Benchmark Electronics (BHE) Valuation Check After Appointing New CTO Focused On AI And Automation

Reviewed by Simply Wall St

Benchmark Electronics (BHE) has drawn fresh attention after naming Josh Hollin as its new Chief Technology Officer, a leadership change that raises questions about how the company might apply AI, automation, and advanced manufacturing capabilities.

See our latest analysis for Benchmark Electronics.

The latest leadership news lands while Benchmark Electronics’ US$45.05 share price has a 90 day share price return of 25.24%, but only a 2.62% year to date share price return and a 0.99% 1 year total shareholder return. This suggests momentum has cooled recently after stronger medium term gains.

If you are weighing Benchmark’s CTO shift against what else is happening in tech hardware and electronics, it can help to scan other fast growing stocks with high insider ownership that might fit a similar thesis.

With a fresh CTO, steady revenue and net income growth, and the share price only about 5% below the US$47.33 analyst target, you have to ask: is there still upside here, or is the market already pricing in future growth?

Most Popular Narrative: 4.8% Undervalued

With Benchmark Electronics closing at US$45.05 against a narrative fair value of US$47.33, the current price sits slightly below that implied level, which puts more focus on the growth and margin story behind the model.

Benchmark is positioned to benefit from the surging demand for advanced computing and AI infrastructure, as evidenced by recent contract wins in water-cooling for high-performance computing and AI data centers, and ramping opportunities expected to drive a return to revenue growth in AC&C by late 2025 and into 2026. This supports both revenue acceleration and an upward mix in gross margin due to the complexity of these projects.

Curious how steady revenue growth, expanding margins, and a lower future P/E all feed into that fair value? The narrative leans on a specific earnings path, disciplined buybacks, and a defined discount rate. The detailed numbers show exactly how that combination lands at US$47.33.

Result: Fair Value of $47.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could change if semi-cap trade restrictions drag on, or if AC&C projects and AI data center wins take longer to translate into visible revenue.

Find out about the key risks to this Benchmark Electronics narrative.

Another Angle on Valuation

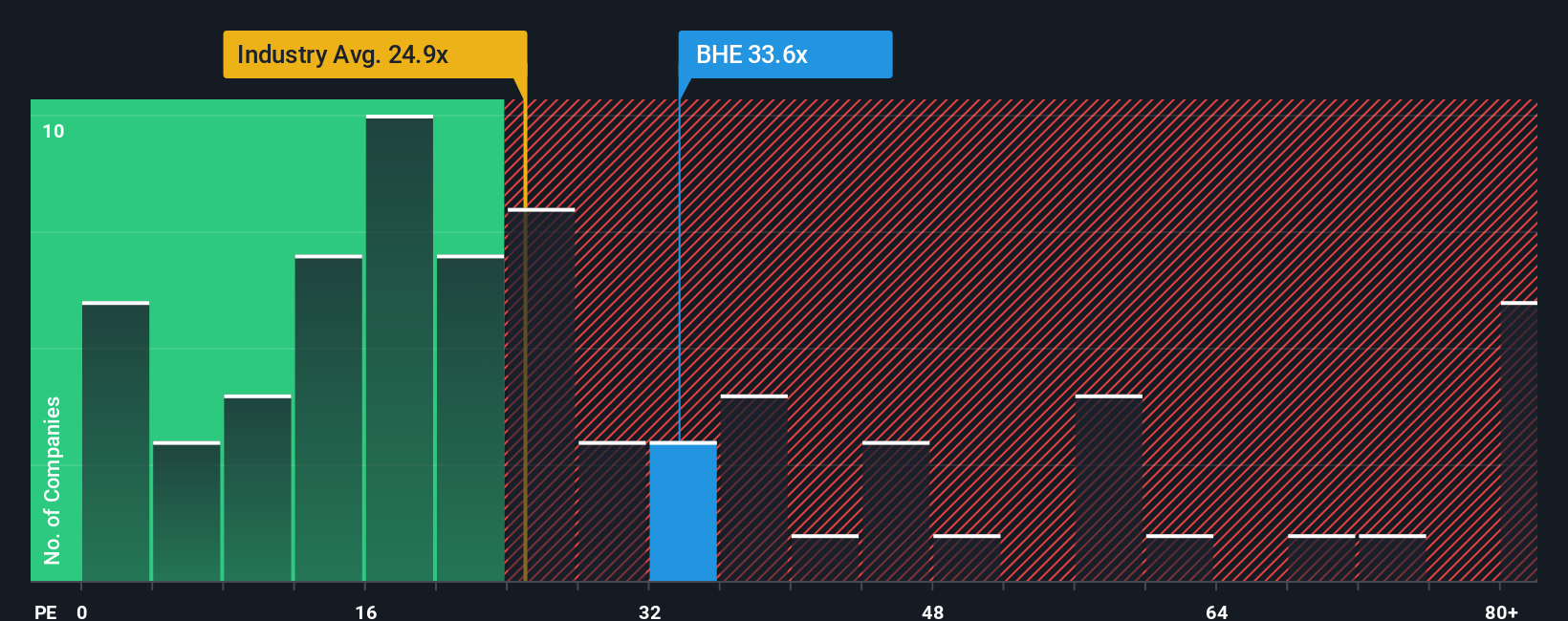

That 4.8% narrative undervaluation paints one picture, but the earnings multiple tells another. Benchmark Electronics trades on a P/E of 43.1x, compared with 25.5x for the US Electronic industry and a fair ratio of 34x. This points to a meaningful valuation premium and less room for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Benchmark Electronics Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to test your own assumptions, you can build a custom view of Benchmark Electronics in just a few minutes, starting with Do it your way.

A great starting point for your Benchmark Electronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you risk missing better fits for your goals. Treat this as your starting point, not the finish line.

- Spot potential value candidates early by checking out these 878 undervalued stocks based on cash flows that align with your preferred fundamentals.

- Tap into the AI build out through these 28 AI penny stocks that connect real business models with this major computing shift.

- Strengthen your income focus with these 12 dividend stocks with yields > 3% that offer yields above 3% plus room to research payout quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Benchmark Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHE

Benchmark Electronics

Offers product design, engineering services, technology solutions, and manufacturing services in the Americas, Asia, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Nike: A Market Leader with Resilience and Long-Term Growth Potential

The Real Power Behind Alphabet’s Growth

RELX: The Quiet Compounder Powering Law, Science, and Risk Intelligence

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026