- United States

- /

- Tech Hardware

- /

- NYSE:CMPO

CompoSecure (CMPO) Faces Insider Selling as Growth Projections Test Valuation Narratives

Reviewed by Simply Wall St

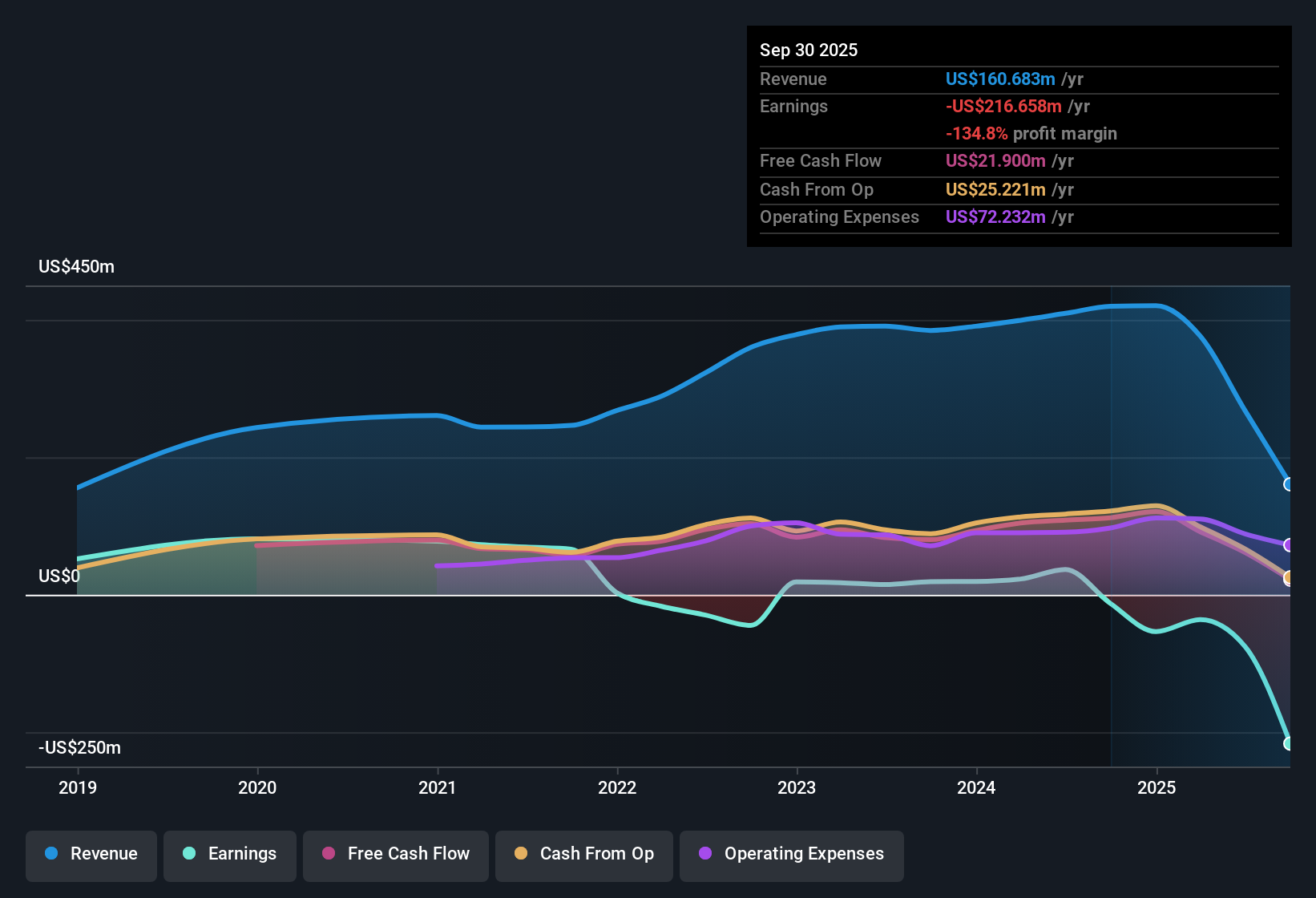

CompoSecure (CMPO) reported that its losses have grown at an annual rate of 66.8% over the past five years, but market watchers are eyeing the company's future, with forecasts pointing to 168.7% annual earnings growth and a move to profitability within three years. Revenue is projected to surge by 37.6% per year, which is far ahead of the broader US market’s 10.5% pace. Shares currently change hands below an estimated fair value of $22.32, even as the company’s Price-To-Sales Ratio sits at a premium compared to both industry and peers. Investors are weighing a powerful growth outlook and undervalued share price against high valuation multiples and recent insider selling activity.

See our full analysis for CompoSecure.With the headline results in hand, it's time to stack these numbers up against the prevailing market narratives and see which stories hold up and which might face a reality check.

See what the community is saying about CompoSecure

Profit Margins Expected to Jump from -28% to 79%

- Analysts predict that CompoSecure’s profit margins could rise dramatically from a current level of -28.2% to 79.1% within the next three years, far outpacing typical industry expectations for margin expansion.

- Under the analysts' consensus view, operational efficiency efforts and new program launches are positioned as major catalysts for this anticipated margin turnaround.

- Management highlights efficiency moves under the “CompoSecure Operating System,” which are seen as drivers for future cost savings and better gross margins.

- New partnerships and recurring revenues from major financial and fintech institutions signal greater stability and potential to sustain these margin gains.

- Consensus narrative points to recurring revenue streams and operational upgrades as the backbone of improving profitability, despite the sector's typical volatility.

See what the community is saying about CompoSecure 📊 Read the full CompoSecure Consensus Narrative.

Share Count and Customer Concentration Create Crosscurrents

- The company is expected to increase its number of shares outstanding by 7.0% annually over the next three years, potentially diluting existing shareholders while fueling growth initiatives.

- According to the analysts' consensus view, CompoSecure’s reliance on a handful of large financial and fintech clients for top-line growth remains a central risk.

- Bears argue that any loss or strategic pivot by a major partner could rapidly cut into revenue, since the business is not yet broadly diversified.

- Analysts highlight that international sales declined 35% year-over-year, raising questions about the company’s ability to offset domestic reliance through global expansion.

Premium Valuation Stands Out Despite Sub-$22 DCF Fair Value

- With a Price-To-Sales Ratio of 16.5x, which is well above the US Tech industry average of 2x and peer average of just 0.4x, CompoSecure trades on a significant premium even as its $21.14 share price sits below the DCF fair value estimate of $22.32.

- Analysts' consensus view acknowledges that robust forecasts for profit growth and a clear path to profitability make the company seem undervalued on a DCF basis, but many are wary that the steep valuation relative to peers could cap upside, especially if operational gains do not materialize as expected.

- Current price targets reflect this tension, with the consensus at $23.83 but notable splits. Some analysts see potential to $23.00, while the more cautious call for just $16.00.

- Ongoing insider selling in recent quarters adds a further cautionary note, especially for investors sensitive to signals of management confidence.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CompoSecure on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Bring your own insights to life and share your unique outlook in just a few minutes: Do it your way.

A great starting point for your CompoSecure research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite CompoSecure’s impressive growth potential, its heavy reliance on a few key clients and recent insider selling highlight risks from concentration and uncertain sustainability.

If you’re seeking more stable fundamentals and want to minimize exposure to these kinds of risks, check out stable growth stocks screener (2077 results) for companies delivering predictable, consistent performance through economic cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMPO

CompoSecure

Manufactures and designs metal, composite, and proprietary financial transaction cards in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives