- United States

- /

- Communications

- /

- NYSE:CALX

Calix (CALX): Assessing Valuation After Next-Gen Broadband Platform and AI Innovation Rollout

Reviewed by Simply Wall St

Calix (NYSE:CALX) just rolled out significant upgrades to its Broadband Platform. The updates feature new agentic AI capabilities built on Google Cloud, along with enhanced SmartBiz, SmartMDU, SmartHome, and SmartTown services for broadband providers.

See our latest analysis for Calix.

Calix has been making waves with its rapid-fire product launches and focus on agentic AI, which has caught investors’ attention. The 74.99% share price return year-to-date shows that momentum is building, especially as innovation themes resonate across the broadband sector. While the 1-year total shareholder return sits at a robust 60.11%, longer-term holders who bought at prior highs are still recovering, given a 3-year total shareholder return of -19.5%. Overall, the stock’s trajectory has shifted to strong positive momentum in 2025 as the market increasingly prices in Calix’s next-gen platform bets.

If Calix’s transformation story sparks your interest, don’t miss the chance to discover See the full list for free.

With such a sharp rebound in performance and ambitious innovation on display, the key question is whether Calix is still undervalued or if the market has already priced in its promising future growth. Could there be more upside ahead?

Most Popular Narrative: 10.3% Undervalued

Calix’s most-followed narrative gives it a fair value above the last close, suggesting that current prices may not reflect the platform’s next growth phase. The narrative builds directly on new technology rollouts and ambitious financial projections, offering context for what drives this bullish stance.

The upcoming rollout of Calix's third-generation platform, which integrates agentic AI capabilities, is expected to dramatically accelerate broadband providers' ability to monetize new services and experiences across residential, business, and municipal segments; this can drive higher ARPU, increased subscriber growth, reduced churn, and ultimately stronger revenue expansion beginning in the second half of 2025 and accelerating into 2026.

Want to glimpse the assumptions that underpin this double-digit upside? The narrative highlights rapid recurring revenue growth, margin improvement, and a new era of profitability. Find out which future milestones and ambitious analyst projections put Calix’s fair value well ahead of today’s price.

Result: Fair Value of $66.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Calix faces potential headwinds from slow adoption of new AI-driven features, as well as complex data compliance laws that could delay international expansion.

Find out about the key risks to this Calix narrative.

Another View: Multiples Tell a Different Story

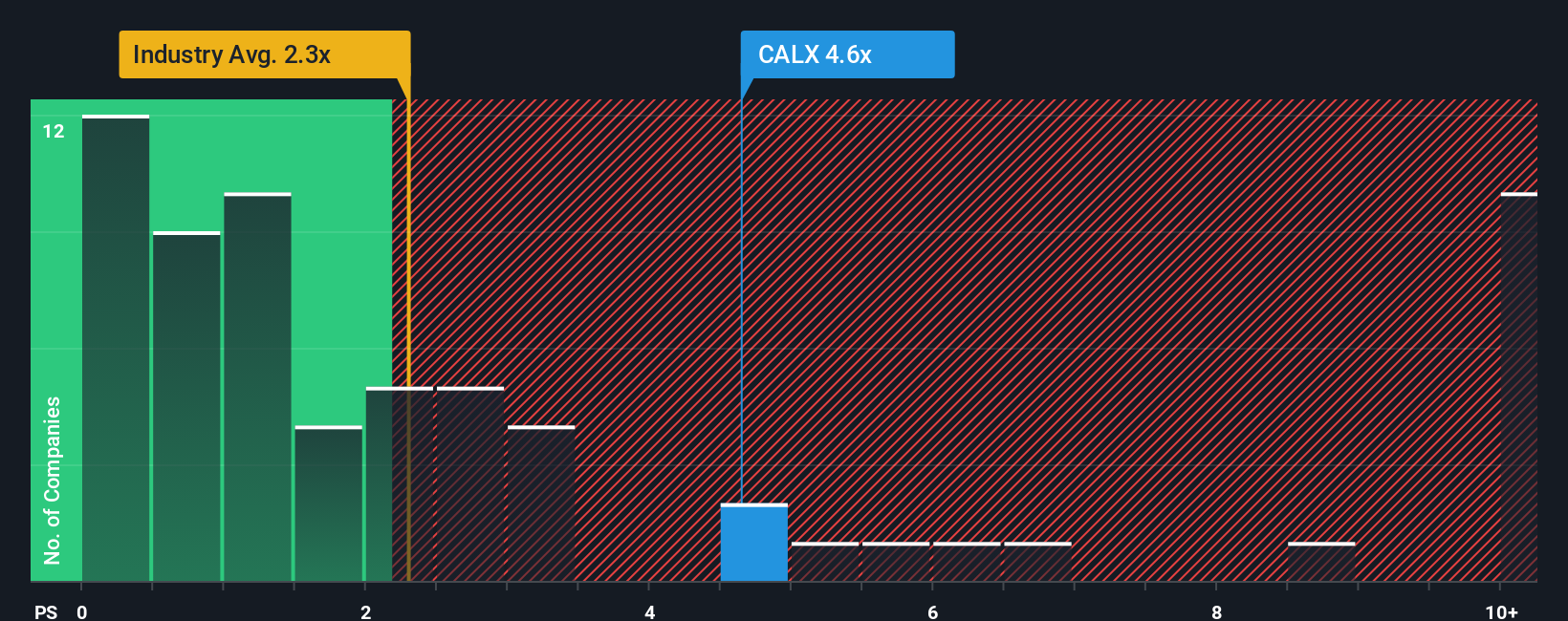

Looking at how Calix is priced using the price-to-sales ratio gives a more expensive picture. Calix trades at 4.5 times sales, higher than the peer average of 1.7 and the US Communications industry average of 2.2. Even compared to its fair ratio of 4.4, it appears a touch pricey. This suggests limited upside unless the company delivers exceptional growth. Should investors pay up now, or wait for signs of more value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Calix Narrative

If you want to dig deeper, keep in mind that you can review the numbers, form your own view, and share your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Calix.

Looking for More Smart Investment Ideas?

Don’t stop with Calix. Make your next move count by checking out other exciting opportunities with strong upside potential across innovative sectors right now.

- Boost your return potential by scanning these 875 undervalued stocks based on cash flows that are trading below fair value and have solid financials backing their growth outlook.

- Capitalize on the AI boom by reviewing these 26 AI penny stocks that are driving transformation in automation, analytics, and machine learning applications.

- Secure passive income and stability with these 17 dividend stocks with yields > 3% offering attractive yields above 3% and a proven track record of shareholder rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CALX

Calix

Provides cloud and software platforms, and systems and services in the United States, rest of Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives