- United States

- /

- Life Sciences

- /

- NasdaqCM:NAGE

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences a slight downturn following a series of gains, investors are keenly observing opportunities that may arise from recent fluctuations in major indices like the S&P 500 and Nasdaq Composite. In this environment, identifying stocks that are potentially trading below their estimated value can be an effective strategy for those looking to capitalize on market inefficiencies and uncover hidden potential within their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Quaker Chemical (NYSE:KWR) | $105.85 | $210.37 | 49.7% |

| KBR (NYSE:KBR) | $55.45 | $108.68 | 49% |

| Horizon Bancorp (NasdaqGS:HBNC) | $15.69 | $30.69 | 48.9% |

| Flowco Holdings (NYSE:FLOC) | $19.17 | $37.91 | 49.4% |

| Curbline Properties (NYSE:CURB) | $23.62 | $47.17 | 49.9% |

| Constellation Brands (NYSE:STZ) | $192.91 | $385.37 | 49.9% |

| Array Technologies (NasdaqGM:ARRY) | $7.265 | $14.21 | 48.9% |

| FinWise Bancorp (NasdaqGM:FINW) | $14.85 | $29.22 | 49.2% |

| TransMedics Group (NasdaqGM:TMDX) | $122.10 | $238.94 | 48.9% |

| Mobileye Global (NasdaqGS:MBLY) | $15.72 | $31.08 | 49.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

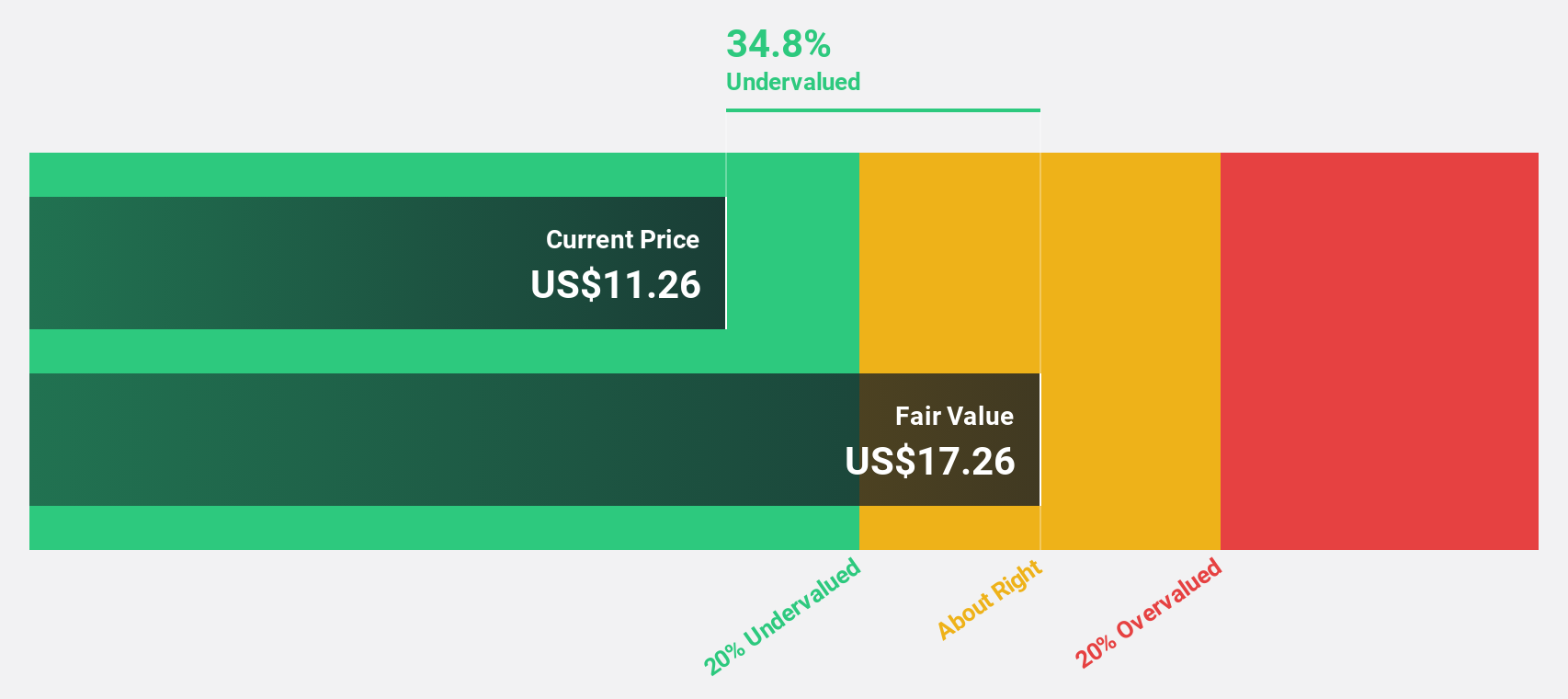

Niagen Bioscience (NasdaqCM:NAGE)

Overview: Niagen Bioscience, Inc. is a bioscience company focused on developing healthy aging products, with a market cap of $864.36 million.

Operations: Niagen Bioscience generates revenue through three primary segments: Ingredients ($23.90 million), Consumer Products ($80.92 million), and Analytical Reference Standards and Services ($3.11 million).

Estimated Discount To Fair Value: 19.7%

Niagen Bioscience's earnings are forecast to grow significantly at 26.1% annually, outpacing the US market average of 14.3%. Trading at US$10.93, it is undervalued against its fair value estimate of US$13.62 by 19.7%. Recent developments include increased revenue guidance for 2025 and a profitable first quarter with net income of US$5.06 million, reflecting strong performance in the expanding NAD+ market despite higher administrative expenses due to revised share-based compensation estimates.

- According our earnings growth report, there's an indication that Niagen Bioscience might be ready to expand.

- Navigate through the intricacies of Niagen Bioscience with our comprehensive financial health report here.

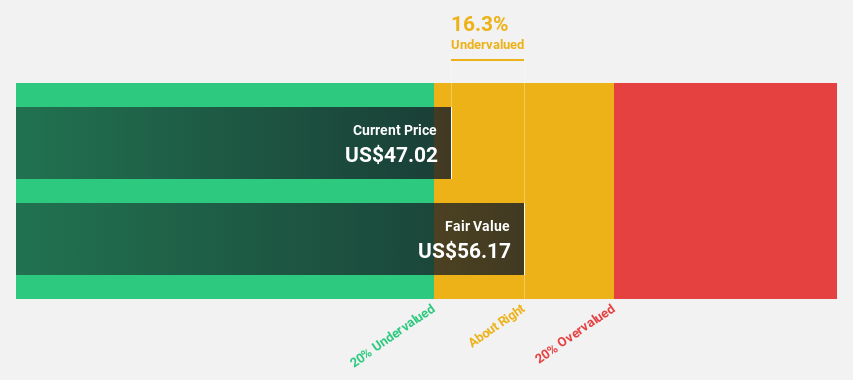

Calix (NYSE:CALX)

Overview: Calix, Inc. is a company that offers cloud and software platforms, systems, and services globally, with a market cap of approximately $2.94 billion.

Operations: The company's revenue segment primarily involves the development, marketing, and sale of communications access systems and software, generating $825.45 million.

Estimated Discount To Fair Value: 18.2%

Calix, trading at US$46.18, is undervalued compared to its fair value estimate of US$56.43, offering a potential opportunity based on cash flow analysis. Despite recent challenges with a net loss of US$4.79 million in Q1 2025 and slower revenue growth at 10.5% annually, Calix's strategic partnerships and product innovations like SmartBiz are enhancing its market position and supporting future profitability expectations above the market average within three years.

- In light of our recent growth report, it seems possible that Calix's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Calix stock in this financial health report.

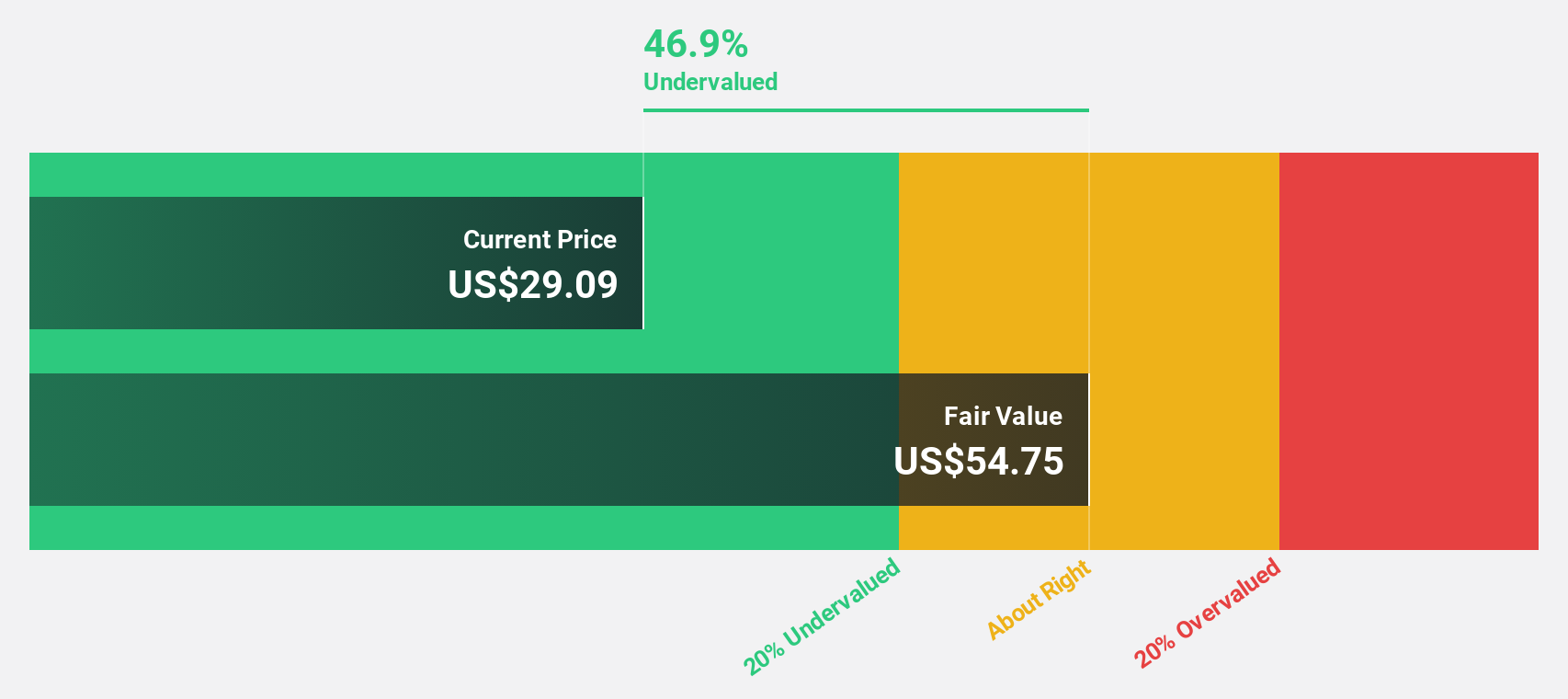

CareTrust REIT (NYSE:CTRE)

Overview: CareTrust REIT is a self-administered, publicly-traded real estate investment trust focused on owning, acquiring, developing, and leasing seniors housing and healthcare-related properties, with a market cap of approximately $5.59 billion.

Operations: The company's revenue primarily comes from its investments in healthcare-related real estate assets, totaling $329.84 million.

Estimated Discount To Fair Value: 46.1%

CareTrust REIT, trading at US$29.36, appears undervalued with a fair value estimate of US$54.46 based on cash flow analysis. Recent acquisitions and increased earnings guidance for 2025 highlight growth potential, though shareholder dilution has occurred. Earnings grew substantially by 157.1% last year and are projected to rise 27.7% annually, outpacing the market's average growth rate of 14.3%. However, its dividend yield of 4.56% is not fully covered by earnings projections.

- Insights from our recent growth report point to a promising forecast for CareTrust REIT's business outlook.

- Dive into the specifics of CareTrust REIT here with our thorough financial health report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 170 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Niagen Bioscience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NAGE

Niagen Bioscience

Operates as a bioscience company engages in developing healthy aging products.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion