECOC 2025 for its Multi-Rail Resource Pooling System and 400G Differential EML products. These wins highlight the company’s rapid advancement in optical networking hardware.

See our latest analysis for Coherent.

Alongside a packed slate of product launches and strategic moves, including a new revolving credit facility and a wave of AI-focused partnerships, Coherent’s recognition at ECOC 2025 is fueling investor confidence around its innovation-led future. The stock’s 1-year total shareholder return of 19.6% hints that momentum is building as Coherent cements its leadership in next-gen optical tech.

If you’re inspired by tech leaders pushing the envelope, this is a perfect opportunity to discover See the full list for free.

With shares delivering double-digit annual returns and analyst price targets hovering just above recent levels, investors now face a key question. Is Coherent still undervalued on all this innovation, or has the market already priced in the growth potential?

Most Popular Narrative: Fairly Valued

Coherent's widely followed narrative points to a fair value that sits right in line with the company's last close price of $112.79. This suggests analysts and the market are closely aligned for now. This sets the stage for a closer look at the drivers expected to shape the company’s next chapter.

The ongoing expansion of AI datacenter infrastructure and high-performance computing is propelling structural growth in demand for advanced optical transceivers (800G, 1.6T, and beyond), optical circuit switches, and related photonics components. This is fueling robust sequential order growth and sustained revenue momentum in Coherent's datacom and communications business.

Want to know what's fueling analyst conviction in this stock? The narrative is built on explosive revenue growth, major margin expansion, and a bold profit target. The formula behind these projections could change how you view Coherent’s next phase. Find out which numbers drive the consensus fair value now.

Result: Fair Value of $113.37 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive pricing pressure from low-cost Asian manufacturers and ongoing economic uncertainty could create challenges for Coherent’s growth and earnings stability in the future.

Find out about the key risks to this Coherent narrative.

Another View: Digging Deeper into Valuation

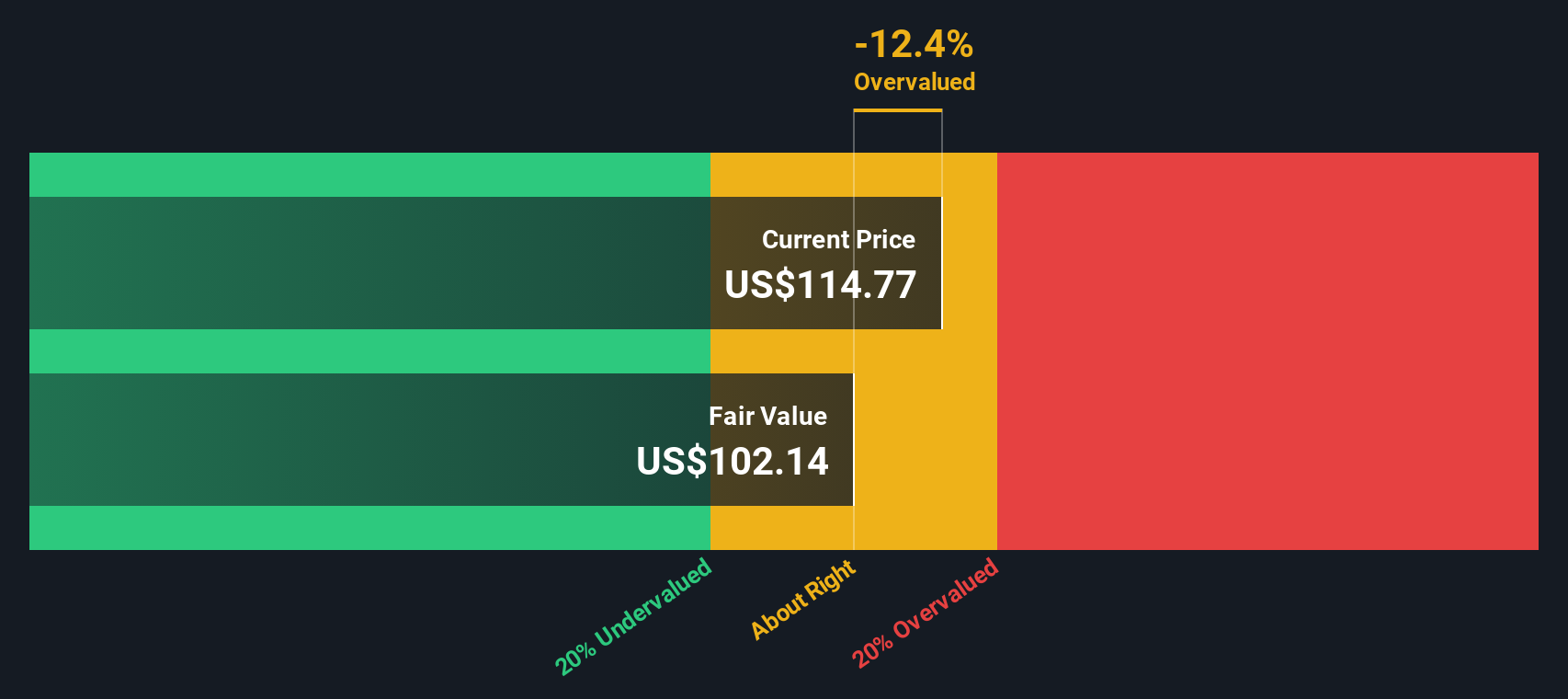

While the analyst consensus pegs Coherent as "about right" on valuation, our SWS DCF model suggests the shares are actually trading above fair value. The fair value estimate is $102.23, compared to the current price of $112.79. Could the market be a little ahead of itself on this stock’s outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coherent for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coherent Narrative

If your take on Coherent differs, or you want to dig into the numbers yourself, it’s simple to build your own perspective in minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Coherent.

Looking for more investment ideas?

Smart moves start with being ahead of the crowd. If you want to catch the next wave, Simply Wall St's screeners spotlight real opportunities others might overlook.

- Spot tomorrow’s AI leaders by checking out these 23 AI penny stocks before they become household names.

- Get ahead of the curve on stocks that look undervalued. See which companies are currently flying under Wall Street’s radar in these 914 undervalued stocks based on cash flows.

- Unlock passive income potential and keep your portfolio balanced with these 19 dividend stocks with yields > 3% offering high yields and steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COHR

Coherent

Develops, manufactures, and markets engineered materials, optoelectronic components and devices, and laser systems for the use in the industrial, communications, electronics, and instrumentation markets worldwide.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives