- United States

- /

- Tech Hardware

- /

- NYSE:CMPO

Is It Too Late To Consider CompoSecure (CMPO) After Multi Year Price Surge?

- If you are wondering whether CompoSecure shares still offer value after recent attention, this article walks through what the current price might be implying about the business.

- The stock last closed at US$21.43, with total returns of 7.8% over 7 days, 6.0% over 30 days, 14.8% year to date, 83.0% over 1 year and a very large gain over 3 years that is around 4x, plus 157.6% over 5 years.

- Recent coverage has focused on CompoSecure's role in payment card and security products, along with how investors may be reassessing its position in the broader fintech supply chain. This context has added interest to how the market prices the stock today, especially after such strong multi year returns.

- Even so, CompoSecure currently scores only 1 out of 6 on our valuation checks. Next we will compare different valuation methods to see what they suggest about the stock, then finish with a simple framework that can make sense of these numbers in a more practical way.

CompoSecure scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CompoSecure Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company might be worth by projecting its future cash flows and then discounting those back to today using a required rate of return.

For CompoSecure, the model used is a 2 stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is about $21.9 million. Looking ahead, analysts and extrapolations point to projected free cash flow of $209.1 million in 2035, with intermediate years such as 2026 and 2027 at $124 million and $139 million respectively. These later years combine one analyst estimate with Simply Wall St extrapolations based on those inputs.

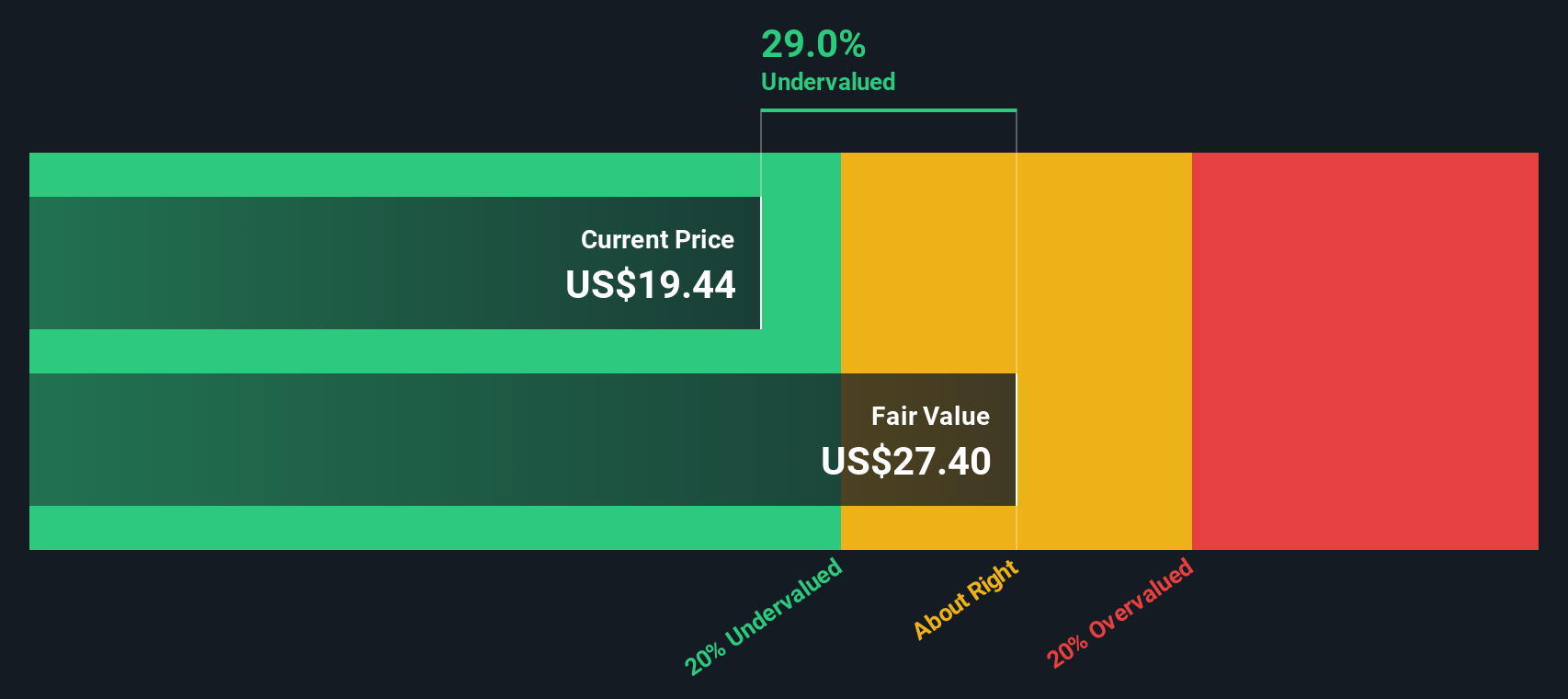

When all these future cash flows are discounted back to today, the model produces an estimated intrinsic value of about $24.63 per share. Against the recent share price of $21.43, this implies the stock trades at roughly a 13.0% discount, which indicates it screens as undervalued on this DCF view.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CompoSecure is undervalued by 13.0%. Track this in your watchlist or portfolio, or discover 884 more undervalued stocks based on cash flows.

Approach 2: CompoSecure Price vs Sales

For companies where earnings can be volatile or less meaningful, the P/S ratio is often a useful way to think about value, because it compares the share price to the revenue the business is generating rather than its accounting profit.

What counts as a normal P/S depends on how quickly investors expect revenue to grow and how risky that revenue stream looks. Higher growth and lower perceived risk can support a higher multiple, while slower growth or higher uncertainty usually call for a lower one.

CompoSecure currently trades on a P/S of 16.86x. That is much higher than the Tech industry average of 1.76x and also above the peer group average of 0.79x. Simply Wall St’s Fair Ratio framework estimates a P/S of 7.03x for CompoSecure, based on factors such as its growth profile, industry, profit margins, market capitalization and specific risks.

This Fair Ratio is designed to be more tailored than a simple comparison with peers or the broad industry because it adjusts for the company’s own characteristics rather than assuming one size fits all. Against this Fair Ratio, CompoSecure’s current P/S of 16.86x suggests the shares screen as expensive on this measure.

Result: OVERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CompoSecure Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, which let you spell out your story for CompoSecure by linking your assumptions about its future revenue, earnings and margins to a forecast and a fair value. You can then compare that fair value to the current price inside Simply Wall St’s Community page, where Narratives are updated automatically when new news or earnings arrive. One investor might build a CompoSecure Narrative around the higher fair value of about US$25.50 tied to margin expansion and the Husky Technologies acquisition, while another focuses on the lower analyst target of US$16.00 because of concerns about customer concentration or crypto related products. You can see both stories quantified side by side.

Do you think there's more to the story for CompoSecure? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMPO

CompoSecure

Manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Titan Cement International S.A. (TITC.AT): Greece's Leading Cement and Building Materials Producer

QDay is coming - 01 Quantum hold the key

Salesforce's Market Dominance and AI Pivot Will Drive Earnings Re-acceleration

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!