- United States

- /

- Communications

- /

- NYSE:CIEN

How Orange Business Choosing Blue Planet at Ciena (CIEN) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Earlier this month, Orange Business announced it selected Ciena's Blue Planet division to deliver intelligent automation, orchestration, and AI-powered service management as part of its comprehensive digital transformation initiative.

- This collaboration highlights Ciena's continued role in providing advanced automation for large enterprises embracing AI-native, flexible network solutions.

- We’ll explore how Blue Planet’s integration into a major European enterprise transformation strengthens Ciena’s positioning within the AI-enabled network automation trend.

Ciena Investment Narrative Recap

To believe in Ciena, an investor needs confidence in the ongoing global demand for high-performance, AI-enabled network infrastructure and automation, especially among large enterprises and service providers. The Orange Business partnership showcases Ciena's growing influence in this field, but does not materially alter the short-term focus on continued cloud and AI investment as the key growth catalyst, nor does it reduce the ongoing risks around customer concentration and competitive pressures.

Ciena’s recent alliance with Ernst & Young (EY) directly connects to the momentum seen from the Orange Business deal, highlighting Blue Planet’s expanding role in delivering automation and operational efficiency for global network operators. Such collaborations reinforce the central catalyst: increasing adoption of automation solutions among major enterprise and telecom clients, which underpins Ciena’s revenue growth outlook.

But investors should also be mindful that, despite these wins, a shift in spending by large cloud and service provider clients could unexpectedly impact future revenues...

Read the full narrative on Ciena (it's free!)

Ciena's outlook anticipates $5.4 billion in revenue and $523.7 million in earnings by 2028. Achieving these targets implies annual revenue growth of 10.1% and a $444.7 million increase in earnings from the current $79.0 million.

Uncover how Ciena's forecasts yield a $81.77 fair value, a 4% downside to its current price.

Exploring Other Perspectives

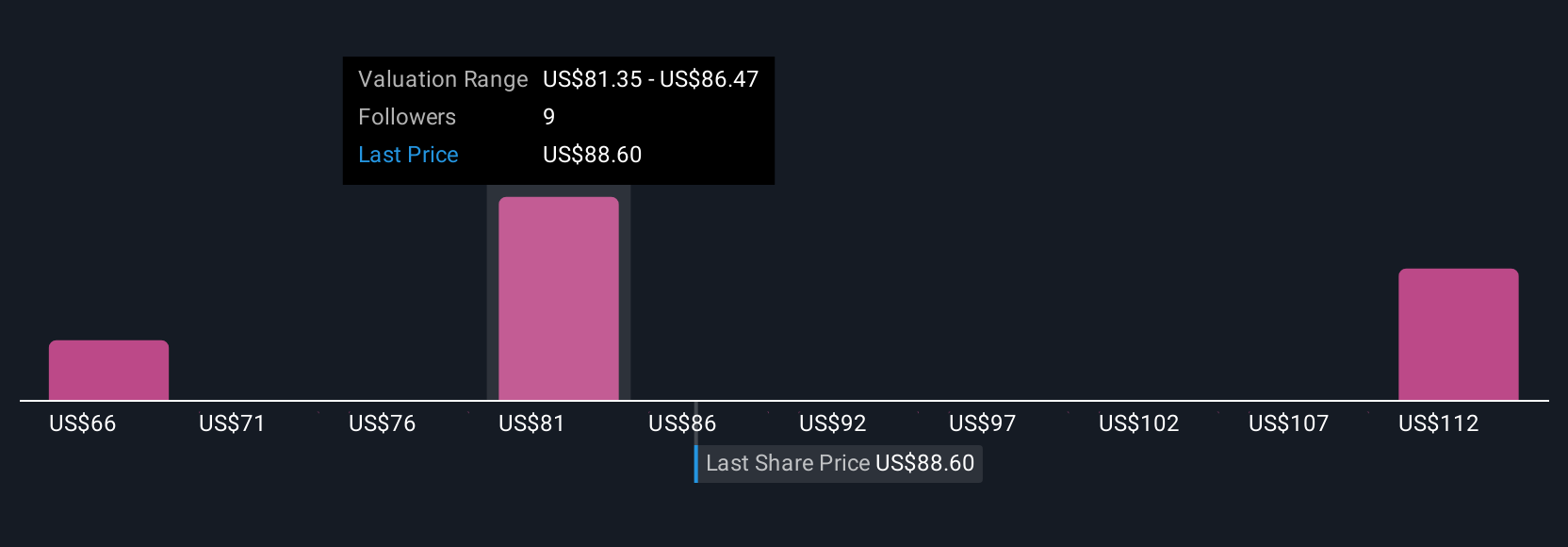

Simply Wall St Community contributors set Ciena’s fair value estimates between US$66 and US$115, with four individual analyses highlighting this spread. While recent enterprise partnerships point to revenue catalysts, some participants may be weighing the risks from concentrated client exposure and competition differently; see how opinions vary across the community.

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives