- United States

- /

- Communications

- /

- NYSE:CIEN

Is Comcast’s Expanded Fiber Investment a Turning Point for Ciena’s (CIEN) Competitive Position?

Reviewed by Sasha Jovanovic

- On September 30, 2025, Comcast announced it is deploying Ciena's 5131 Coherent Access Platform to extend its fiber network reach by more than 100 km and deliver 100 Gb/s capacity to unserved and underserved communities.

- This deployment underscores increasing industry demand for high-capacity, efficient networking technology that supports both residential and enterprise connectivity needs as digital infrastructure expands.

- We'll explore how Comcast's adoption of Ciena's 5131 platform for broader fiber coverage shapes the company's evolving investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ciena Investment Narrative Recap

Owning Ciena means believing in the multiyear growth of optical networking driven by AI, cloud, and bandwidth needs, while navigating a business built on a handful of major clients whose spending decisions can heavily sway results. The Comcast deployment extends Ciena’s customer portfolio but, by itself, does not materially reduce the short-term risk that a sudden slowdown or change in orders from hyperscalers or other large clients could hit revenue and earnings volatility.

A particularly relevant recent announcement is Ciena’s record quarter reported in September 2025, with revenue up over 29% year-on-year. This strong performance underlines the ongoing demand for Ciena’s high-capacity solutions; however, the Comcast win fits within a pattern of concentrated, high-profile deployments that still leave Ciena’s fortunes tied to a relatively small number of large-scale technology buyers.

In contrast, investors should remain aware of how revenue concentration among a few large customers remains a double-edged sword if order cycles turn…

Read the full narrative on Ciena (it's free!)

Ciena's narrative projects $6.5 billion revenue and $590.5 million earnings by 2028. This requires 12.5% yearly revenue growth and a $449.6 million earnings increase from $140.9 million today.

Uncover how Ciena's forecasts yield a $132.69 fair value, a 19% downside to its current price.

Exploring Other Perspectives

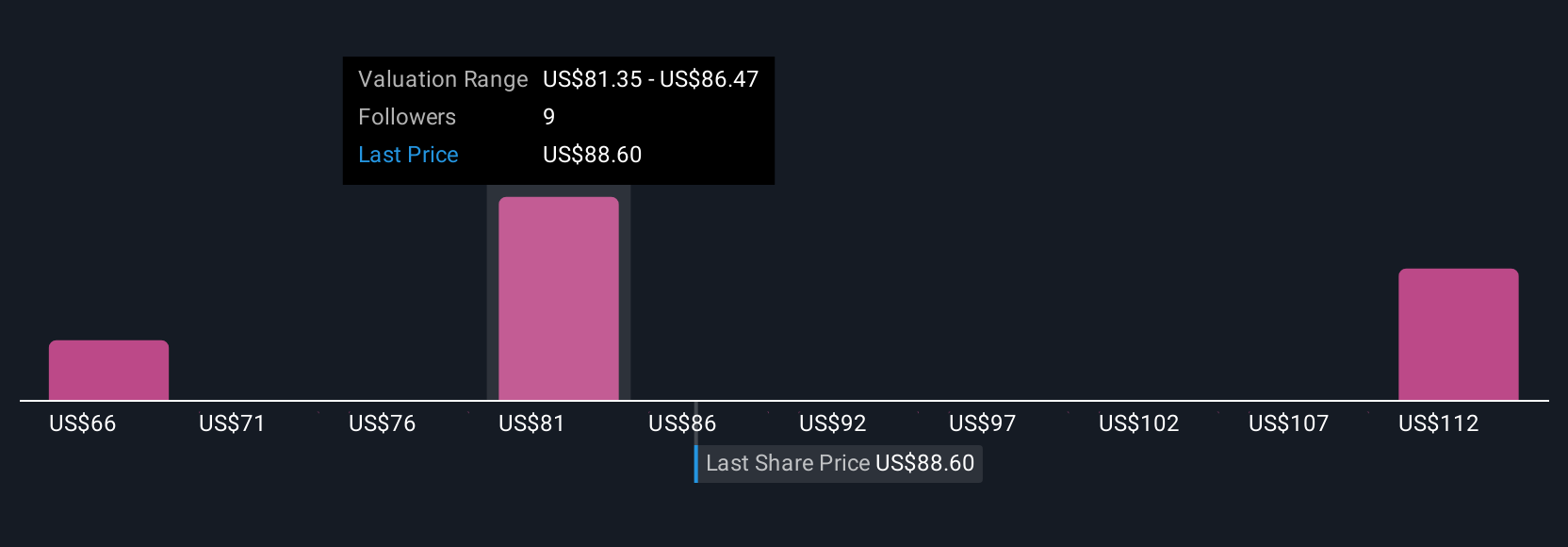

Five fair value estimates from the Simply Wall St Community put Ciena’s value between US$67.93 and US$132.69 per share. The market sees robust catalysts from cloud and AI network investment, but wide-ranging community views highlight just how differently performance expectations can be interpreted.

Explore 5 other fair value estimates on Ciena - why the stock might be worth as much as $132.69!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives