- United States

- /

- Communications

- /

- NYSE:CIEN

Can Expanding Comcast Ties Strengthen Ciena's (CIEN) Competitive Edge in Fiber Technology?

Reviewed by Sasha Jovanovic

- Comcast recently announced the deployment of Ciena's 5131 Coherent Access Platform, enabling faster and more efficient fiber connectivity expansion across new and underserved communities.

- This collaboration highlights how Ciena's coherent optics can significantly extend fiber reach and simplify network installation, supporting growing bandwidth needs across diverse customer segments.

- We'll examine how this Comcast deployment could strengthen Ciena's technology leadership and shape its future investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

Ciena Investment Narrative Recap

For investors considering Ciena, the core thesis centers on the company's leadership in next-generation optical networking and its ability to capture rising demand from AI and cloud-driven infrastructure. While the Comcast deployment of Ciena's 5131 Coherent Access Platform highlights the firm's innovation, its near-term importance largely supports ongoing catalysts, specifically, hyperscaler investments, rather than materially shifting the narrative. The main short-term risk remains customer concentration, which this partnership does little to ease.

Among recent news, Ciena’s collaboration with DFA to achieve a 1.6 Tbps single wavelength transmission illustrates the company’s position at the forefront of optical innovation. This is highly relevant since continuous technical advancements strengthen Ciena's pitch to major cloud and service provider clients, underlining the core catalyst of expanding market opportunity as traffic volumes accelerate.

Yet, even with growing client wins, investors should keep in mind the significant revenue risk if major customers suddenly reduce orders or shift priorities, because...

Read the full narrative on Ciena (it's free!)

Ciena's narrative projects $6.5 billion revenue and $590.5 million earnings by 2028. This requires 12.5% yearly revenue growth and a $449.6 million increase in earnings from $140.9 million today.

Uncover how Ciena's forecasts yield a $127.22 fair value, a 16% downside to its current price.

Exploring Other Perspectives

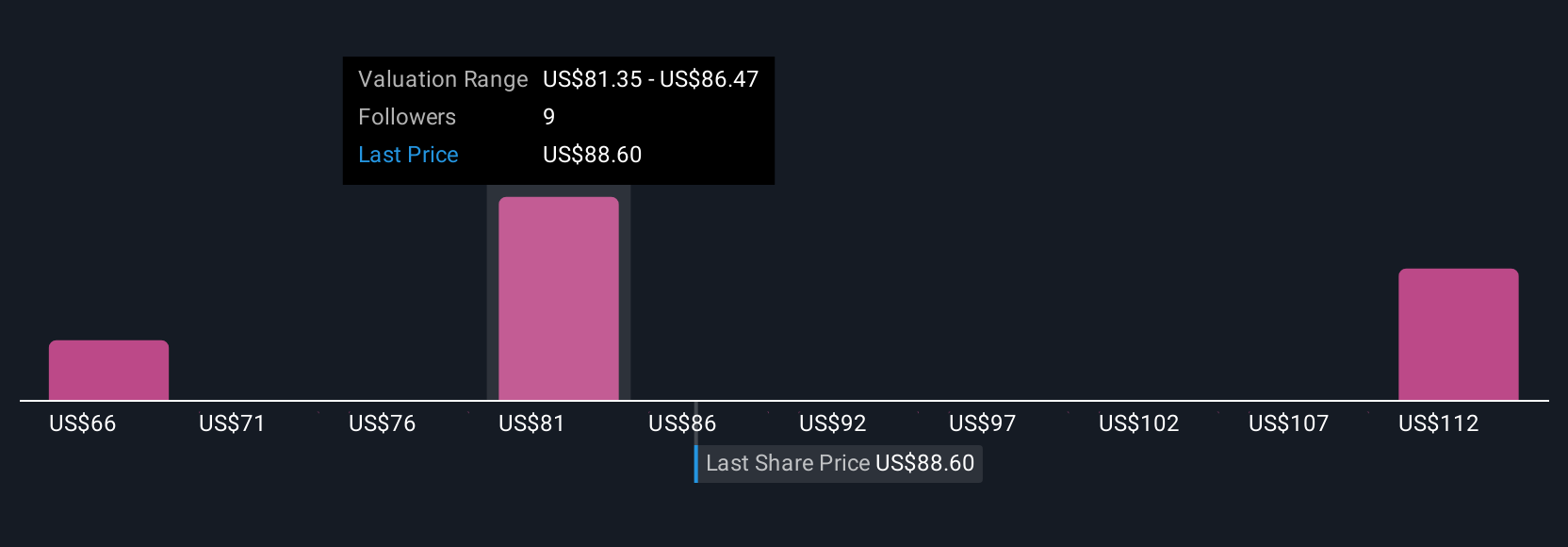

Five fair value estimates from the Simply Wall St Community span US$67.93 to US$127.22 per share, reflecting wide-ranging expectations. With customer concentration still a central risk, you can see why opinions diverge, explore more viewpoints on what might shape Ciena’s future.

Explore 5 other fair value estimates on Ciena - why the stock might be worth as much as $127.22!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIEN

Ciena

A network technology company, provides hardware, software, and services for various network operators in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives